In the realm of real estate financing, hard money lenders play a crucial role in providing funding for properties that are in a state of distress. When faced with properties plagued by various issues such as extensive repairs, legal complications, or financial difficulties, hard money lenders employ a unique approach to assess and manage these properties. Through their expertise and specialized strategies, hard money lenders are able to navigate the challenges posed by distressed conditions, ultimately facilitating the revitalization of these properties and enabling borrowers to pursue profitable investment opportunities.

Overview of Distressed Properties

Definition of distressed properties

Distressed properties refer to real estate assets that are in poor physical condition and/or facing financial challenges. These properties can be residential or commercial and are typically in need of significant repairs or renovations. They may also be burdened with financial problems such as delinquent mortgage payments or tax liens. Distressed properties are often sold at a discounted price due to their unfavorable conditions and the financial risks they pose to potential buyers.

Causes of property distress

There are several factors that can lead to property distress. Economic downturns, such as recessions or financial crises, can result in homeowners or businesses being unable to meet their financial obligations, leading to foreclosure or bankruptcy. Natural disasters, such as hurricanes or earthquakes, can also cause extensive damage to properties, making them distressed. Neglect or poor management can contribute to the deterioration of a property over time, leading to distress. Additionally, unexpected events such as family emergencies or job loss can result in homeowners or businesses being unable to maintain or repair their properties, leading to distress.

Challenges associated with distressed properties

Distressed properties present unique challenges for both buyers and lenders. For buyers, the primary challenge is the substantial amount of repairs and renovations required to bring the property back to a livable or usable condition. This can involve significant financial investments and extensive time and resources. Additionally, distressed properties often have legal and financial issues that need to be resolved, such as outstanding liens or title problems.

For lenders, the main challenge is assessing the value and marketability of distressed properties. These properties may not qualify for traditional mortgage financing due to their poor condition or financial challenges. Lenders need to carefully evaluate the potential risks and benefits associated with providing financing for distressed properties. They also need to consider the borrower’s ability to repay the loan, particularly if the property is not generating income.

Understanding Hard Money Loans

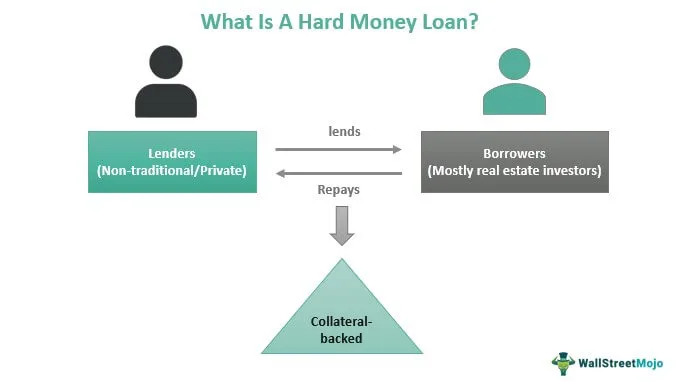

Definition of hard money loans

Hard money loans are short-term loans provided by private individuals or companies, often referred to as hard money lenders. These loans are typically backed by the value of the distressed property rather than the creditworthiness of the borrower. Hard money loans are commonly used to finance the purchase and renovation of distressed properties.

Typical terms and conditions

Hard money loans typically have higher interest rates than traditional bank loans. The interest rates can range from 10% to 15% or more, depending on the lender and the specific circumstances of the loan. The loan-to-value ratio (LTV) for hard money loans is usually lower than that of traditional loans, typically ranging from 60% to 70%. The loan duration is typically shorter as well, ranging from a few months to a few years. Hard money lenders may also charge additional fees, such as origination fees or prepayment penalties.

Advantages and disadvantages of hard money loans

Hard money loans offer several advantages for borrowers in distressed property situations. Firstly, hard money lenders often have a faster loan approval process compared to traditional lenders, enabling borrowers to quickly secure the financing they need. This can be crucial for distressed property investors who need to act swiftly to acquire and renovate the property. Secondly, hard money lenders are primarily concerned with the value of the property and the borrower’s exit strategy, rather than their credit score or financial history. This provides an opportunity for borrowers with lower credit scores or financial challenges to access financing. Lastly, hard money loans can be a valuable tool for building or rehabilitating a borrower’s credit history if they successfully repay the loan.

However, hard money loans also come with certain disadvantages. They generally have higher interest rates and fees compared to traditional loans, which can increase the borrowing costs for the borrower. The shorter loan term can also create pressure for borrowers to quickly sell or refinance the property to repay the loan. Additionally, hard money loans may have stricter terms and conditions, including higher down payment requirements and more extensive due diligence processes.

Criteria for Evaluating Distressed Properties

Key factors considered by hard money lenders

Hard money lenders consider several key factors when evaluating distressed properties. The first factor is the market value of the property. Lenders need to assess the property’s current value and its potential value after repairs and renovations. They consider factors such as location, comparable sales, and market trends to determine the property’s market value.

Another important factor is the borrower’s exit strategy. Hard money lenders need to understand how the borrower intends to repay the loan. This can be through the sale or refinancing of the property once it has been renovated. The viability and potential profitability of the exit strategy play a significant role in the lender’s decision-making process.

Assessing property value

Evaluating the value of a distressed property requires a thorough analysis of its current condition and potential for improvement. Hard money lenders often rely on professional appraisals, inspections, and market research to estimate the property’s value. They take into account factors such as the property’s size, age, location, and the extent of repairs needed. Comparisons with similar properties in the area are also used to determine the potential market value.

Determining repair costs

Determining the repair costs is crucial for both borrowers and lenders when evaluating distressed properties. Lenders need to assess the feasibility of the proposed renovations and estimate the costs involved. This information helps them determine the loan amount they are willing to provide. Borrowers must ensure that their renovation plans are financially viable and that the projected costs align with the budget.

Flexibility in Underwriting

Less reliance on credit scores

One of the key advantages of hard money loans is the flexibility in underwriting criteria, particularly regarding credit scores. Traditional lenders heavily rely on credit scores to determine a borrower’s creditworthiness and loan eligibility. However, hard money lenders place less emphasis on credit scores and instead focus on the value of the distressed property and the borrower’s exit strategy. This allows borrowers with lower credit scores or financial challenges to secure financing for distressed properties that would not qualify for traditional loans.

Focus on property value

Hard money lenders prioritize the value of the distressed property when making underwriting decisions. Unlike traditional lenders who may weigh borrower characteristics more heavily, hard money lenders are primarily concerned with the collateral. By focusing on the property value, lenders can assess the potential profitability of the investment and determine the appropriate loan amount.

Importance of exit strategy

Another essential factor in underwriting distressed properties is the borrower’s exit strategy. Hard money lenders need to understand how the borrower plans to repay the loan once the property is renovated or improved. This could involve selling the property, refinancing it with a traditional loan, or using other sources of funds. A clear and viable exit strategy is crucial for lenders to mitigate the risks associated with distressed properties.

Loan-to-Value Ratio

Definition of loan-to-value ratio (LTV)

The loan-to-value ratio (LTV) is a financial term that compares the loan amount to the value of the property. It is a key factor in determining the maximum loan amount a lender is willing to provide. The LTV ratio is calculated by dividing the loan amount by the appraised value of the property. For example, if a lender provides a loan of $150,000 for a property with an appraised value of $200,000, the LTV ratio would be 75%.

How LTV affects lending decisions

The LTV ratio affects lending decisions because it provides an indication of the level of risk involved for both the lender and the borrower. A higher LTV ratio implies a higher risk for the lender since the loan amount is a larger proportion of the property value. Higher LTV ratios are typically associated with properties in poorer condition or higher financial risks. Consequently, lenders may be more conservative with loan amounts, impose stricter terms and conditions, or require additional collateral for higher LTV ratios.

LTV requirements for distressed properties

LTV requirements for distressed properties are generally lower than those for non-distressed properties. This is because distressed properties often have lower market values due to their condition or financial challenges. The lower LTV ratios help lenders mitigate the risks associated with distressed properties by providing a margin of safety in case the property value decreases or the borrower defaults on the loan. LTV requirements for distressed properties typically range from 60% to 70%.

Due Diligence Process

Comprehensive property inspection

During the due diligence process, hard money lenders conduct a thorough inspection of the distressed property to assess its overall condition and identify any necessary repairs or renovations. The inspection involves evaluating the property’s structure, systems, and functionality. This assessment helps lenders determine the feasibility of the proposed renovations and estimate repair costs.

Evaluation of liens and title issues

Hard money lenders also conduct a careful evaluation of any existing liens or title issues associated with the distressed property. This involves reviewing public records, title reports, and other relevant documents to identify any outstanding debts or legal claims against the property. Lenders need to ensure that the title is clear and that there are no undisclosed liabilities or encumbrances that could adversely affect the property’s value or marketability.

Thorough assessment of repair estimates

Estimating the costs of repairs and renovations is a critical part of the due diligence process for hard money lenders. Lenders typically rely on contractor bids, cost estimates, and industry knowledge to evaluate the feasibility and financial viability of the proposed renovations. Accurate repair estimates help lenders determine the maximum loan amount they are willing to provide and assess the potential profitability of the investment for the borrower.

Loan Repayment and Exit Strategies

Options for loan repayment

Hard money loans are typically short-term loans, often ranging from six months to three years. Borrowers have several options for repaying the loan during this timeframe. One common option is to sell the property once it has been renovated and use the proceeds to repay the loan. Borrowers may also choose to refinance the property with a traditional mortgage loan once its value has increased. Other sources of funds, such as personal savings or investments, can also be used to repay the loan.

Importance of a viable exit strategy

A viable exit strategy is crucial for both borrowers and lenders in distressed property situations. Lenders need assurance that the borrower has a realistic and achievable plan for repaying the loan. The exit strategy should consider factors such as current market conditions, potential buyer demand, and the anticipated timeline for selling or refinancing the property. A well-thought-out exit strategy helps mitigate risks for lenders and ensures a successful outcome for borrowers.

Minimizing risks for lenders and borrowers

Hard money lenders and borrowers can minimize risks associated with distressed properties through careful planning and collaboration. Both parties must thoroughly evaluate the property and its potential for repairs and renovations. Lenders should assess the borrower’s financial capability and determine if the exit strategy is viable. Borrowers, on the other hand, need to have a clear understanding of the risks involved and the financial obligations associated with the loan. Adequate risk assessment and open communication between lenders and borrowers are essential to minimize potential challenges and ensure successful loan repayment.

Loan Terms and Conditions

Typical interest rates

Interest rates for hard money loans are typically higher than those for traditional bank loans. Due to the increased risks associated with distressed properties, hard money lenders generally charge interest rates ranging from 10% to 15% or more. The specific interest rate depends on various factors, including the lender, the borrower’s creditworthiness, and the condition of the property. Borrowers should carefully consider the interest rate offered and assess its impact on the overall borrowing costs before entering into a hard money loan agreement.

Loan duration and extension options

Hard money loans have relatively short durations compared to traditional loans. The loan term can range from a few months to a few years, depending on the lender and the specific circumstances. Borrowers should carefully consider the project timeline and ensure that they can complete the renovations and secure the necessary funds to repay the loan within the agreed-upon timeframe. In certain situations, lenders may consider extensions to the loan term, but this will be subject to negotiation and agreement between the lender and the borrower.

Penalties and fees

Hard money loans often come with additional fees and penalties beyond the interest rate. These fees can include origination fees, loan processing fees, and prepayment penalties. Origination fees are typically calculated as a percentage of the loan amount and cover the costs associated with processing the loan. Prepayment penalties are fees charged if the borrower repays the loan earlier than the agreed-upon term. Borrowers should carefully review the terms and conditions of the loan agreement to understand the specific fees and penalties involved.

Collateral and Asset Protection

Role of collateral in hard money loans

Collateral plays a significant role in hard money loans, as the loan is typically secured by the distressed property itself. The property serves as collateral, meaning that if the borrower fails to repay the loan, the lender can seize and sell the property to recover their investment. Collateral provides lenders with a level of security and assurance that they can recoup their funds in the event of default.

Methods for asset protection

There are various methods to protect assets in hard money loans, both for lenders and borrowers. For lenders, conducting thorough due diligence and carefully evaluating the distressed property’s value and potential can help mitigate risks. Proper contract structuring, including clear terms and conditions, can also protect lenders’ interests in case of defaults or breaches. For borrowers, ensuring proper insurance coverage on the property can help protect against unforeseen events that may damage the property. Additionally, establishing a limited liability company (LLC) or other legal entities can help separate personal assets from business investments and provide an additional layer of protection.

Legal aspects of collateral

Collateral in hard money loans involves legal considerations. Lenders need to ensure that they have proper legal documentation, such as a mortgage or deed of trust, to secure their interest in the property. Proper recording and registration of the collateral can protect the lender’s rights in case of disputes or competing claims. Borrowers should seek legal advice to understand the implications of providing collateral and ensure that they have a clear understanding of their rights and obligations regarding the property.

Communication and Collaboration

Engaging with borrowers

Effective communication between hard money lenders and borrowers is vital in distressed property transactions. Lenders need to establish open and transparent lines of communication with borrowers throughout the loan process. This includes explaining the terms and conditions of the loan, discussing repayment options, and addressing any concerns or questions the borrower may have. Regular updates and progress reports should also be provided to ensure both parties are aware of the project’s status and any potential issues that may arise.

Coordinating with real estate professionals

Collaboration with real estate professionals such as contractors, appraisers, and real estate agents can greatly enhance the success of distressed property transactions. Hard money lenders often work closely with these professionals to assess property values, estimate repair costs, and evaluate the potential profitability of the investment. Real estate professionals can provide valuable insights and expertise in their respective areas, contributing to a comprehensive and well-informed decision-making process.

Developing effective partnerships

Establishing effective partnerships and professional relationships is essential for hard money lenders handling properties in distressed conditions. Lenders can benefit from collaborating with experienced real estate professionals, contractors with a track record of successful renovations, and other industry experts. These partnerships can enhance the due diligence process, streamline property evaluations and repairs, and contribute to successful loan repayment and exit strategies. Ongoing collaboration and networking within the real estate community can lead to new investment opportunities and mutual growth for lenders and borrowers alike.

In conclusion, hard money lenders play a crucial role in handling properties in distressed conditions. Distressed properties present various challenges, both for buyers and lenders. Hard money loans offer a viable financing option for distressed property investors due to their flexibility in underwriting criteria, focus on property value, and considerations of the borrower’s exit strategy. Evaluating distressed properties requires careful assessment of key factors such as market value, repair costs, and potential risks. Diligent due diligence processes, comprehensive property inspections, and thorough evaluations of liens and title issues are essential. Loan repayment and effective exit strategies, along with clear terms and conditions, contribute to successful outcomes for both borrowers and lenders. Collateral and asset protection, as well as communication and collaboration with real estate professionals, are crucial elements of navigating distressed property transactions. By understanding the intricacies of distressed properties and engaging in professional partnerships, hard money lenders can effectively handle properties in distressed conditions and contribute to successful real estate investments.