If you find yourself in a situation where you are interested in purchasing a family-owned property by buying out the heirs, you may be wondering if a hard money loan is a viable option for financing. Many individuals turn to hard money loans for their flexible terms and quick approval process. In this article, we will explore whether using a hard money loan is a feasible solution for buying out heirs in a family-owned property. By examining the advantages and potential drawbacks of this financing option, you can make an informed decision on how to proceed with your property acquisition goals.

Overview of Hard Money Loans

Definition of hard money loans

Hard money loans are a type of short-term financing that is primarily secured by real estate collateral. Unlike traditional mortgage loans, hard money loans are often provided by private individuals or companies, rather than traditional financial institutions. These loans are typically sought by borrowers who are unable to obtain financing through traditional means, or who need funds quickly.

How hard money loans work

Hard money loans are based on the value of the property being used as collateral, rather than the borrower’s creditworthiness or income. The loan amount is determined by the loan-to-value (LTV) ratio, which is calculated by dividing the loan amount by the property’s appraised value. Typically, hard money loans have relatively short terms, often ranging from six months to several years. The borrower makes monthly interest payments and repays the principal at the end of the loan term.

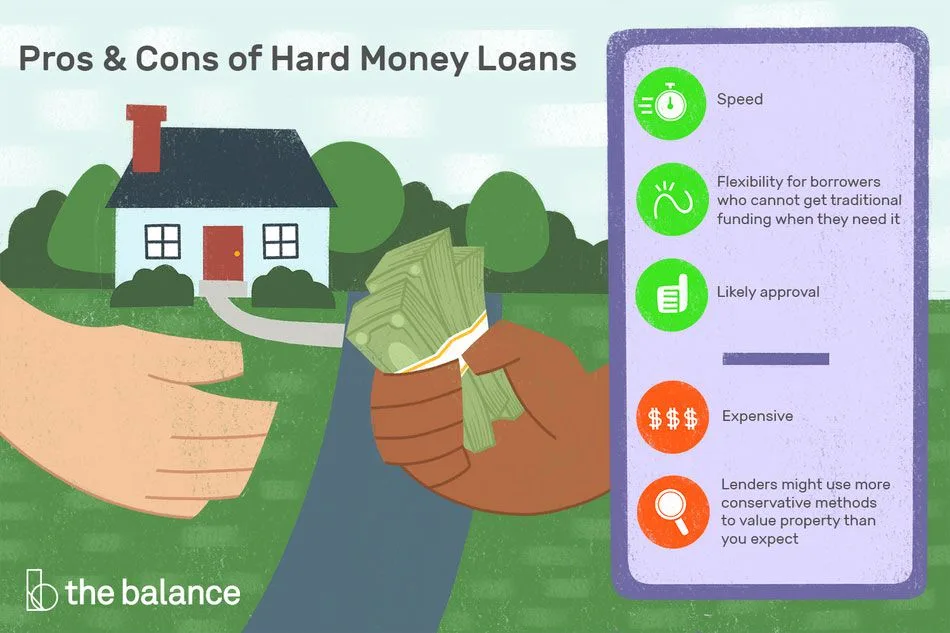

Benefits of hard money loans

Hard money loans offer several advantages over traditional financing options. First, they provide quick access to funds, allowing borrowers to take advantage of time-sensitive opportunities, such as buying out heirs in a family-owned property. Additionally, hard money lenders are typically more flexible in their underwriting criteria, making it easier for borrowers with less-than-perfect credit or unconventional income sources to qualify for a loan. Lastly, hard money lenders are known for their quick closing times, which can help borrowers secure a property or complete a buyout faster than with traditional financing.

Drawbacks of hard money loans

While hard money loans offer unique advantages, they also come with some drawbacks. One major disadvantage is the higher interest rates associated with hard money loans. Since these loans are considered high-risk, the interest rates can range from 8% to 15% or even higher. Additionally, hard money loans often have shorter repayment terms, typically ranging from six months to three years. This can put a significant burden on borrowers who may struggle to repay the loan within the short timeframe. Another drawback is the limited borrowing capacity of hard money loans, as lenders typically offer loans up to a certain percentage of the property’s value, often 70% to 80% of the appraised value.

Understanding Family-Owned Properties

Definition of family-owned properties

Family-owned properties are real estate assets that are jointly owned by multiple members of the same family. These properties often have strong sentimental value and are passed down through generations. Family-owned properties can include primary residences, vacation homes, rental properties, or commercial buildings.

Challenges of managing family-owned properties

Managing family-owned properties can present unique challenges. One of the primary challenges is the potential for disagreements and conflicts between different family members regarding property decisions. These disagreements can range from maintenance and repair issues to rental income distribution. The emotional attachment to the property can amplify these conflicts, making it difficult to reach consensus on important matters. Additionally, coordinating the financial aspects of managing a family-owned property, such as tax obligations and mortgage payments, can be complex when multiple individuals are involved.

Issues with multiple heirs

When a family-owned property is inherited by multiple heirs, it can create additional complications. Each heir may have different financial needs or preferences regarding the property’s future, leading to conflicts and disagreements. Furthermore, ownership shares may be divided unequally among heirs, which can complicate decision-making processes and potentially strain familial relationships. These challenges can make it desirable for some heirs to explore options for selling their share or buying out other heirs to obtain sole ownership of the property.

Considering a Buyout of Heirs

Reasons for considering a buyout

There are various reasons why a buyout of heirs in a family-owned property may be considered. One common reason is a desire for sole ownership and control over the property. A buyout allows one heir to take full ownership and make independent decisions regarding the property’s management and future. Additionally, a buyout can provide an opportunity to consolidate ownership and simplify financial obligations associated with the property. Furthermore, a buyout can be an appealing option if there are disagreements or conflicts between heirs that make co-ownership unfeasible or undesirable.

Advantages of buying out heirs

Buying out heirs in a family-owned property offers several advantages. Firstly, it provides a clear path to sole ownership, allowing for more streamlined decision-making and management of the property. It also provides stability and security for the buyer, as they no longer need to navigate the complexities of shared ownership or potential disagreements among heirs. Additionally, by buying out the other heirs, the buyer may have greater control over the property’s future, whether it involves selling, renovating, or maintaining the property.

Potential challenges in the buyout process

While buying out heirs can have numerous benefits, there can also be challenges in the process. One significant challenge is determining a fair buyout price that satisfies both the buyer and the heirs being bought out. Valuing a family-owned property can be subjective and emotional, and reaching a mutually agreeable price can be a complex negotiation process. Additionally, arranging financing for the buyout can pose a challenge. Traditional mortgage lenders may be reluctant to finance a buyout, particularly if the property’s ownership is complicated or unclear. This is where hard money loans can provide a potential solution.

Applying for a Hard Money Loan

Requirements for obtaining a hard money loan

Obtaining a hard money loan typically requires meeting certain eligibility criteria set by the lender. While specific requirements may vary between lenders, common prerequisites include a clear title to the property being used as collateral, a minimum percentage of equity in the property, and the ability to make monthly interest payments. Lenders may also consider the borrower’s experience in real estate or related industries, as well as their overall financial stability.

How lenders evaluate hard money loan applications

Hard money lenders take a different approach to evaluating loan applications compared to traditional lenders. While traditional lenders primarily focus on the borrower’s creditworthiness and income, hard money lenders prioritize the value and condition of the property being used as collateral. They may request an appraisal or property inspection to assess the property’s value and determine the loan amount. Additionally, hard money lenders may consider the borrower’s exit strategy, such as how they plan to repay the loan, often through property sale or refinancing.

Loan-to-value ratio considerations

Loan-to-value (LTV) ratio is an important factor in hard money loan applications. Lenders typically offer loans up to a certain percentage of the property’s appraised value, which can range from 50% to 80% or higher. The LTV ratio impacts the loan amount, interest rates, and the lender’s risk exposure. A higher LTV ratio may result in higher interest rates or require additional collateral to mitigate risk.

Interest rates and fees associated with hard money loans

Hard money loans generally come with higher interest rates compared to traditional loans, partly due to the increased risk associated with these types of loans. Interest rates can range from 8% to 15% or higher, depending on factors such as the borrower’s creditworthiness and the perceived risk of the property being used as collateral. Additionally, borrowers should be aware of potential fees, such as loan origination fees, underwriting fees, and early repayment penalties. These fees can vary among lenders, so it is essential to review the terms and conditions carefully before accepting a hard money loan.

Using a Hard Money Loan for Heir Buyouts

Feasibility of using a hard money loan for buyouts

Using a hard money loan for an heir buyout can be a feasible option, depending on the specific circumstances. Hard money loans provide quick access to funds, which can be advantageous when time is of the essence in completing the buyout. Additionally, hard money lenders are often more flexible in their underwriting criteria, making it possible for borrowers with less-than-ideal credit or complex ownership situations to qualify for a loan.

Eligible properties for hard money loans

Hard money loans can potentially be used for buyouts of heirs in many types of properties, including single-family homes, multi-unit residential buildings, commercial properties, and land. However, it is important to note that individual lenders may have restrictions on the types of properties they are willing to finance. Some lenders may have preferences for specific property types or may avoid financing properties with certain issues, such as extensive repairs or environmental hazards.

Steps involved in using a hard money loan

To use a hard money loan for an heir buyout, the first step is to identify a suitable hard money lender. Researching and comparing multiple lenders can help borrowers find ones that offer favorable terms and have experience with buyouts. After selecting a lender, the borrower would need to submit an application, provide the necessary documentation, and receive approval. Once approved, the borrower can finalize the buyout by negotiating a purchase price with the heirs and completing the necessary legal processes. The hard money loan funds would then be used to pay off the heirs, and the borrower would begin making monthly interest payments to the lender.

Potential risks and considerations

While using a hard money loan for an heir buyout can be a viable option, borrowers should carefully consider the risks involved. The higher interest rates associated with hard money loans mean that borrowers will pay more in interest over the loan term compared to traditional financing options. Therefore, it is crucial to assess the feasibility of repaying the loan within the short term and consider potential exit strategies, such as refinancing or selling the property, to repay the loan. Borrowers should also ensure that they have a comprehensive understanding of the buyout process, including any legal obligations or potential tax implications.

Benefits of Using Hard Money Loans to Buy Out Heirs

Flexibility in terms of repayment

One significant benefit of using a hard money loan to buy out heirs is the flexibility it offers in terms of repayment. Unlike traditional loans with rigid repayment schedules, hard money loans can be structured to accommodate the borrower’s specific needs and goals. This flexibility can be particularly advantageous when there is uncertainty regarding the timing or source of funds for loan repayment.

Quick access to funds

Hard money loans are known for their fast turnaround times, providing borrowers with quick access to funds. This attribute is essential, especially in the case of heir buyouts, where timing can be critical. The ability to secure financing promptly can help expedite the buyout process and avoid potential complications that may arise from a lengthy financing process.

Opportunity to negotiate with heirs

Using a hard money loan for an heir buyout can give the borrower a significant advantage during the negotiation process. A borrower with access to quick funds from a hard money loan can present a more attractive offer to the heirs, who may be motivated to sell their shares of the property promptly. This opportunity to negotiate from a position of strength can potentially result in a more favorable purchase price for the borrower.

No credit score or income requirements

One notable advantage of hard money loans is that they do not typically require a high credit score or proof of income. Since hard money lenders primarily focus on the value of the property being used as collateral, borrowers with less-than-perfect credit or non-traditional sources of income can still qualify for a loan. This flexibility makes hard money loans a viable option for individuals who may not meet the strict requirements of traditional lenders.

Drawbacks of Using Hard Money Loans to Buy Out Heirs

Higher interest rates

One of the significant drawbacks of using hard money loans for heir buyouts is the higher interest rates compared to traditional financing options. Hard money lenders assume a higher level of risk due to the short-term nature of these loans and the reliance on collateral rather than the borrower’s creditworthiness. As a result, borrowers can expect to pay significantly higher interest rates, which can increase the total cost of the loan.

Short repayment terms

Hard money loans are typically short-term loans, often ranging from six months to a few years. The short repayment terms can create challenges for borrowers, as it may be difficult to repay the loan within the designated timeframe. This is especially true for heir buyouts, as the buyout process itself may take time, and additional financing may be required to fully repay the loan.

Potential impact on relationships with heirs

Using a hard money loan to buy out heirs can have potential implications for familial relationships. The buyout process can be emotionally charged, and engaging in financial transactions with family members can add additional complexities. Disputes over pricing or disagreements related to financial obligations may strain relationships or create long-lasting tensions among family members. It is crucial to consider the potential impact on personal dynamics and carefully navigate the buyout process to minimize any negative consequences.

Limited borrowing capacity

Another drawback of using hard money loans for heir buyouts is the limited borrowing capacity. Hard money lenders typically offer loans ranging from 50% to 80% of the property’s appraised value. This means that borrowers may need to provide additional funds or collateral to cover the remaining portion of the purchase price. The limited borrowing capacity can restrict the options available to borrowers, particularly if they require a substantial buyout amount.

Alternatives to Hard Money Loans for Heir Buyouts

Traditional mortgage financing

One alternative to a hard money loan for an heir buyout is traditional mortgage financing. Traditional lenders, such as banks or credit unions, can offer longer repayment terms and lower interest rates compared to hard money loans. However, securing traditional financing for an heir buyout may be challenging due to factors such as complex ownership structures or a lack of clear title to the property. Additionally, traditional lenders often have stringent credit and income requirements, which may limit the borrowing capacity of some individuals.

Home equity loans or lines of credit

Home equity loans or lines of credit can be another alternative for financing an heir buyout. If the borrower has sufficient equity in their primary residence or another property, they may be able to access funds through these types of loans. Home equity loans or lines of credit typically offer longer repayment terms and lower interest rates compared to hard money loans. However, borrowers should carefully evaluate the risks associated with using their home as collateral and have a solid plan for repaying the loan.

Private borrowing from family or friends

Borrowing funds from family or friends can be a viable alternative to hard money loans, particularly for smaller buyouts or when traditional financing options are not available. Private borrowing can offer more flexible terms and potentially lower interest rates, depending on the agreement reached with the lender. However, borrowers should approach private borrowing with caution and ensure that all parties involved have a clear understanding of the terms, obligations, and potential impact on personal relationships.

Seller financing

In some cases, the heirs may be willing to provide seller financing for the buyout. With seller financing, the heirs act as the lender and allow the buyer to make payments directly to them over a specified period. This arrangement can be mutually beneficial, as it allows the heirs to receive payments gradually while the buyer obtains ownership of the property. However, not all heirs may be open to this option, and the terms of the seller financing agreement should be carefully negotiated and documented to protect the interests of both parties.

Tips for a Successful Heir Buyout

Conducting thorough property valuation

Before proceeding with an heir buyout, it is crucial to conduct a thorough valuation of the property. This ensures that the buyer has a clear understanding of the property’s market value and can make an informed offer. Employing the services of a professional appraiser or real estate agent can help ensure an accurate valuation.

Negotiating a fair price with heirs

Negotiating a fair purchase price with the heirs is a crucial step in the buyout process. Open and honest communication, coupled with a willingness to listen to the concerns and preferences of all parties involved, can help establish a fair and mutually agreeable price. Engaging the services of a professional mediator or attorney can also facilitate the negotiation process and ensure that the interests of all parties are adequately represented.

Seeking professional legal advice

Given the complex legal implications and potential tax considerations associated with heir buyouts, it is advisable to seek professional legal advice. A qualified attorney with experience in real estate and estate planning can provide guidance on navigating the legal intricacies of the buyout process, ensuring compliance with relevant laws and protecting the interests of the buyer.

Creating a comprehensive repayment plan

Developing a comprehensive repayment plan is essential when using a hard money loan or other financing options for an heir buyout. The plan should include a realistic timeline for repaying the loan, consider potential exit strategies, and factor in any potential financial obligations associated with the property, such as property taxes or maintenance costs. Regularly reviewing and adjusting the repayment plan as necessary can help ensure successful loan repayment and prevent financial strain.

Conclusion

When considering a buyout of heirs in a family-owned property, it is crucial to carefully assess the available financing options and the associated benefits and drawbacks. Hard money loans can offer a viable solution for expediting the buyout process and accessing quick funds. However, borrowers should consider factors such as higher interest rates, short repayment terms, and potential impacts on relationships with heirs. Additionally, it is essential to evaluate alternative financing options, such as traditional mortgage financing, home equity loans, private borrowing, or seller financing, to determine the most suitable approach for the buyout. By analyzing personal circumstances, assessing the implications of different financing options, and weighing the pros and cons, buyers can navigate the heir buyout process successfully and achieve their desired outcomes.