Borrowers often wonder if they have any room for negotiation when it comes to securing a loan from a hard money lender. Specifically, they question whether they can negotiate the interest rate, a crucial factor in determining the affordability of the loan. This article examines the possibility of negotiating the interest rate with a hard money lender, shedding light on the factors that influence this possibility and providing valuable insights for borrowers seeking the best terms for their loan.

Understanding Hard Money Lenders

Definition and Role of Hard Money Lenders

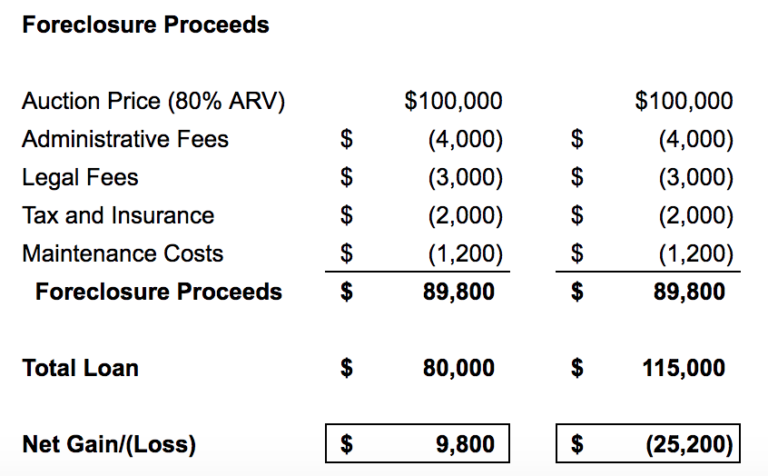

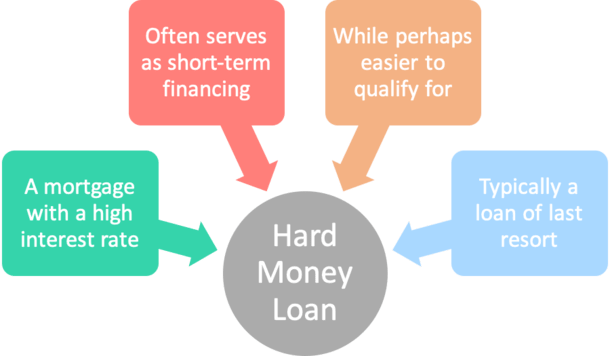

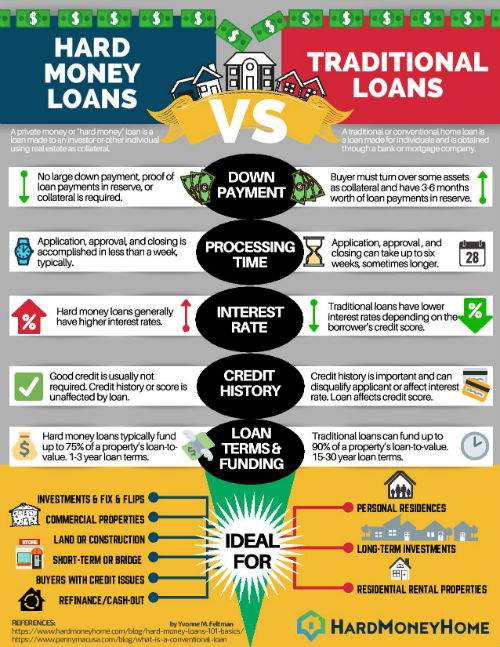

Hard money lenders are private individuals or companies that provide short-term loans, typically with a higher interest rate, using real estate as collateral. Unlike traditional lenders such as banks, hard money lenders focus more on the value of the property rather than the borrower’s creditworthiness. They play a crucial role in the real estate industry by offering quick financing options for borrowers who may not qualify for conventional loans.

Key Differences Between Traditional Lenders and Hard Money Lenders

While both traditional lenders and hard money lenders provide loans, there are significant differences between the two. Traditional lenders, such as banks, have strict lending criteria and require extensive documentation, including credit history, income verification, and detailed financial statements. On the other hand, hard money lenders base their lending decision primarily on the collateral provided, allowing borrowers with lower credit scores or unique financial situations to obtain financing. Additionally, hard money loans typically have shorter terms and higher interest rates compared to traditional loans.

Typical Borrowers that Seek Hard Money Loans

There are various scenarios in which borrowers seek hard money loans. Real estate investors who require quick financing to acquire properties, renovate them, and sell them at a higher price often turn to hard money lenders. This type of loan is also commonly sought by individuals who do not meet the stringent requirements of traditional lenders due to previous bankruptcy, foreclosure, or self-employment. Moreover, borrowers who need funding for time-sensitive projects or have limited access to conventional financing options can benefit from working with hard money lenders.

Benefits and Drawbacks of Working with Hard Money Lenders

Working with hard money lenders can offer several benefits. Firstly, the approval process is typically faster, allowing borrowers to secure funding in a shorter timeframe. Additionally, hard money lenders are more flexible regarding the property’s condition and may consider properties that traditional lenders would deem ineligible. Moreover, hard money loans can be a useful tool for building or rebuilding credit if borrowers make timely payments. However, there are also drawbacks to be considered. Hard money loans come with higher interest rates and fees, which can significantly increase the cost of borrowing. Additionally, the short-term nature of these loans can put pressure on borrowers to repay the loan quickly.

Factors Influencing Interest Rates

Market Factors and Economic Conditions

Interest rates for hard money loans are influenced by various market factors and economic conditions. Factors such as inflation, the supply and demand for loans, and changes in the overall economic climate can affect interest rates. In times of economic uncertainty or high inflation, hard money lenders may increase their interest rates to mitigate the risks associated with lending.

Loan-to-Value Ratio (LTV)

The loan-to-value ratio (LTV) is an essential factor in determining the interest rate for a hard money loan. LTV represents the percentage of the property’s appraised value that the lender is willing to finance. The higher the LTV, the riskier the loan is for the lender. Hard money lenders often require a higher LTV to compensate for the increased risk, which may result in a higher interest rate.

Borrower’s Creditworthiness

While hard money lenders primarily focus on the property’s value, the borrower’s creditworthiness can still influence the interest rate. Borrowers with a more favorable credit history and higher credit scores may be able to negotiate a lower interest rate with the lender. However, it is important to note that hard money lenders generally prioritize collateral over credit scores when making lending decisions.

Loan Amount and Length

The loan amount and length can impact the interest rate offered by hard money lenders. Typically, larger loan amounts or longer loan terms carry higher interest rates. This is because larger loans and longer terms expose the lender to more significant risks and potential fluctuations in the real estate market.

Property Type and Condition

The type and condition of the property being used as collateral can also affect the interest rate. Properties with a higher market value and in good condition may result in lower interest rates since they are considered less risky for the lender. In contrast, properties that are in poor condition or located in less desirable areas may lead to higher interest rates due to the increased risk involved.

Negotiating Interest Rates

Setting Realistic Expectations

Before entering into negotiations with a hard money lender, it is crucial to set realistic expectations. Understand the current market conditions and familiarize yourself with the average interest rates offered by hard money lenders. This will provide you with a baseline to assess and negotiate the interest rate.

Doing Research and Gathering Information

Research and gather as much information as possible about different hard money lenders and their interest rate offerings. Compare their rates, terms, and reputation within the industry. This knowledge will empower you to negotiate effectively by demonstrating your understanding of the market and available options.

Demonstrating Strong Borrower Profile

To negotiate for a lower interest rate, it is important to present a strong borrower profile. Emphasize your experience in real estate, financial stability, and any other relevant qualifications that demonstrate your ability to successfully complete the project and repay the loan. Showing the lender that you are a reliable and trustworthy borrower can increase your chances of securing a lower interest rate.

Presenting a Compelling Loan Proposal

Prepare a compelling loan proposal that outlines the details of the project, including the property’s value, your renovation or development plans, and the potential for profitability. Highlight any unique aspects of the project that may offer additional security for the lender. A well-crafted loan proposal can showcase the potential benefits of working with you and can support your negotiation efforts.

Offering Additional Collateral

If you are looking to negotiate for a lower interest rate, consider offering additional collateral to reduce the lender’s risk. This could include personal assets or other properties with significant equity. By providing additional security, you may be able to persuade the lender to offer a more favorable interest rate.

Leveraging Multiple Lender Options

To increase your negotiating power, explore multiple lender options and obtain multiple quotes. Having options allows you to compare offers and leverage one lender’s offer against another. This competition among lenders can give you an advantage when negotiating the interest rate and terms.

Alternative Ways to Reduce Interest Costs

Considering Points and Prepayment Penalties

Points are a form of prepaid interest paid to the lender at the loan closing. Prepayment penalties, on the other hand, are fees charged if the loan is paid off before the agreed-upon term. Both points and prepayment penalties can affect the overall interest cost of the loan. Carefully consider these factors and negotiate their terms to minimize the impact on the total interest paid.

Exploring Flexible Repayment Terms

Negotiating for flexible repayment terms can also help reduce interest costs. Instead of following a standard repayment schedule, consider structuring the loan to align with the cash flow generated by the property. This may involve interest-only payments for a certain period or adjustable interest rates based on the property’s performance.

Seeking Refinancing Opportunities

If your financial situation improves or market conditions change, it may be beneficial to seek refinancing opportunities. Refinancing allows you to replace your current hard money loan with a new loan at a potentially lower interest rate. However, be mindful of any refinancing fees or penalties, and carefully evaluate the potential savings before proceeding.

Reviewing Interest Rate Lock Options

When negotiating a hard money loan, it is essential to discuss and agree upon interest rate lock options. An interest rate lock ensures that the agreed-upon interest rate remains in effect for a specified period. This protects you from potential rate fluctuations and allows you to secure a favorable interest rate.

Building Relationships with Lenders

Establishing Trust and Credibility

Building trust and credibility with hard money lenders can increase your chances of securing better terms. Be transparent and provide accurate information about your financial status, project plans, and repayment capabilities. Consistently meet deadlines, communicate effectively, and maintain a professional relationship with the lender to establish trust.

Maintaining Good Communication

Maintaining open and proactive communication with your hard money lender is crucial throughout the borrowing process. Respond promptly to inquiries, provide regular updates on the status of your project, and address any concerns or issues that may arise. Good communication fosters a positive relationship and may lead to more favorable terms in the future.

Repeat Borrowers and Loyalty

Being a repeat borrower with a hard money lender can have significant benefits in terms of negotiating better interest rates and terms. By successfully completing previous projects and repaying loans on time, you establish a track record of reliability and trustworthiness. Lenders are more likely to offer improved terms to borrowers with a proven track record.

Referrals and Recommendations

Referrals and recommendations from trusted sources can also enhance your relationship with hard money lenders. If you have a positive experience with a particular lender, consider referring them to friends or colleagues who may also require financing. Lenders value referrals, and the potential for increased business may encourage them to offer more favorable terms.

Negotiating Terms Beyond Interest Rates

Loan Origination Fees

In addition to interest rates, loan origination fees are another important factor to consider and negotiate. Loan origination fees are charged by the lender for processing the loan application and managing the administrative tasks associated with approving and closing the loan. Negotiating lower origination fees can save you money upfront.

Loan Term and Repayment Schedule

Negotiating the loan term and repayment schedule can greatly impact the overall cost of the loan. Shorter loan terms often come with lower interest rates but higher monthly payments, while longer loan terms may have higher interest rates but lower monthly payments. Carefully consider your financial goals and constraints to determine the most suitable loan term and repayment schedule.

Loan-to-Value Ratio

The loan-to-value ratio, as mentioned earlier, plays a significant role in determining the interest rate. By negotiating a lower loan-to-value ratio with the lender, you can potentially secure a more favorable interest rate. Providing a higher down payment or offering additional collateral are strategies that can help reduce the loan-to-value ratio.

Loan Renewal Options

If your project needs more time to be completed, negotiating favorable loan renewal options can be crucial. Loan renewal allows you to extend the maturity date of the loan without going through the entire application process again. Ensure that the terms of the loan renewal, including any associated fees or changes in interest rates, are carefully negotiated to avoid any unexpected surprises.

Personal Guarantees

Some hard money lenders may require personal guarantees as added security for the loan. A personal guarantee indicates that you are personally liable for the repayment of the loan, even if the property securing the loan fails to generate sufficient funds. Negotiating the terms and extent of personal guarantees can protect you from assuming excessive personal liability.

Working with a Loan Broker

Leveraging the Expertise of a Loan Broker

Working with a loan broker can provide numerous advantages when negotiating with hard money lenders. Loan brokers have extensive knowledge of the lending landscape and can help you navigate the complex process of securing a hard money loan. Their expertise can help you find the most suitable lender, negotiate favorable terms, and streamline the application process.

Broker’s Ability to Negotiate on Borrower’s Behalf

Loan brokers have the advantage of being able to negotiate with hard money lenders on your behalf. They have established relationships with lenders and understand their preferences, lending criteria, and willingness to negotiate. This puts them in a favorable position to secure more favorable interest rates and terms.

Exploring Multiple Lender Options

One of the key benefits of working with a loan broker is access to a network of multiple lenders. Brokers can present you with various options, allowing you to compare interest rates, terms, and other conditions. This increased visibility into the market can improve your negotiating position and increase the likelihood of securing advantageous terms.

Broker’s Fee Structure

When engaging a loan broker, it is important to understand their fee structure and ensure that it aligns with your budget and expectations. Some brokers charge a percentage of the loan amount, while others may charge a flat fee. Additionally, consider any potential conflicts of interest that may arise due to the broker’s fee structure and negotiate transparency and fairness in their compensation.

Ensuring Fair and Legal Deals

Understanding State Regulations and Laws

It is essential to have a good understanding of the state regulations and laws governing hard money lending. Familiarize yourself with the rules and requirements specific to your location to ensure that the lending process and terms are fair and compliant. Seek legal advice if necessary to protect your rights as a borrower.

Reviewing Loan Documents and Agreements

Thoroughly review all loan documents and agreements before signing. Pay close attention to the interest rate, loan terms, repayment schedule, any prepayment penalties, and any other fees or charges associated with the loan. If you come across any clauses or terms that are unclear or appear unfair, seek clarification or negotiate changes to ensure a fair and transparent lending arrangement.

Seeking Legal Advice if Necessary

If you are unsure about any aspect of the hard money loan or the negotiation process, it is wise to seek legal advice. A qualified attorney with experience in real estate and lending can review the loan documents, provide guidance, and ensure that your rights and interests are protected. Legal advice can prevent potential issues and disputes down the line.

Tips for Successful Negotiations

Being Professional and Respectful

Maintaining a professional and respectful tone throughout the negotiation process is crucial. Treat the lender with respect and professionalism, even if there are challenges or disagreements. Maintain open lines of communication and approach negotiations with a cooperative mindset.

Preparing Well for Negotiation

Thorough preparation is key to successful negotiation. Familiarize yourself with the lender’s offer, gather relevant information and research, and anticipate potential questions or objections. By being well-prepared, you demonstrate your commitment and seriousness, increasing the likelihood of achieving your desired outcome.

Focusing on Win-Win Outcomes

Approach negotiations with the mindset of creating win-win outcomes. Understand the lender’s interests and priorities, and try to find common ground that benefits both parties. By finding mutually beneficial terms, you increase the chances of reaching an agreement that satisfies both your financial needs and the lender’s risk mitigation strategies.

Considering Long-Term Benefits

When negotiating, consider the long-term benefits rather than solely focusing on short-term gains. A slightly higher interest rate but favorable terms or a flexible loan renewal option may provide greater overall benefits. Assess the long-term impact on your financial goals and objectives before finalizing the negotiation.

Being Persistent and Willing to Walk Away

Negotiating with hard money lenders can involve multiple rounds of discussions and potentially facing rejection. Remain persistent and proactive in your negotiations, but also be prepared to walk away if the terms offered are not advantageous. Maintain a realistic view of the available options and be willing to explore alternatives if necessary.

Conclusion

In conclusion, understanding hard money lenders and effectively negotiating with them can significantly impact your borrowing experience and overall costs. By acquainting yourself with the role of hard money lenders, differences from traditional lenders, and the typical borrower profile, you can better position yourself for negotiation success. Additionally, factors influencing interest rates, alternative strategies to reduce interest costs, and the significance of building relationships with lenders all play a crucial role in securing better terms. Remember, negotiations extend beyond interest rates, and carefully considering all aspects of the loan, seeking professional advice when needed, and maintaining a professional and respectful approach can lead to favorable outcomes. Negotiating for better terms can ultimately provide greater financial flexibility and contribute to a successful partnership with hard money lenders.