If you’re considering venturing into the world of house flipping, you may be wondering if a hard money loan could be a viable option to fund your business. In this article, we will explore the potential benefits and drawbacks of using a hard money loan for house flipping. From understanding what a hard money loan entails to evaluating its suitability for your specific situation, this article will provide you with a comprehensive overview to help you make an informed decision. So, if you’re ready to delve into the world of house flipping financing, let’s get started.

What is a Hard Money Loan?

Definition

A hard money loan is a type of short-term financing that is typically used by real estate investors to fund house flipping projects. Unlike traditional bank loans, hard money loans are funded by private individuals or companies rather than banks or financial institutions. These loans are secured by the property being purchased, which means that the borrower must provide collateral in order to secure the loan. Hard money lenders usually base their lending decision on the value of the property rather than the borrower’s creditworthiness.

How it Works

When a real estate investor wants to fund a house flipping project, they can apply for a hard money loan from a private lender. The lender will evaluate the property’s value and the investor’s ability to repay the loan. If approved, the lender will provide the funds necessary for the purchase of the property. The investor will then use these funds to purchase the property and begin the renovation process. Once the property is sold, the investor will use the proceeds to repay the hard money loan.

Benefits

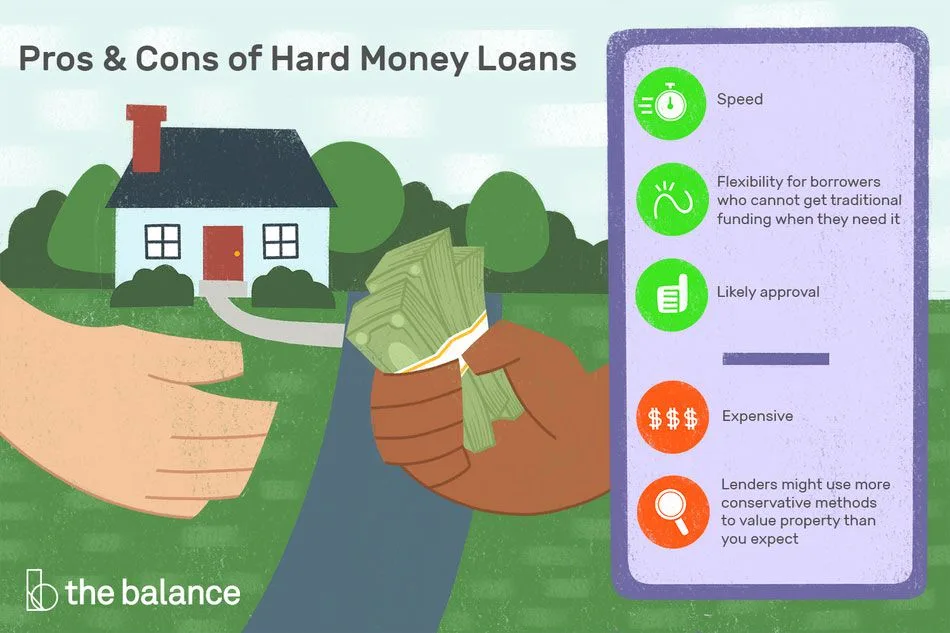

One of the main benefits of using a hard money loan for house flipping is the quick access to funding. Unlike traditional bank loans which can take weeks or even months to be approved, hard money loans can often be approved and funded within a matter of days. This allows real estate investors to take advantage of time-sensitive opportunities and secure properties quickly.

Another benefit of hard money loans is the flexible qualification criteria. Since hard money lenders primarily focus on the value of the property rather than the borrower’s credit score or income, investors with less-than-perfect credit or limited income can still qualify for a hard money loan. This makes it an attractive option for real estate investors who may not meet the strict requirements of traditional lenders.

Using a hard money loan also offers the opportunity to scale your house flipping business. With quick access to funding and flexible qualification criteria, investors can take on multiple projects simultaneously, increasing their potential profits and expanding their business.

Lastly, hard money loans allow investors to have less reliance on personal credit. Traditional lenders often heavily consider a borrower’s credit score and history when determining loan approval and terms. With hard money loans, the focus is primarily on the property being purchased and its potential value, rather than the borrower’s personal creditworthiness.

Drawbacks

While there are many benefits to using a hard money loan for house flipping, there are also some drawbacks to consider. One of the main drawbacks is the high interest rates and fees associated with hard money loans. Since these loans are short-term and often considered higher-risk, lenders charge higher interest rates to compensate for the risk. Additionally, there may be upfront fees and closing costs that need to be paid.

Another drawback of using a hard money loan is the short repayment period. Hard money loans typically have a repayment period of 6 to 12 months, with some lenders offering extensions or renewals if needed. This short timeframe can put pressure on the investor to complete the renovation and sell the property quickly in order to repay the loan.

Using a hard money loan also comes with higher risk. Since these loans are based on the value of the property rather than the borrower’s creditworthiness, if the project fails or the property does not sell for the expected price, the investor may lose their investment and be unable to repay the loan.

Lastly, when using a hard money loan, investors have less control over the financing terms compared to traditional bank loans. Traditional lenders often offer more flexibility in terms of loan repayment, interest rates, and other terms. Hard money lenders may have stricter terms and less room for negotiation.

House Flipping Business Overview

Definition

House flipping is a real estate investment strategy where an investor purchases a property, renovates it, and then sells it for a profit. The goal of house flipping is to buy properties at a lower price, increase their value through renovations, and sell them at a higher price within a relatively short period of time.

Process

The house flipping process typically involves several steps. Firstly, the investor identifies and analyzes potential properties that have the potential for a profitable renovation. Once a property is selected, the investor will secure financing, either through traditional lenders or alternative financing options such as hard money loans.

After acquiring the property, the investor will then proceed with the renovation process. This may involve hiring contractors, managing the renovation budget, and overseeing the renovation work. The investor must ensure that the renovation adds value to the property and aligns with the current market trends and buyer preferences.

Once the renovations are complete, the investor will list the property for sale and market it to potential buyers. The goal is to sell the property quickly and at a price that generates a significant profit for the investor. In some cases, the investor may choose to work with a real estate agent or use other marketing strategies to attract potential buyers.

Challenges

While house flipping can be a profitable investment strategy, it also comes with its fair share of challenges. One of the main challenges faced by house flippers is accurately estimating renovation costs. It is essential to carefully analyze the property and create a detailed budget to avoid unexpected expenses that could eat into potential profits.

Another challenge is finding and acquiring properties at a discounted price. The real estate market can be competitive, and finding properties that offer sufficient profit potential can be a daunting task. It requires extensive research, networking, and diligent property analysis to identify investment-worthy opportunities.

Timing is another critical factor in house flipping. Fluctuations in the real estate market can impact the profitability of a project. It is essential to stay updated on market trends and economic indicators to make informed decisions about when to buy and sell properties.

Lastly, managing the renovation process and ensuring quality workmanship can be challenging. House flippers must coordinate and supervise contractors, handle permit requirements, and ensure that the renovations are completed on time and within budget.

The Pros of Using a Hard Money Loan for House Flipping

Quick Access to Funding

One of the biggest advantages of using a hard money loan for house flipping is the quick access to funding. When pursuing a house flipping project, speed is often crucial. Traditional bank loans can take weeks or even months to be approved and funded, causing investors to miss out on potentially lucrative opportunities. Hard money lenders, on the other hand, can often approve and fund loans within a matter of days, allowing investors to secure properties quickly and start renovations immediately.

Flexible Qualification Criteria

Another significant benefit of hard money loans is the flexible qualification criteria. Traditional lenders typically place heavy emphasis on a borrower’s credit score, income, and financial history when determining loan eligibility. This can be challenging for real estate investors who have less-than-perfect credit or limited income.

Hard money lenders, however, primarily evaluate the value of the property being purchased rather than the borrower’s personal financial situation. As long as the property has sufficient value to serve as collateral, investors with less-than-ideal credit or income can still qualify for a hard money loan. This flexibility gives real estate investors a viable financing option, even if they do not meet the strict requirements of traditional lenders.

Opportunity to Scale

Using a hard money loan can also present opportunities for real estate investors to scale their house flipping business. With quick access to funding and flexible qualification criteria, investors can take on multiple projects simultaneously. This ability to increase the number of projects can lead to higher potential profits and can significantly expand the investor’s business.

Additionally, scaling the business through hard money loans allows investors to build a portfolio of successful projects, which can enhance their reputation and attract more financing options in the future. This scalability can ultimately lead to greater success and growth in the house flipping industry.

Less Reliance on Personal Credit

When using a hard money loan for house flipping, an investor’s personal credit history and score are of lesser importance. Traditional lenders often heavily consider a borrower’s creditworthiness when determining loan eligibility and terms. This can be a significant obstacle for individuals who may have experienced financial difficulties in the past or have a limited credit history.

Hard money lenders focus primarily on the property’s value and the potential for profit. As long as the investment property is deemed valuable enough to serve as collateral, the borrower’s credit history becomes less of a factor. This allows real estate investors to secure financing for their house flipping projects, even if their personal credit situation is less than ideal.

The Cons of Using a Hard Money Loan for House Flipping

High Interest Rates and Fees

One of the main drawbacks of using a hard money loan for house flipping is the high interest rates and fees associated with these loans. Due to the short-term nature of hard money loans and the higher risk involved, lenders often charge higher interest rates compared to traditional bank loans.

The interest rates on hard money loans can range from 8% to 15% or higher. These rates can significantly increase the cost of borrowing and reduce the potential profit margin for the investor. Additionally, there may be upfront fees and closing costs that need to be paid, further adding to the overall cost of the loan.

Short Repayment Period

Another downside of hard money loans is the short repayment period. Hard money loans usually have a repayment period of 6 to 12 months, although some lenders may offer extensions or renewals if needed. This short timeframe can create a sense of urgency and pressure for the investor to complete the renovation, sell the property, and repay the loan within the given time frame.

The short repayment period can be particularly challenging if the renovation process takes longer than expected or if the property does not sell as quickly as anticipated. Failing to repay the loan on time can result in additional fees and penalties, as well as potential damage to the investor’s credit score and relationship with the lender.

Higher Risk

Using a hard money loan for house flipping comes with a higher level of risk compared to traditional bank loans. Hard money lenders primarily base their lending decisions on the value of the property rather than the borrower’s personal financial situation. This means that if at any point the project fails or the property does not sell for the expected price, the investor may lose their investment and be unable to repay the loan.

The real estate market can be unpredictable, and there are external factors beyond the investor’s control that can impact the success or failure of a house flipping project. Economic downturns, changes in market conditions, and unexpected construction or renovation challenges can increase the risk associated with the investment.

Less Control over Financing Terms

When using a hard money loan for house flipping, investors generally have less control over the financing terms compared to traditional bank loans. Traditional lenders often offer more flexibility in terms of loan repayment, interest rates, and other terms based on the borrower’s creditworthiness and financial history.

Hard money lenders, however, may have stricter terms and less room for negotiation. The focus is primarily on the value of the property, and the borrower’s personal financial situation may carry less weight. This limited control over financing terms can make it more challenging for investors to secure favorable loan conditions that align with their specific needs and goals.

How to Qualify for a Hard Money Loan for House Flipping

Find a Reputable Hard Money Lender

The first step to qualifying for a hard money loan for house flipping is to find a reputable hard money lender. Conduct thorough research and compare various lenders to ensure they have a proven track record in the industry. Look for lenders who specialize in house flipping loans and have experience working with real estate investors.

Reading reviews, checking references, and reaching out to other investors who have worked with the lender can provide valuable insights into their reputation and credibility. It is essential to select a lender that aligns with your specific financing needs and has a solid reputation for delivering on their loan commitments.

Proof of House Flipping Experience

Most hard money lenders will require proof of house flipping experience before approving a loan. They want to ensure that the borrower has a sound understanding of the house flipping process and the real estate market. This typically involves providing documentation and records of previous house flipping projects, including information on the purchase price, renovation costs, and final sale prices.

If you are new to house flipping and do not have previous experience, it may be more challenging to qualify for a hard money loan. In this case, you may need to consider partnering with an experienced house flipper or seeking private money lenders who may be more willing to finance your project based on other factors.

A Solid Business Plan

To secure a hard money loan, you will need to present a solid business plan that outlines your house flipping strategy and investment goals. The business plan should include detailed information on the property you intend to purchase, the estimated renovation costs, the anticipated sale price, and the potential profit margin.

The business plan should also address any potential challenges or risks associated with the project and outline your strategy for mitigating these risks. A well-prepared and comprehensive business plan will demonstrate to the lender that you have thoroughly assessed the property and have a clear plan for success.

Demonstrate Ability to Repay the Loan

Hard money lenders are primarily concerned with the value of the property and the potential for profit. However, they still need assurance that the borrower has the ability to repay the loan. As part of the loan application process, you will need to provide documentation and proof of income, assets, and financial stability.

This can include bank statements, tax returns, pay stubs, and other financial documents that demonstrate your ability to generate income and cover loan repayment obligations. The lender wants to be confident that you will be able to repay the loan, even in the event of unforeseen challenges or delays in selling the property.

Factors to Consider Before Using a Hard Money Loan for House Flipping

Real Estate Market Conditions

Before using a hard money loan for house flipping, it is crucial to consider the current real estate market conditions. The market trends and economic indicators can significantly impact the success of a house flipping project. A strong seller’s market with high demand and low inventory can provide opportunities for quick property sales and potentially higher profits. Alternatively, a stagnant or declining market may present challenges and make it more difficult to sell the renovated property at a desired price.

Regularly monitoring the real estate market, staying informed about local trends, and consulting with real estate professionals can help you make informed decisions about when to enter the market and undertake a house flipping project.

Scope of the Project

The scope of the house flipping project is an essential factor to consider before using a hard money loan. Assess the property’s condition, the necessary renovations, and the estimated costs involved. Consider the required timeline for renovations and the potential time it will take to sell the property.

Taking on a project that is beyond your expertise or budget can lead to unexpected challenges and expenses that may negatively impact your profitability. It is essential to realistically evaluate your capabilities and resources before committing to a project financed by a hard money loan.

Potential Return on Investment

Evaluating the potential return on investment (ROI) is critical when considering a hard money loan for house flipping. Carefully analyze the expected purchase price, renovation costs, and the anticipated sale price. Calculate your estimated profit margin and compare it to the overall investment, including financing costs and fees.

Ensure that the potential ROI justifies the associated risks and costs of using a hard money loan. If the profit potential does not align with your financial goals, it may be necessary to reevaluate the viability of the project or explore alternative financing options.

Risk Management Strategies

Given the higher risks associated with hard money loans and house flipping, it is crucial to have effective risk management strategies in place. This includes identifying potential risks and challenges that may arise during the project and developing contingency plans to mitigate these risks.

Some common risk management strategies include conducting thorough property inspections to identify any potential structural or hidden issues, securing insurance coverage to protect against unexpected damages or liabilities, and creating a detailed budget and timeline to track expenses and progress.

Having a solid risk management plan in place can help minimize potential losses and ensure a successful house flipping project.

Alternatives to Hard Money Loans for House Flipping

Traditional Bank Loans

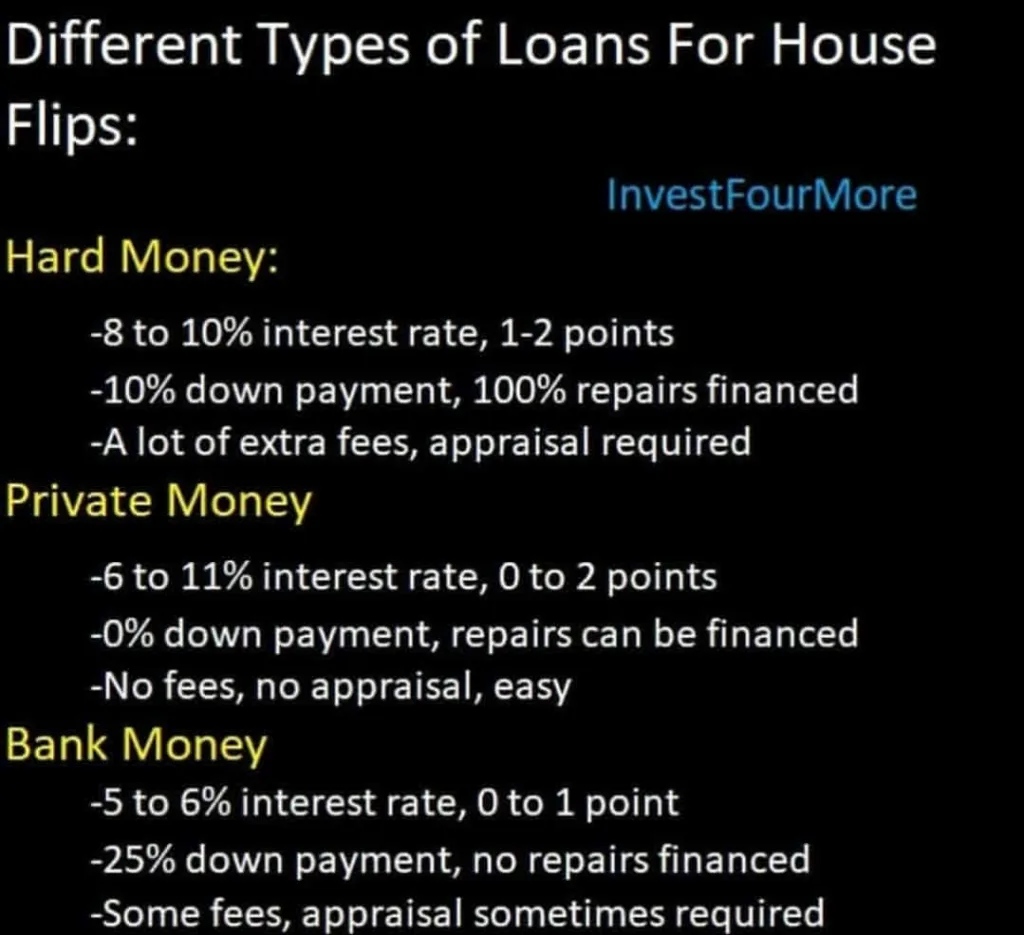

While hard money loans are commonly used for house flipping, traditional bank loans can also be a viable financing option, especially for investors with strong credit history and financial stability. Traditional bank loans generally offer lower interest rates and longer repayment periods compared to hard money loans.

To qualify for a traditional bank loan, investors typically need to meet stricter qualification criteria, provide extensive documentation of their financial history, and undergo a lengthier application process. However, if qualified, traditional bank loans can provide more favorable financing terms and lower overall borrowing costs.

Private Money Lenders

Private money lenders are another alternative to hard money loans for financing house flipping projects. Private money lenders are individual investors or small lending companies that provide loans to real estate investors. These lenders typically have more flexibility in their lending criteria compared to traditional banks, making them more accessible to investors who may not meet the stringent requirements of traditional lenders.

Private money lenders may charge higher interest rates compared to traditional bank loans but can offer more favorable terms compared to hard money loans. Building relationships with private money lenders and demonstrating a track record of successful house flipping projects can lead to longer-term financing options and potentially lower interest rates.

Self-Financing

For investors with substantial personal savings or equity in existing properties, self-financing can be a viable option to fund house flipping projects. Self-financing involves using your own funds to purchase and renovate the property without relying on external lenders.

Self-financing eliminates the need to pay interest or fees associated with loans, allowing investors to retain a larger portion of the profits. However, self-financing may require a significant upfront investment and can tie up personal funds, limiting the number of projects an investor can undertake simultaneously.

Partnerships or Joint Ventures

Partnering with other real estate investors or business entities can help share the financial burden and reduce the reliance on hard money loans. Partnerships or joint ventures involve pooling resources, capital, and expertise to undertake house flipping projects together.

By partnering with individuals or entities who can contribute funds or experience, investors can expand their investment capacity and potentially qualify for more favorable financing terms. However, it is crucial to have a clear partnership agreement that outlines each party’s responsibilities, profit-sharing structure, and exit strategy to avoid potential conflicts or disputes.

Finding the Right Hard Money Lender for House Flipping

Research and Compare Lenders

When searching for a hard money lender for house flipping, it is essential to conduct thorough research and compare multiple lenders. Look for lenders who specialize in real estate investments and have experience working with house flippers. Consider factors such as reputation, track record, and customer reviews.

Compile a list of potential lenders and thoroughly research each one, paying attention to their lending criteria, interest rates, fees, and loan terms. This allows you to make an informed decision and select a lender that aligns with your specific financing needs and investment goals.

Check Credentials and Reputation

Before choosing a hard money lender, check their credentials and reputation in the industry. Ensure that the lender is licensed and registered, as this indicates a level of professionalism and compliance with legal requirements. Additionally, verify that the lender has experience with house flipping loans and a track record of successful partnerships with real estate investors.

Reading customer reviews and testimonials can provide valuable insights into the lender’s reputation and customer satisfaction. Seek recommendations from other investors or real estate professionals who have used the lender’s services in the past.

Read the Fine Print

Before entering into a loan agreement with a hard money lender, thoroughly read and understand all loan documents and the associated terms and conditions. Pay close attention to the interest rates, fees, repayment schedule, and any potential penalties or additional costs.

It is essential to have a clear understanding of the lender’s expectations, as well as any exit strategies or contingencies in case of unforeseen circumstances. Seek clarification on any terms or conditions that are unclear or do not align with your financial goals or project requirements.

Seek Expert Advice

If you are new to house flipping or uncertain about the financing options available to you, seeking expert advice can be invaluable. Consult with experienced real estate professionals, investors, or financial advisors who have knowledge of the house flipping industry and the specific requirements of hard money lenders.

Experts can provide insights and guidance on the suitability of hard money loans for your specific circumstances and goals. They can help you evaluate the risks and benefits, assess alternative financing options, and navigate the loan application process.

Managing Hard Money Loan Repayment Obligations

Create a Realistic Repayment Plan

To effectively manage hard money loan repayment obligations, it is essential to create a realistic repayment plan from the outset. Assess the loan amount, interest rates, and other associated costs to determine the total repayment amount. Then, develop a detailed timeline and schedule that outlines the steps and milestones required to repay the loan.

Be sure to consider the project’s timeline, potential delays, and other factors that may impact the renovation and sale process. Incorporating contingency plans or buffer periods into the repayment plan can help mitigate unforeseen challenges and prevent defaulting on the loan.

Monitor Project Expenses

To ensure that you can meet your hard money loan repayment obligations, closely monitor project expenses throughout the renovation and sale process. Keep detailed records of all expenses, including materials, labor costs, permits, and other related costs.

Regularly review and compare actual expenses to the initial budget, making adjustments and optimizations as necessary. Maintaining strict control over expenses can help prevent any surprises or unexpected costs that may strain your ability to repay the loan.

Maintain Good Communication with the Lender

Open and ongoing communication with the hard money lender is crucial to effectively manage loan repayment obligations. Keep the lender informed of the project’s progress, upcoming milestones, and any potential delays or challenges that may arise.

If there are any changes or deviations from the original business plan, promptly communicate these changes to the lender and discuss potential solutions. Maintaining good communication ensures transparency, builds trust, and allows the lender to provide guidance or support when needed.

Plan for Unexpected Costs

House flipping projects can be unpredictable, and unexpected costs may arise throughout the renovation process. It is essential to plan for these unexpected costs and build contingency funds into your budget and repayment plan.

Setting aside a reserve or contingency fund that can cover unexpected expenses can help protect your ability to repay the loan even in the face of unforeseen challenges. This demonstrates prudence and preparedness to the lender, increasing confidence in your ability to successfully manage the project and repay the loan.

Conclusion

Using a hard money loan to fund a house flipping business can provide real estate investors with quick access to funding, flexible qualification criteria, and scalability opportunities. However, it is essential to carefully consider the drawbacks, such as high interest rates and repayment period, higher risk, and less control over financing terms.

Before using a hard money loan, it is crucial to qualify by finding a reputable lender, demonstrating house flipping experience, presenting a solid business plan, and proving your ability to repay the loan. Evaluating factors such as real estate market conditions, project scope, potential return on investment, and risk management strategies can help you make an informed decision.

While hard money loans are commonly used for house flipping, it is important to consider alternative financing options, such as traditional bank loans, private money lenders, self-financing, or partnerships. Finding the right hard money lender requires thorough research, checking credentials and reputation, reading the fine print, and seeking expert advice.

Managing hard money loan repayment obligations involves creating a realistic repayment plan, monitoring project expenses, maintaining good communication with the lender, and planning for unexpected costs. Assessing the pros and cons, evaluating your financial position, and making an informed decision are key steps to successfully using a hard money loan for house flipping.