In the fast-paced world of real estate, one of the challenges that hard money lenders face is handling properties in areas where values constantly fluctuate. These lenders employ a systematic approach to mitigate the risks associated with volatile markets. By conducting thorough market research, carefully assessing the property’s condition, and implementing conservative loan-to-value ratios, hard money lenders are able to navigate through the uncertainties of fluctuating property values while minimizing their exposure to potential losses.

Understanding Hard Money Lending

Definition of hard money lending

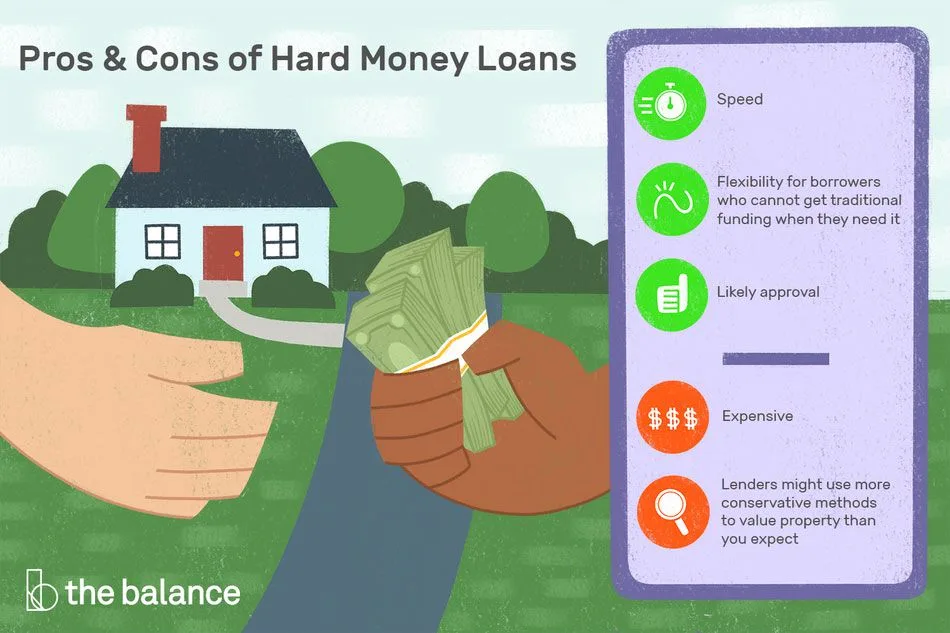

Hard money lending is a specialized form of lending that involves the use of collateral, primarily real estate, to secure a loan. Unlike traditional mortgage lending, which typically involves a lengthy approval process and strict underwriting guidelines, hard money lending offers a quicker and more flexible alternative. Hard money lenders focus on the value of the collateral rather than the borrower’s creditworthiness, making it an attractive option for individuals and businesses who may not qualify for traditional financing.

How it differs from traditional mortgage lending

One of the key differences between hard money lending and traditional mortgage lending is the emphasis on collateral. Traditional mortgage lenders heavily weigh factors such as credit history, income verification, and debt-to-income ratios when evaluating loan applications. In contrast, hard money lenders primarily consider the value of the property being used as collateral. This allows borrowers with less-than-perfect credit or unconventional financial situations to secure financing based on the value of the property rather than their personal financial status.

Another significant difference is the speed at which loans are processed. Traditional mortgage lending can involve a lengthy approval process that includes extensive documentation, underwriting, and verification procedures. Hard money lending, on the other hand, often provides rapid funding, with loans closing in a matter of days or weeks. This quick turnaround time is particularly beneficial for borrowers who need immediate access to funds for time-sensitive real estate investments or emergencies.

Importance of collateral

Collateral plays a crucial role in hard money lending. It serves as security for the lender in case the borrower defaults on the loan. The value of the collateral determines the loan amount that can be extended to the borrower. Lenders thoroughly assess and evaluate the collateral to ensure it has sufficient value to cover the loan in the event of default.

The use of collateral allows hard money lenders to offer financing options to borrowers who may not meet the strict criteria of traditional lenders. By focusing on the collateral’s value rather than the borrower’s financial history, hard money lenders mitigate their risk and broaden access to funding. This flexibility helps facilitate real estate transactions and investments that may not otherwise be possible under traditional lending requirements.

Challenges of Fluctuating Property Values

Definition of fluctuating property values

Fluctuating property values refer to the dynamic nature of real estate markets, where the market value of properties can rise or fall over time. These fluctuations can be influenced by various factors such as economic conditions, supply and demand, interest rates, and local market conditions. The volatile nature of property values presents challenges for both borrowers and lenders, especially in hard money lending.

Factors contributing to fluctuations

Several factors contribute to the fluctuations in property values. Economic factors such as inflation, interest rates, and job growth can significantly impact the demand for real estate and, consequently, property values. Additionally, changes in zoning regulations, infrastructure development, and shifts in local demographics can influence the desirability and value of specific areas.

External factors like natural disasters or major events, such as the COVID-19 pandemic, can also have a substantial impact on property values. These unforeseen circumstances can cause significant fluctuations, making it crucial for lenders to carefully assess the risk associated with financing properties in areas prone to such volatility.

Impact on hard money lenders

Fluctuating property values pose unique challenges for hard money lenders. Since hard money lending relies heavily on collateral, lenders must carefully consider the potential risks involved when lending in areas with uncertain or volatile property values. A decline in property values can potentially expose lenders to a higher risk of default, as the collateral may no longer cover the loan amount.

To mitigate this risk, hard money lenders must employ comprehensive risk assessment strategies and adopt flexible loan structuring techniques that allow for adjustments based on changing market conditions. Additionally, active monitoring and regular property inspections are necessary to identify any warning signs of declining property values and take appropriate measures to protect their investment.

Risk Assessment for Properties in Fluctuating Areas

Evaluation of market trends

When assessing the risk of financing properties in areas with fluctuating values, hard money lenders must thoroughly evaluate market trends. This involves analyzing historical data, current economic conditions, and future projections. By understanding the direction of property values, lenders can make informed decisions regarding the viability and potential risks associated with a particular investment.

Assessing the property’s location

Location plays a significant role in property values. Hard money lenders must consider the location of the property when evaluating its risk and potential for value fluctuations. Factors such as proximity to amenities, schools, transportation, job centers, and the overall desirability of the area will impact the property’s value.

Furthermore, lenders must assess the stability and growth potential of the location. Researching demographic trends, population growth, and future development plans can provide insights into the long-term prospects of the property’s value. It is essential for lenders to be knowledgeable about the local market dynamics to accurately assess the risk associated with financing properties in fluctuating areas.

Examining historical data

Analyzing historical data is a vital component of risk assessment for properties in fluctuating areas. By studying past trends and patterns, lenders can gain valuable insights into how property values have changed over time. This allows them to identify any recurring patterns or cycles and make more informed decisions regarding the risk involved in financing properties in such areas.

Historical data can help lenders identify trends of appreciation or depreciation, understand the impact of external factors on property values, and determine the underlying stability of the market. This information enables lenders to adjust their loan structuring and risk mitigation strategies accordingly.

Flexible Loan Structuring

Adapting loan-to-value (LTV) ratios

Flexibility in loan structuring is crucial for hard money lenders operating in areas with fluctuating property values. Lenders often adjust the loan-to-value (LTV) ratios based on the current market conditions. A lower LTV ratio reduces the lender’s exposure to risk by limiting the loan amount compared to the property’s appraised value.

By adapting LTV ratios, hard money lenders can better protect their investment and mitigate the potential impact of declining property values. This flexibility allows lenders to strike a balance between providing adequate funding to borrowers and ensuring their investment remains secured.

Adjusting interest rates

Another method of structuring loans in fluctuating areas is by adjusting the interest rates. Hard money lenders have the flexibility to set interest rates based on the risk associated with financing properties in specific locations. In areas with volatile property values, lenders may choose to set higher interest rates to compensate for the increased risk.

Adjusting interest rates not only helps lenders manage their risk but also ensures that borrowers are aware of the potential challenges they may face. Higher interest rates serve as a deterrent to borrowers who may not be prepared to take on the risk associated with properties in areas with fluctuating values.

Flexible repayment terms

Flexibility in repayment terms is essential in hard money lending, particularly in areas with fluctuating property values. Hard money lenders often offer more flexible repayment options compared to traditional lenders. This flexibility allows borrowers to adapt their repayment schedule to better align with their investment strategy or the real estate market conditions.

By providing flexible repayment terms, hard money lenders can support borrowers during challenging market conditions. This adaptability strengthens the lender-borrower relationship and promotes a higher likelihood of successful loan repayments.

Collateral Evaluation

Importance of collateral

Collateral evaluation is a critical aspect of hard money lending. Since hard money lenders primarily rely on the value of the collateral to secure the loan, properly assessing the collateral is crucial to mitigate risk. The collateral serves as a safeguard for the lender in the event of default, as it can be liquidated to recover the outstanding loan balance.

The importance of collateral evaluation becomes even more pronounced in areas with fluctuating property values. The lender must ensure that the collateral has sufficient value to cover the loan, considering potential fluctuations and declines in property values. Thorough collateral evaluation helps protect the lender’s investment and ensures the borrower has a vested interest in maintaining the property’s value.

Valuation methods

Various valuation methods are employed by hard money lenders to assess the collateral’s value. The most common approach is conducting an appraisal, where a certified appraiser evaluates the property’s value based on factors such as location, size, condition, and comparable sales in the area. Appraisals provide lenders with an objective and independent assessment of the property’s value.

Additionally, lenders may also consider obtaining broker price opinions (BPOs) or automated valuation models (AVMs) to gain an estimate of the property’s value. While these methods are less comprehensive than a full appraisal, they can be useful for preliminary evaluations or properties where an appraisal may not be feasible.

Considering the risk factor

In areas with fluctuating property values, lenders must carefully consider the risk factor associated with the collateral. This risk assessment entails evaluating the property’s location, market conditions, and the potential for future fluctuations. The lender may take into account the borrower’s experience and expertise in the real estate market to gauge their ability to manage any potential risks effectively.

By considering the risk factors associated with the collateral, hard money lenders can make informed decisions about the loan terms, including interest rates, repayment schedules, and exit strategies. This comprehensive evaluation helps mitigate risk and ensures the lender’s investment remains secure.

Experience and Expertise of Hard Money Lenders

In-depth knowledge of local market

Hard money lenders operating in areas with fluctuating property values possess a deep understanding of the local real estate market dynamics. Their familiarity with the region allows them to assess the risk associated with financing properties in specific locations accurately. They are knowledgeable about market trends, demand factors, and potential challenges that may arise, allowing them to make informed lending decisions.

Understanding the property value fluctuations

Experience and expertise enable hard money lenders to identify and understand the fluctuations in property values within specific areas. By analyzing historical data, tracking market trends, and leveraging their industry knowledge, lenders can evaluate the potential risks and rewards of financing properties in fluctuating areas. This understanding allows them to adjust loan structuring, collateral evaluation, and risk mitigation strategies accordingly.

Risk mitigation strategies

Hard money lenders with experience in fluctuating property value areas employ effective risk mitigation strategies. They understand the need for proactive monitoring, regular property inspections, and periodic reviews of market conditions. By actively managing their loan portfolios, these lenders can identify warning signs early on, take appropriate measures, and minimize potential losses.

Additionally, experienced hard money lenders often have established networks and relationships within the real estate industry. This allows them to leverage their connections to mitigate risk and increase the chances of successful loan repayments.

Active Monitoring and Regular Inspections

Tracking property values

Hard money lenders must actively monitor property values in fluctuating areas. By continuously tracking the market and staying informed about changes and trends, lenders can make timely decisions about lending or adjusting loan terms. Active monitoring ensures that lenders have accurate and up-to-date information to base their loan structuring and risk assessment on.

Conducting regular inspections

Regular property inspections are an integral part of risk mitigation for hard money lenders operating in areas with fluctuating property values. Inspections allow lenders to assess the condition of the property and identify any potential issues or maintenance needs that could impact its value.

Through regular inspections, lenders can ensure that the property remains in good condition and properly maintained. Should any concerns arise, lenders can take necessary actions to protect their investment, such as requiring repairs or setting aside reserves for potential future expenses.

Identifying warning signs

Active monitoring and regular inspections help hard money lenders identify warning signs of declining property values or potential default risks. By staying vigilant and observant, lenders can detect any adverse market trends, changes in the local economy, or signs of neglect that could negatively impact the collateral’s value.

Early identification of warning signs allows lenders to take proactive measures to mitigate risk. They can engage in open communication with borrowers about the potential challenges and explore alternative exit strategies if necessary.

Effective Communication with Borrowers

Open lines of communication

Effective communication between hard money lenders and borrowers is crucial in areas with fluctuating property values. Lenders must establish open lines of communication, ensuring that borrowers are aware of the potential risks associated with their investment. Transparent and frequent communication allows borrowers to make informed decisions and actively participate in mitigating potential challenges.

Discussing market conditions

To ensure borrowers have a clear understanding of the market dynamics, hard money lenders should engage in regular discussions about market conditions. This includes sharing information about property value trends, economic indicators, and any external factors that could impact property values. By keeping borrowers informed, they can make educated decisions regarding their investment goals and risk appetite.

Ensuring borrower’s understanding of risks

Hard money lenders should take the necessary steps to ensure that borrowers fully comprehend the risks associated with properties in areas with fluctuating values. This may involve providing educational resources, facilitating discussions with experienced professionals, or requiring borrowers to undergo thorough due diligence.

By actively promoting borrower education and understanding, hard money lenders foster a mutually beneficial relationship built on trust and transparency. This approach sets the foundation for successful loan repayment and minimizes the likelihood of default.

Flexible Exit Strategies

Multiple exit options

In areas with fluctuating property values, hard money lenders understand the importance of flexible exit strategies. They offer borrowers multiple options to exit their loans, depending on the market conditions and their individual circumstances. These options may include refinancing, selling the property, or negotiating alternative repayment methods.

By providing borrowers with various exit strategies, lenders allow them to adapt to changing market conditions and potential fluctuations in property values. This flexibility empowers borrowers to make strategic decisions that best align with their investment goals and financial well-being.

Considering refinancing

Refinancing is a common exit strategy in areas with fluctuating property values. Hard money lenders may work closely with borrowers to assess the feasibility of refinancing options as market conditions change. Refinancing can help borrowers secure more favorable loan terms, lower interest rates, or access additional funds based on the current value of the property.

By offering refinancing options, hard money lenders enable borrowers to take advantage of favorable market conditions or adjust their loan terms to better suit their investment strategy. This adaptability strengthens the lender-borrower relationship and promotes long-term success.

Negotiating alternative repayment methods

In situations where borrowers may face challenges or anticipate potential fluctuations in property values, hard money lenders can negotiate alternative repayment methods. This could include interest-only payments, balloon payment structures, or extending the loan term to provide borrowers with more time to repay the loan.

By being flexible and accommodating, hard money lenders support borrowers in navigating the uncertainties of fluctuating property values. These alternative repayment methods can help alleviate short-term financial strain and improve the chances of successful loan repayment.

Conclusion

Hard money lenders play a vital role in financing properties in areas with fluctuating values. Their approach involves a thorough understanding of the unique challenges presented by such market dynamics and requires adaptability and effective risk management strategies.

By evaluating and mitigating risks, actively monitoring market conditions, communicating openly with borrowers, and providing flexible loan structuring options, hard money lenders can navigate the complexities of fluctuating property values. This approach ensures the successful execution of real estate investments, while safeguarding the interests of both lenders and borrowers.

The importance of thorough assessment, adaptability, and risk mitigation cannot be overstated in hard money lending. By combining experience, expertise, and effective communication, hard money lenders can confidently navigate the challenges of fluctuating property values and contribute to the growth and success of real estate investments in these areas.