In the real estate market, pre-foreclosure properties can present both challenges and opportunities for potential buyers. This article examines the viability of utilizing a hard money loan to finance the purchase of a property in pre-foreclosure. By addressing the key considerations and benefits of this alternative financing option, you will gain a deeper understanding of the potential feasibility of using a hard money loan in this specific scenario.

Understanding Hard Money Loans

Definition of Hard Money Loans

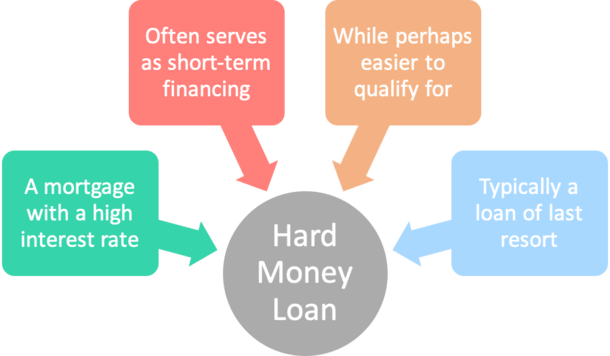

Hard money loans are a type of short-term financing that is typically used by real estate investors or individuals who are unable to obtain traditional bank loans. These loans are secured by the property itself, rather than the borrower’s creditworthiness or income. Hard money loans are usually provided by private lenders or companies that specialize in these types of loans.

How Hard Money Loans Work

Unlike traditional bank loans, hard money loans are based primarily on the value of the property being used as collateral. The lender will assess the property’s current market value and determine the loan-to-value ratio (LTV), which is the percentage of the property’s value that the lender is willing to lend. The borrower will then receive a loan for a portion of the property’s value, typically between 50% and 70%.

Hard money loans often have shorter terms than traditional bank loans, usually ranging from several months to a few years. They also tend to have higher interest rates, often in the double digits. This is because hard money loans are considered higher risk for the lender due to the lack of creditworthiness and income verification requirements.

Benefits and Drawbacks of Hard Money Loans

One of the main benefits of hard money loans is the speed at which they can be obtained. Unlike traditional bank loans, which can take weeks or even months to secure, hard money loans can be approved and funded within days. This makes them particularly appealing to individuals who need quick access to capital, such as real estate investors looking to purchase a property in pre-foreclosure.

However, the speed and convenience of hard money loans come at a cost. These loans often come with high interest rates and fees, which can significantly increase the cost of borrowing. Additionally, the shorter repayment periods of hard money loans can be challenging for some borrowers, as they may need to refinance or sell the property before the loan matures. Moreover, there is a risk of losing the property if the borrower is unable to repay the loan within the designated timeframe.

Pre-Foreclosure: An Overview

Definition of Pre-Foreclosure

Pre-foreclosure refers to the period of time during which a property is in the early stages of the foreclosure process. It begins when the property owner falls behind on their mortgage payments and ends when the property is either sold or repossessed by the lender. During pre-foreclosure, the property owner still has the opportunity to pay off the outstanding mortgage debt and avoid foreclosure.

Stages of Pre-Foreclosure

Pre-foreclosure typically involves several stages, including the initial default notice, the notice of intent to accelerate, and the notice of sale. The initial default notice is sent to the property owner when they miss their first mortgage payment. This notice informs the owner that they are in default and gives them a certain period of time to bring their payments up to date.

If the property owner fails to remedy the default, they will receive a notice of intent to accelerate, which states that the lender intends to accelerate the loan and proceed with foreclosure. This notice usually provides the property owner with another opportunity to bring the loan current before foreclosure proceedings begin.

The final stage of pre-foreclosure is the notice of sale, which is issued when the lender schedules the property for foreclosure auction. At this point, the property owner has limited time to either repay the outstanding debt or sell the property to satisfy the mortgage. If neither of these options is pursued, the property will be sold at the foreclosure auction.

Effects of Pre-Foreclosure on Property Owners

Pre-foreclosure can have significant financial and emotional impacts on property owners. Falling behind on mortgage payments can lead to stress, anxiety, and uncertainty about the future. In addition, the property owner’s credit score may be negatively affected, making it more difficult to obtain future loans or credit.

Furthermore, if the property is ultimately foreclosed upon, the owner will lose their home and may be evicted. This can be a devastating situation for individuals and families who have invested time and money into their property.

Opportunities in Pre-Foreclosure

While pre-foreclosure can be a challenging time for property owners, it can also present opportunities for real estate investors or individuals looking to purchase a home at a discounted price. During pre-foreclosure, property owners are often willing to sell their homes at a lower price in order to avoid foreclosure and salvage their credit.

This creates opportunities for buyers to acquire properties at below-market prices and potentially generate a profit. By utilizing a hard money loan, investors can quickly secure the funds needed to purchase a property in pre-foreclosure and take advantage of the potential financial benefits.

Using a Hard Money Loan in Pre-Foreclosure

Is It Possible to Use a Hard Money Loan in Pre-Foreclosure?

Yes, it is possible to use a hard money loan in pre-foreclosure. In fact, hard money loans are often a preferred financing option for individuals looking to purchase properties in pre-foreclosure. The speed at which hard money loans can be obtained makes them well-suited for this particular situation, as time is of the essence when dealing with properties in pre-foreclosure.

Advantages of Using a Hard Money Loan in Pre-Foreclosure

Using a hard money loan in pre-foreclosure offers several advantages. Firstly, hard money loans can be obtained quickly, allowing investors to act swiftly when a property becomes available in pre-foreclosure. This can give them a competitive edge over other potential buyers who may require more time to secure traditional financing.

Additionally, hard money lenders often focus more on the value of the property rather than the borrower’s creditworthiness or income. This means that individuals with less-than-perfect credit or inconsistent income can still qualify for a hard money loan. This flexibility can be particularly beneficial for real estate investors who may have multiple ongoing projects or limited income documentation.

Considerations Before Using a Hard Money Loan

While using a hard money loan in pre-foreclosure can provide certain advantages, there are important considerations to keep in mind. Firstly, the higher interest rates and fees associated with hard money loans can significantly increase the cost of borrowing. It is crucial to carefully analyze the potential return on investment and financial viability of the property before committing to a hard money loan.

Another consideration is the shorter repayment period typically associated with hard money loans. Borrowers must have a solid plan in place to either refinance or sell the property within the designated timeframe in order to repay the loan. Failure to do so can result in the loss of the property and potentially significant financial consequences.

Finding Lenders Who Provide Hard Money Loans for Pre-Foreclosure Properties

Finding lenders who provide hard money loans specifically for pre-foreclosure properties may require some research and networking within the real estate investment community. Local real estate investment clubs or online forums can be valuable resources for connecting with private lenders who specialize in these types of loans.

Working with a knowledgeable mortgage broker or real estate attorney can also be helpful in identifying reputable lenders who are experienced in providing hard money loans for pre-foreclosure properties. These professionals can guide borrowers through the process and help ensure that they are working with lenders who have a proven track record of success in this area.

Requirements and Process for Obtaining a Hard Money Loan

Credit and Income Requirements

One of the advantages of hard money loans is that they are primarily based on the value of the property rather than the borrower’s creditworthiness or income. This means that individuals with less-than-perfect credit or inconsistent income may still qualify for a hard money loan.

However, it is important to note that hard money lenders will still review the borrower’s credit history and income documentation as part of the application process. While these factors may not be the primary determinants of loan approval, they can still play a role in the lender’s decision-making process.

Loan-to-Value Ratio

The loan-to-value ratio (LTV) is a key factor in determining the amount of funding a borrower can receive through a hard money loan. LTV represents the percentage of the property’s value that the lender is willing to lend.

In general, hard money lenders will typically offer loans with an LTV ratio ranging from 50% to 70%, although this can vary depending on the lender and the specific property being financed. The LTV ratio is calculated based on the appraised value of the property, rather than the purchase price.

Collateral and Property Evaluation

Hard money loans are secured by the property itself, so the lender will conduct a thorough evaluation of the property to assess its value and condition. This evaluation may include an appraisal, property inspection, and review of comparable sales in the area.

It is important to note that hard money lenders may place restrictions on the type of properties they are willing to finance. Some lenders may specialize in residential properties, while others may focus on commercial properties or certain property types such as single-family homes or apartments. Borrowers should ensure that the property they are interested in purchasing aligns with the lender’s criteria.

Approval and Funding Timeline

The approval and funding timeline for a hard money loan can vary depending on the specific lender and the complexity of the transaction. However, one of the main advantages of hard money loans is the speed at which they can be obtained.

In general, hard money loan applications can be approved and funded within days, compared to the weeks or months it may take to secure a traditional bank loan. This quick turnaround time can be particularly advantageous when dealing with properties in pre-foreclosure, as it allows borrowers to act swiftly and secure the necessary funds to purchase the property.

Risks and Challenges of Using Hard Money Loans in Pre-Foreclosure

Higher Interest Rates and Fees

One of the main risks associated with using hard money loans in pre-foreclosure is the higher interest rates and fees that are typically charged. Hard money loans are considered higher risk for lenders, and they compensate for this risk by charging higher interest rates and fees. Borrowers must carefully evaluate the potential return on investment and financial viability of the property to ensure that the higher borrowing costs can be justified.

Short Repayment Period

Hard money loans often come with shorter repayment periods compared to traditional bank loans. While this can be advantageous for borrowers who are able to quickly refinance or sell the property, it can also be a challenge for those who are unable to do so within the designated timeframe. Failing to repay the loan on time can result in the loss of the property and potentially significant financial consequences.

Risk of Losing the Property

Since hard money loans are secured by the property, there is always a risk of losing the property if the borrower is unable to repay the loan. This risk is particularly relevant in pre-foreclosure scenarios, as the property may be at a higher risk of foreclosure if the borrower does not have a solid plan in place to repay the loan.

Limited Options for Exit Strategy

The shorter repayment periods and higher borrowing costs of hard money loans can limit the options for exit strategies. Borrowers must carefully consider their plans for repaying the loan and have a backup plan in case the initial strategy does not materialize. This may involve refinancing the loan with a traditional bank or selling the property to generate sufficient funds for repayment.

Analyzing the Potential ROI and Financial Viability

Evaluating the Property’s Potential

Before deciding to use a hard money loan in pre-foreclosure, it is crucial to thoroughly evaluate the potential of the property. This includes assessing factors such as the property’s location, condition, market demand, and potential for appreciation. Conducting a comprehensive analysis will help determine whether the property is likely to generate a profit and whether the investment aligns with the borrower’s financial goals.

Calculating Potential Return on Investment (ROI)

Calculating the potential return on investment (ROI) is an essential step in assessing the financial viability of using a hard money loan in pre-foreclosure. This involves estimating the costs associated with acquiring and rehabilitating the property, as well as projecting the potential income from renting or selling the property. By comparing the estimated expenses and income, borrowers can determine whether the potential ROI justifies the use of a hard money loan.

Exit Strategies for Repayment

Having a well-defined exit strategy for repayment is crucial when using a hard money loan in pre-foreclosure. This involves considering options such as refinancing the property with a traditional bank loan, selling the property to generate funds, or utilizing profits from other investments. It is important to have a backup plan in case the initial strategy does not materialize, as the short repayment period of hard money loans can leave little room for error.

Assessing the Overall Financial Viability

Assessing the overall financial viability of using a hard money loan in pre-foreclosure involves considering various factors, including the potential ROI, the borrower’s financial situation, and the market conditions. Borrowers should conduct a comprehensive analysis to ensure that the investment aligns with their financial goals and risk tolerance.

Alternatives to Hard Money Loans for Pre-Foreclosure Properties

Traditional Bank Loans

While hard money loans are often used in pre-foreclosure scenarios due to their speed and flexibility, traditional bank loans can also be a viable option. Traditional bank loans typically offer lower interest rates and fees compared to hard money loans, but they may have stricter creditworthiness and income requirements.

Government Programs and Assistance

Government programs and assistance may be available to property owners in pre-foreclosure, depending on their individual circumstances and location. These programs can provide financial support, counseling services, and resources to help individuals navigate the pre-foreclosure process and potentially avoid foreclosure.

Private Financing Options

Private financing options, such as loans from friends or family members, can be another alternative to hard money loans. These arrangements often offer more flexibility and may have lower interest rates and fees compared to hard money loans. However, it is important to approach these arrangements with caution and ensure that all parties involved are comfortable with the terms of the loan.

Joint Ventures or Partnerships

Entering into a joint venture or partnership with another investor can be a creative financing solution for properties in pre-foreclosure. In this arrangement, multiple investors pool their resources and expertise to purchase the property and share in the profits or risks. Joint ventures or partnerships can provide access to additional capital and expertise, potentially increasing the likelihood of a successful outcome.

Legal and Ethical Considerations in Pre-Foreclosure Transactions

Understanding Legal Obligations and Requirements

Engaging in pre-foreclosure transactions requires a thorough understanding of the legal obligations and requirements involved. Property owners and potential buyers must be aware of the specific laws and regulations governing pre-foreclosure transactions in their jurisdiction. It is advisable to consult with a real estate attorney who can provide guidance and ensure that all legal requirements are met.

Avoiding Predatory Practices

In pre-foreclosure transactions, it is crucial to avoid predatory practices that take advantage of vulnerable property owners. This includes unethical tactics such as charging excessive fees, misleading property owners, or misrepresenting the terms of the transaction. Working with reputable professionals and conducting transactions in a transparent and ethical manner is essential to maintain the integrity of the real estate industry.

Working with Professionals: Lawyers and Real Estate Agents

Working with professionals, such as real estate lawyers and agents, can help ensure that pre-foreclosure transactions are conducted legally and ethically. Real estate lawyers can provide valuable legal advice and guidance throughout the process, while real estate agents can assist with property valuation, negotiations, and other aspects of the transaction.

Ethical Responsibilities in Pre-Foreclosure Deals

Ethical responsibilities in pre-foreclosure deals involve acting in the best interests of all parties involved and maintaining transparency throughout the transaction. This includes providing accurate and complete information, treating all parties with respect and fairness, and disclosing any potential conflicts of interest. Upholding ethical standards is essential for building trust and maintaining the reputation of the real estate industry.

Case Studies and Success Stories

Real-Life Examples of Successful Hard Money Loan Usage in Pre-Foreclosure

Examining real-life examples of successful hard money loan usage in pre-foreclosure can provide valuable insights and inspiration for potential investors. These examples illustrate how investors were able to leverage hard money loans to acquire properties in pre-foreclosure, make necessary improvements, and sell or rent the properties for a profit.

Lessons Learned from Case Studies

Analyzing the lessons learned from case studies can help potential investors avoid common pitfalls and make informed decisions when using hard money loans in pre-foreclosure. These lessons may include the importance of thorough due diligence, accurate property valuation, effective project management, and proactive exit strategies.

Inspiration and Insights from Success Stories

Success stories of utilizing hard money loans in pre-foreclosure can serve as inspiration for individuals looking to enter the real estate market. These stories highlight the potential financial benefits and demonstrate that with the right strategy, hard money loans can be a valuable tool for acquiring and rehabilitating properties in pre-foreclosure.

Conclusion

Summary of Key Points

Hard money loans are short-term financing options that are often used by real estate investors or individuals unable to obtain traditional bank loans. These loans are secured by the property itself, making them particularly appealing for properties in pre-foreclosure. Using a hard money loan in pre-foreclosure can provide several advantages, including fast access to capital and flexibility in lending criteria.

However, there are risks and challenges associated with using hard money loans in pre-foreclosure, such as higher interest rates and fees, short repayment periods, the risk of losing the property, and limited options for exit strategies. It is crucial to thoroughly evaluate the potential return on investment and financial viability of the property before committing to a hard money loan.

There are alternatives to hard money loans for pre-foreclosure properties, including traditional bank loans, government programs and assistance, private financing options, and joint ventures or partnerships. It is important to consider individual circumstances and consult with professionals to determine the most suitable financing option.

Final Thoughts on Using Hard Money Loans in Pre-Foreclosure

Using a hard money loan in pre-foreclosure can be a viable strategy for real estate investors or individuals looking to purchase a property at a discounted price. However, it is essential to carefully analyze the potential risks and rewards, and ensure that the investment aligns with individual financial goals and risk tolerance.

Consulting with professionals, conducting thorough due diligence, and staying informed about legal and ethical considerations are integral parts of navigating the pre-foreclosure process successfully.

Consideration for Individual Circumstances

Every individual’s circumstances and financial goals are unique, and it is important to consider these factors when deciding whether to use a hard money loan in pre-foreclosure. Conducting a comprehensive analysis, seeking professional advice, and being mindful of legal and ethical responsibilities will help individuals make well-informed decisions that align with their specific needs and objectives.