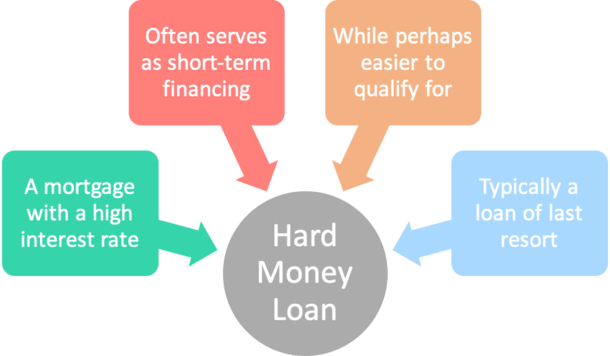

Have you ever wondered how long it takes for hard money lenders to respond to inquiries? In the fast-paced world of real estate investing, time is of the essence, and finding the right financing solution quickly is crucial. This article examines the typical response time for inquiries to hard money lenders, shedding light on the factors that influence the speed of their response and providing valuable insights for those seeking funding for their projects.

Factors That Affect Response Time

When it comes to responding to inquiries, there are several factors that can influence the speed at which hard money lenders can provide a response. These factors can have a significant impact on the overall customer experience and the success of the borrower’s loan application. In this article, we will explore three key factors that affect response time: existing workload, information provided, and communication channels.

1. Existing Workload

The existing workload of a hard money lender is one of the primary factors that determine their response time. If the lender is already dealing with a high volume of loan applications and client inquiries, it may take longer for them to provide a response. This is because the lender needs sufficient time to review and process each application thoroughly.

Processing Time

The processing time required for each loan application can vary depending on its complexity and the lender’s efficiency. If the lender is overwhelmed with a heavy workload, it is likely that their processing time will be longer. It is essential for borrowers to understand that a longer processing time does not necessarily indicate a lack of interest or commitment from the lender. Instead, it reflects the lender’s efforts to ensure a comprehensive evaluation of each loan application.

Availability of Staff

Another crucial factor that affects response time is the availability of staff. If a hard money lender has limited staff members to handle inquiries and process loan applications, it can lead to delays in response time. The lender needs to allocate sufficient resources to effectively handle customer inquiries and ensure that borrowers receive timely responses.

2. Information Provided

The information provided by borrowers in their loan inquiries plays a vital role in determining the response time from hard money lenders. The completeness and accuracy of the information can significantly impact the lender’s ability to evaluate the loan application promptly.

Completeness of Inquiry

When borrowers submit their loan inquiries, it is crucial for them to provide all the necessary information required by the lender. Incomplete inquiries can lead to delays as the lender may need to follow up to gather additional information before providing a response. To expedite the response time, borrowers should ensure that they provide a detailed and comprehensive inquiry that includes all the necessary documentation and supporting materials.

Accuracy of Details

In addition to completeness, the accuracy of the details provided in the loan inquiry is equally important. Errors or inconsistencies in the information can lead to additional clarifications and further delays in the response time. Borrowers should double-check their inquiry to ensure that all the details are accurate and up to date. This will help streamline the evaluation process for the lender and result in a quicker response.

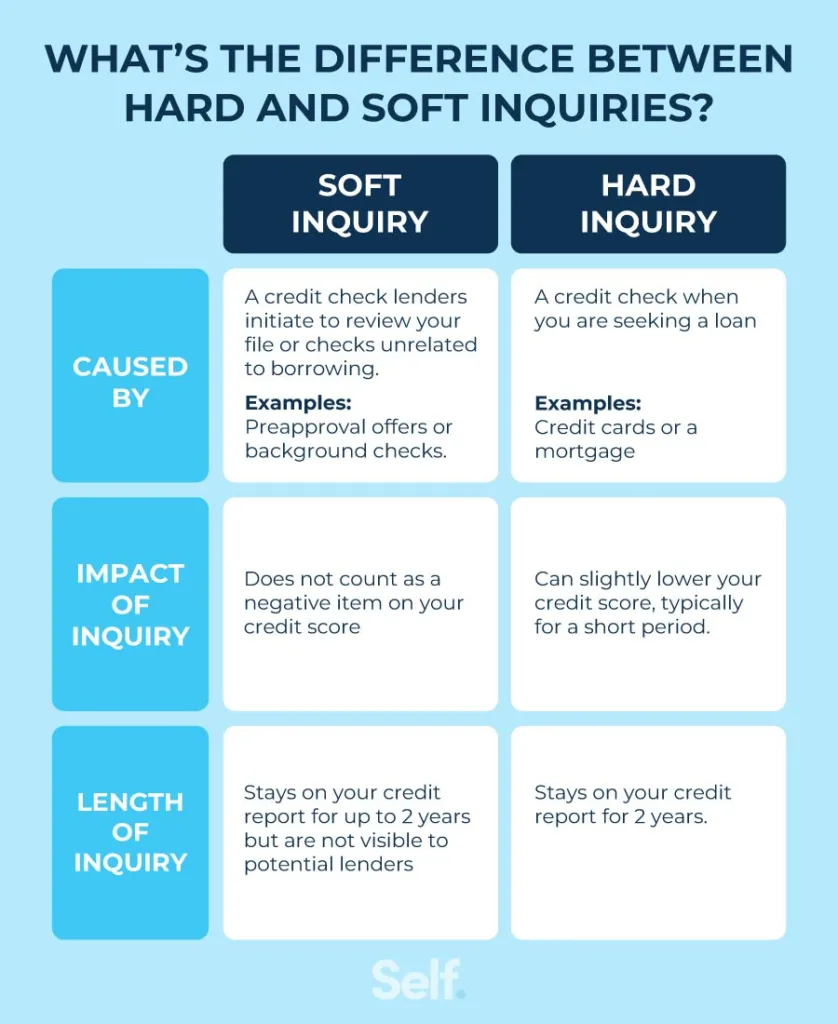

3. Communication Channels

The communication channels utilized by borrowers and lenders can significantly impact the response time. Different communication methods have varying levels of efficiency, and borrowers must choose the most effective channel to expedite their inquiries.

Email is one of the most common forms of communication used by borrowers when inquiring about hard money loans. While it allows for a written record of the correspondence, it is important to note that email response times can vary depending on the lender’s workload and their preference for communication channels. To increase the chances of a prompt response, borrowers should clearly state their inquiry in the email and provide all the necessary information upfront.

Phone Calls

Phone calls offer the advantage of direct and immediate communication, allowing borrowers to receive real-time responses to their inquiries. However, it is important to consider that lenders may be busy attending to other calls or meetings, which can lead to longer response times. To ensure a quick response, borrowers should schedule a call in advance or inquire about the best time to reach out to the lender.

In-person Meetings

In-person meetings provide the opportunity for borrowers to have a face-to-face discussion with the lender. This form of communication can be valuable for complex loan inquiries or when borrowers prefer a more personal approach. However, it often requires a scheduled appointment, which can lead to longer wait times for a response.

The Importance of Response Time

Response time plays a crucial role in the borrower’s experience with hard money lenders. The timeliness of the response not only demonstrates the lender’s commitment and professionalism but also affects several key aspects.

4. Competitive Market

In today’s competitive market, borrowers have several options to choose from when seeking funding for their projects. A prompt response from a hard money lender can give borrowers a competitive edge by allowing them to secure funding quickly and move forward with their plans. Conversely, a slow response can lead to missed opportunities and potential loss of business.

5. Client Experience

The borrower’s experience throughout the loan application process significantly impacts their satisfaction and overall impression of the lender. A quick response time shows attentiveness and a commitment to customer service, enhancing the borrower’s experience. On the other hand, a slow response can create frustration and uncertainty, potentially leading borrowers to seek alternative lending options.

6. Deal Closing Timeline

Time is often of the essence when it comes to real estate financing. Borrowers may have specific timelines to meet, such as closing a deal or starting a project. A timely response from a hard money lender allows borrowers to plan ahead and ensure that they can meet their deadlines effectively. Delayed responses, on the other hand, can disrupt the borrower’s timeline and potentially jeopardize their opportunity to secure the necessary financing.

Ways to Expedite Response Time

To expedite the response time from hard money lenders, borrowers can take certain proactive steps. By following these strategies, borrowers can increase the likelihood of receiving prompt and satisfactory responses to their inquiries.

10. Research Different Lenders

Before submitting a loan inquiry, borrowers should conduct thorough research on different hard money lenders. By understanding each lender’s response time, communication preferences, and loan criteria, borrowers can choose the lender that aligns best with their needs. This helps avoid unnecessary delays and ensures a smoother loan application process.

In conclusion, response time is a critical factor in the borrower’s experience with hard money lenders. By considering factors such as existing workload, information provided, and communication channels, borrowers can better understand and manage their expectations. Proactive communication, including prompt and complete inquiries, can also help expedite the response time. Ultimately, a streamlined loan application process with a quick response time benefits both borrowers and lenders, enabling successful and timely transactions.