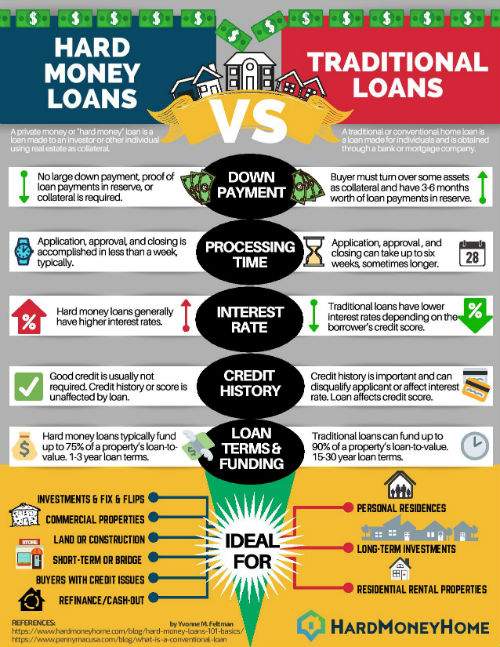

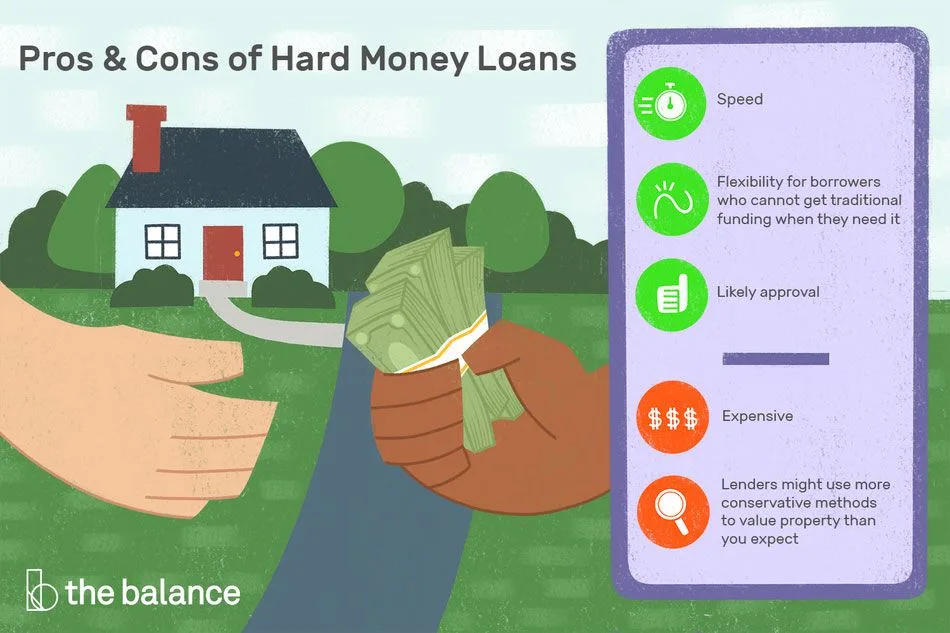

In the world of real estate financing, hard money loans offer a viable alternative for investors looking to secure funds quickly and efficiently. These loans, typically provided by private investors or companies, prioritize the value of the property rather than the borrower’s creditworthiness. With this flexibility, hard money loans can be used to finance a diverse range of properties, including residential homes, commercial buildings, vacant land, and even fix-and-flip projects. By understanding the potential of hard money loans, investors can navigate the real estate market with more confidence and seize profitable opportunities.

Residential Properties

Single-family homes

Single-family homes are one of the most common types of residential properties that can be financed with a hard money loan. These properties are typically occupied by a single family and are a popular choice for homeownership. Single-family homes offer a range of options for buyers, from starter homes to larger, more luxurious residences. With a hard money loan, investors can secure financing for the purchase or renovation of single-family homes for various purposes, including rental properties or investment opportunities.

Condominiums

Condominiums, or condos, are another type of residential property that can be financed with a hard money loan. Condos are individual units within a larger building or complex and often offer amenities such as swimming pools, gyms, and communal spaces. Investing in condos through hard money loans can be a viable option for investors looking to generate rental income or who are interested in purchasing properties for short-term rental platforms like Airbnb.

Townhouses

Townhouses are a type of residential property that shares walls with neighboring units and typically has multiple floors. These properties are often part of a larger complex or community and offer a balance between apartment living and single-family homes. Townhouses can be a lucrative investment option, and hard money loans can provide the necessary financing for purchasing and renovating these properties for rental or resale purposes.

Duplexes

Duplexes are residential properties with two separate living units, each with its own entrance. These properties can be financed with a hard money loan and are commonly used as investment properties where the owner lives in one unit and rents out the other. Investing in duplexes allows for the potential to generate rental income while having the convenience of living on the same property.

Triplexes

Similar to duplexes, triplexes are residential properties that contain three separate living units. These properties provide even greater opportunities for rental income, as there are three units available for occupancy. With a hard money loan, investors can secure the necessary funds to acquire and renovate triplexes for investment purposes.

Fourplexes

Fourplexes, as the name suggests, are residential properties that consist of four separate living units. These properties are larger than duplexes and triplexes and can offer higher potential for rental income. Investing in fourplexes can be a strategic move for investors looking to expand their real estate portfolio, and hard money loans can play a vital role in financing these endeavors.

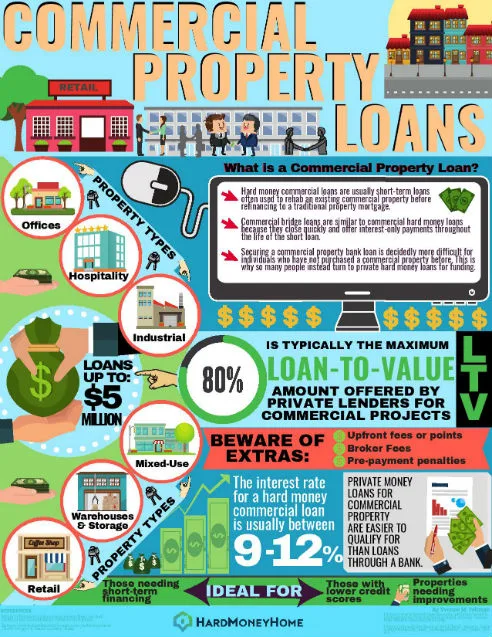

Commercial Properties

Retail properties

Retail properties refer to commercial spaces used for the sale of goods and services to consumers. Financing retail properties with a hard money loan can offer investors a valuable opportunity to generate income through leasing to retail businesses. Whether it’s a standalone store, a shopping center, or a strip mall, hard money loans can provide the necessary capital to acquire and renovate these properties.

Office buildings

Office buildings are commercial properties designed for businesses to conduct their operations. These properties can range from small office spaces to large corporate headquarters. Financing office buildings with a hard money loan can be an attractive option for investors looking to diversify their real estate portfolio and generate rental income from commercial tenants.

Industrial properties

Industrial properties are commercial real estate spaces used for manufacturing, warehousing, and distribution purposes. These properties often require specialized infrastructure and can be a profitable investment option. With a hard money loan, investors can secure financing to acquire and renovate industrial properties for rental or resale purposes.

Hospitality properties

Hospitality properties encompass hotels, motels, resorts, and other accommodations designed for travelers and tourists. These properties can offer significant income potential, especially in popular tourist destinations. Hard money loans can provide the necessary funds to invest in hospitality properties and capitalize on the demand for accommodation in various markets.

Multifamily properties

Multifamily properties include apartment buildings or complexes with multiple residential units. Investing in multifamily properties through hard money loans can be a lucrative option for generating rental income. With several units within a single property, investors have the potential to maximize their return on investment while diversifying their real estate portfolio.

Vacant Land

Vacant land refers to undeveloped or unoccupied parcels of land without any existing structures. Financing vacant land with a hard money loan can provide investors with the opportunity to acquire land for development purposes. Whether it’s for residential, commercial, or industrial purposes, hard money loans can help investors secure the necessary funds to purchase and develop vacant land.

Fixer-Upper Properties

Fixer-upper properties are properties that require significant renovations or repairs to bring them up to modern standards. These properties can be purchased at a lower price compared to move-in ready homes, but they often require a substantial investment of time and money. Hard money loans can be an ideal financing option for purchasing fixer-upper properties, as they provide the necessary funds to acquire the property and cover the renovation costs.

Non-Owner-Occupied Properties

Non-owner-occupied properties are residential properties that are not occupied by the owner but are instead rented out to tenants. These properties can include single-family homes, condos, townhouses, or even multifamily properties. Financing non-owner-occupied properties with a hard money loan allows investors to generate income through rental payments while the property appreciates in value.

Foreign Properties

Investing in foreign properties can be an attractive opportunity for investors seeking diverse real estate holdings. Whether it’s a vacation home or an international rental property, financing foreign properties with a hard money loan can provide investors with the necessary capital to purchase and maintain these properties overseas. However, it’s important to carefully consider the legal and financial implications of investing in foreign real estate.

Distressed or Foreclosed Properties

Distressed or foreclosed properties are properties that have been seized by lenders due to the owner’s default on their mortgage payments. These properties are often sold at a discounted price, presenting an opportunity for investors to acquire properties at below-market value. Hard money loans can be an effective means of financing the purchase of distressed or foreclosed properties, allowing investors to capitalize on these opportunities.

Unique or Unconventional Properties

Unique or unconventional properties refer to real estate that deviates from the traditional residential or commercial property types. These can include properties such as castles, lighthouses, churches, or even converted shipping containers. Financing unique or unconventional properties with a hard money loan can enable investors to acquire these distinctive properties and explore creative avenues for rental income or resale value.

Investment Properties

Investment properties, in general, are properties purchased with the primary objective of generating income or profit through appreciation. Whether it’s a residential rental property or a commercial space, financing investment properties with a hard money loan can provide investors with the necessary funds to acquire and renovate these properties for optimal returns.

Properties with Unfavorable Credit

Properties with unfavorable credit refer to real estate transactions where the borrower has poor credit history or a low credit score. Traditional lenders may be hesitant to provide financing in such cases, making hard money loans an alternative financing option. Hard money lenders often prioritize the value of the property itself rather than the borrower’s creditworthiness, allowing investors with less-than-favorable credit to secure financing for their real estate ventures.

In conclusion, a hard money loan can be utilized to finance a wide range of properties, including residential, commercial, vacant land, fixer-uppers, non-owner-occupied properties, foreign properties, distressed properties, unique properties, investment properties, and properties with unfavorable credit. By understanding the potential of hard money loans, investors can leverage these financing options to pursue their real estate goals and diversify their portfolios.