When it comes to extending a hard money loan, understanding the usual process is key to ensuring a smooth and successful transaction. This article explores the steps involved in extending a hard money loan, providing valuable insights for borrowers seeking the flexibility they may require. By familiarizing yourself with these procedures, you can navigate the process with confidence and make informed decisions regarding the extension of your hard money loan.

Understanding Hard Money Loans

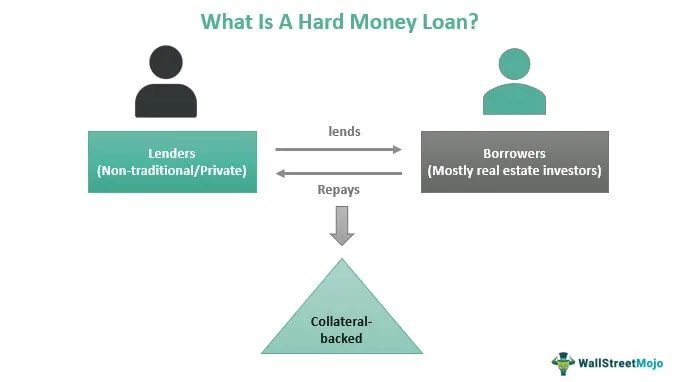

Definition of hard money loans

Hard money loans, also known as private money loans, are a type of short-term financing provided by private lenders or investors. Unlike traditional mortgages or bank loans, hard money loans are primarily based on the value of the collateral (usually real estate) rather than the borrower’s credit history or financial standing. These loans are typically used by borrowers who may not qualify for conventional financing or need immediate access to funds.

Typical terms and conditions

Hard money loans usually have shorter terms compared to traditional loans, typically ranging from six months to a few years. The interest rates on hard money loans are typically higher than those of conventional loans, reflecting the higher risk associated with these loans. Lenders may charge points, which are a percentage of the loan amount, at the time of origination. The loan-to-value (LTV) ratio, which is the percentage of the property’s value that the lender will finance, is typically around 60-70%. Additionally, hard money loans may have prepayment penalties and require regular interest-only payments.

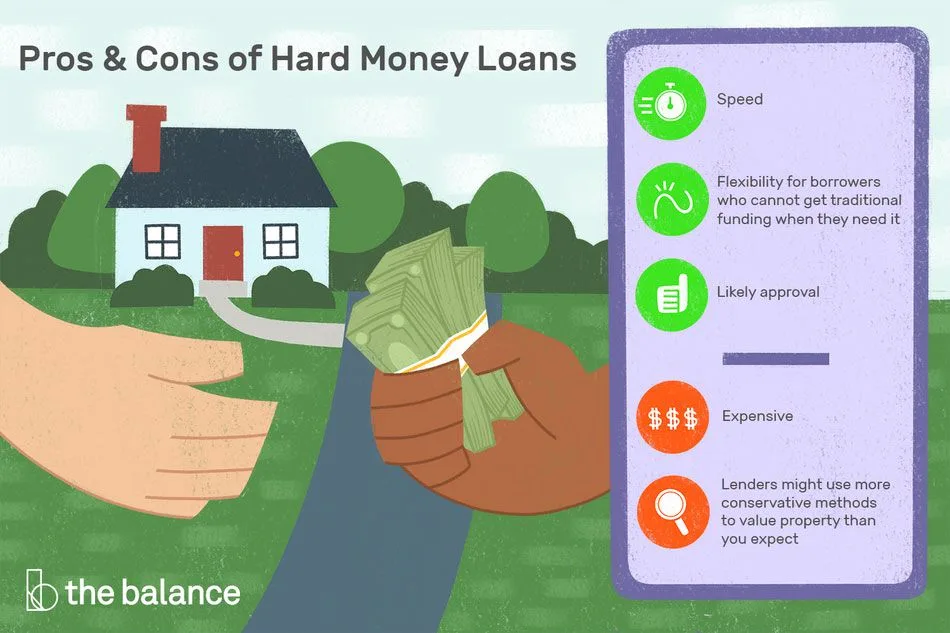

Advantages and disadvantages of hard money loans

Hard money loans offer several advantages for borrowers. Firstly, the approval process is typically faster compared to traditional loans, allowing borrowers to access funds quickly. Additionally, hard money lenders often consider the value of the collateral more than the borrower’s creditworthiness, making it an option for individuals with less-than-perfect credit. However, hard money loans also come with certain disadvantages. The interest rates and fees associated with these loans are generally higher than those of traditional loans. Moreover, the shorter repayment period and interest-only payments may pose challenges for borrowers who need longer-term financing solutions.

When is an Extension Needed?

Common scenarios that require an extension

There are several common scenarios in which borrowers may need an extension on their hard money loan. One such situation is when the borrower encounters unexpected delays in completing a construction project or selling a property. These delays can affect the borrower’s ability to repay the loan within the agreed-upon timeframe. Another common scenario is when the borrower experiences a significant change in their financial situation, such as a loss of income or an unforeseen emergency expense. In such cases, the borrower may need additional time to secure alternative financing or stabilize their financial situation.

Factors to consider before extending a hard money loan

Before considering an extension, borrowers should carefully evaluate their financial situation and consider their ability to fulfill the loan obligations within the original timeframe. Factors to consider include the availability of alternative financing options, the market conditions for selling the property, and the potential impact of the extension on the borrower’s overall financial goals. It is also crucial to assess the cost implications of extending the loan, including any additional fees or interest rate adjustments that may apply. Additionally, maintaining open communication with the lender is vital for assessing the possibility of an extension.

Importance of open communication with the lender

Open communication with the lender throughout the loan term is essential, particularly when an extension may be needed. By maintaining a transparent line of communication, borrowers can keep the lender informed about any potential issues or changes in circumstances that may affect their ability to repay the loan on time. This open dialogue allows the lender to evaluate the borrower’s situation and explore possible solutions, such as an extension, that may be mutually beneficial. By proactively addressing potential challenges and working together, both the borrower and the lender can find a resolution that meets their needs.

Negotiating an Extension

Assessing the feasibility of an extension

Before initiating negotiations for an extension, borrowers should assess the feasibility of obtaining additional time for repayment. This assessment involves considering factors such as the reasons for the extension, the current loan-to-value ratio, and the borrower’s overall financial standing. By evaluating these factors, borrowers can determine whether an extension is a viable solution and whether it aligns with their long-term financial goals.

Reviewing the loan agreement and terms

During the negotiation process, borrowers should review the original loan agreement and terms to understand the agreed-upon conditions and any implications of extending the loan. This review helps borrowers identify any provisions related to extensions, fees, or interest rate adjustments that may apply. Understanding these terms is crucial for negotiating an extension that is favorable for both parties involved.

Determining the borrower’s ability to repay

In negotiating an extension, it is important for borrowers to demonstrate their ability to repay the loan within the proposed extended period. Lenders will assess the borrower’s financial situation, including income, assets, and creditworthiness, to evaluate the likelihood of repayment. Providing accurate and updated financial information, along with a detailed repayment plan, can help strengthen the borrower’s case for an extension.

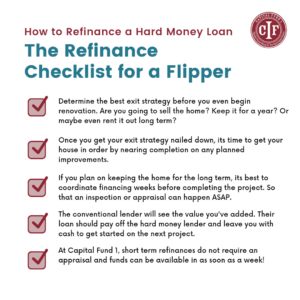

Preparing a Request for Extension

Reasons for needing an extension

When preparing a request for an extension, borrowers should clearly articulate the reasons why the extension is necessary. Valid reasons may include unexpected delays, changes in financial circumstances, or other factors beyond the borrower’s control. It is crucial to provide a well-documented explanation to help the lender understand the need for additional time and evaluate the request accordingly.

Documenting changes in circumstances

In addition to explaining the reasons for the extension, borrowers should document any changes in circumstances that have affected their ability to repay the loan within the original timeframe. This documentation can include financial statements, tax returns, proof of income or loss, and any other relevant supporting documents. By providing comprehensive documentation, borrowers can strengthen their case for an extension and help the lender assess the impact of the changes on the loan repayment.

Supporting documentation required

When submitting a request for an extension, borrowers should ensure they include all the necessary supporting documentation. This may include updated financial statements, bank statements, tax returns, appraisal reports, and any other relevant information requested by the lender. By providing complete and accurate documentation, borrowers can facilitate the lender’s evaluation process and increase the likelihood of a successful extension request.

Submitting the Request

Contacting the lender and discussing the extension

Once the request for an extension is prepared, borrowers should contact the lender to initiate the discussion. It is important to communicate the request clearly and professionally, explaining the reasons for the extension and providing an overview of the proposed changes to the loan terms. During this initial conversation, borrowers should also inquire about any specific documentation or information the lender may require to evaluate the request thoroughly.

Providing necessary documentation

After the initial contact, borrowers should promptly provide the lender with all the necessary documentation to support the extension request. This documentation should be organized and presented in a clear and concise manner to facilitate the lender’s review process. By promptly addressing the lender’s information needs, borrowers demonstrate their commitment to resolving the situation and increase the chances of a favorable decision.

Outlining proposed changes to the loan terms

In the extension request, borrowers should outline the proposed changes to the loan terms that they believe would be fair and feasible. This may include adjustments to the repayment schedule, interest rate, fees, or other terms as agreed upon. By presenting well-thought-out proposals, borrowers can demonstrate their willingness to find a mutually beneficial solution and increase the likelihood of gaining approval for the extension.

Evaluating the Request

Lender’s review and analysis process

Once the extension request is submitted, the lender will initiate a review and analysis process to evaluate the borrower’s situation and the feasibility of extending the loan. This review may involve assessing the borrower’s financial documents, conducting due diligence on the property, and considering the potential risks and rewards associated with the extension. The lender will also compare the extension request with the provisions outlined in the original loan agreement to ensure compliance.

Factors considered by the lender

During the evaluation process, lenders consider various factors to assess the eligibility of the extension request. These factors may include the borrower’s creditworthiness, the current loan-to-value ratio, the borrower’s repayment history, the property’s market value, and the proposed changes to the loan terms. The lender will weigh these factors to make an informed decision regarding the extension.

The lender’s decision-making timeline

The timeline for the lender’s decision-making process may vary depending on the complexity of the extension request and the lender’s internal procedures. Generally, lenders strive to complete their evaluation within a reasonable timeframe to accommodate the borrower’s needs. However, borrowers should be prepared for the possibility of some waiting time as the lender conducts their due diligence and carefully considers the extension request.

Terms of the Extension

Negotiating revised loan terms and conditions

If the lender approves the extension request, the next step is to negotiate the revised loan terms and conditions. This negotiation process involves discussing the proposed changes and reaching a mutually agreeable arrangement that reflects the borrower’s financial situation and capacity to repay. The borrower should be prepared to provide any additional information or documentation requested by the lender during this negotiation.

Extension fees and interest rate adjustments

When negotiating the terms of the extension, borrowers should consider any additional fees or interest rate adjustments that may apply. Lenders may charge extension fees to compensate for the additional administrative and risk management efforts involved. It is important for borrowers to understand these fees and evaluate their financial implications before agreeing to the extension.

Establishing a new repayment schedule

As part of the extension negotiation, borrowers and lenders will establish a new repayment schedule that reflects the extended timeframe. This schedule should be realistic and manageable for the borrower, while also meeting the lender’s requirements. It is crucial to ensure that the borrower’s financial capabilities align with the proposed repayment schedule to minimize the risk of default and maintain a positive borrower-lender relationship.

Amending the Loan Agreement

Modifications to the original loan agreement

Once the revised loan terms and conditions are agreed upon, it is necessary to amend the original loan agreement to reflect the changes. This amendment may involve updating sections related to the loan term, interest rate, repayment schedule, fees, and any other modified terms. It is important that both parties carefully review the amended agreement and ensure its accuracy before proceeding.

Creating a written addendum

To formally document the agreed-upon changes, borrowers and lenders should create a written addendum to the original loan agreement. This addendum should clearly outline the revised terms and conditions, the effective date of the extension, and any other relevant details. Both parties should sign and date the addendum to indicate their acceptance and acknowledgment of the modified agreement.

Ensuring legal compliance and enforceability

When amending the loan agreement, it is crucial to ensure that the changes comply with all applicable laws and regulations. Borrowers and lenders should consult legal professionals to ensure that the amended agreement is legally valid and enforceable. By taking this step, both parties can protect their interests and prevent potential disputes or complications in the future.

Finalizing the Extension

Signing the amended loan agreement

Once the amended loan agreement and addendum are finalized, borrowers and lenders should sign the documents to formalize the extension. This step signifies the agreement between both parties and the acceptance of the revised terms and conditions. It is important for all parties involved to retain a copy of the signed agreement for their records.

Disbursing the extended loan funds

Upon finalizing the extension, lenders will disburse the extended loan funds according to the revised terms. Borrowers should ensure that they are aware of the disbursement timeline and any specific instructions provided by the lender. It is important to follow these instructions to avoid delays or misunderstandings regarding the distribution of the funds.

Updating relevant records and documentation

After the extension is finalized, borrowers should update their financial records and documentation to reflect the changes. This includes updating the repayment schedule, adjusting any automated payment systems, and maintaining clear and organized records of the amended loan agreement and addendum. By keeping accurate records, borrowers can effectively manage their loan obligations and ensure compliance with the revised terms.

Conclusion

Understanding the process of extending a hard money loan is crucial for borrowers who may encounter unexpected challenges or require additional time to fulfill their loan obligations. By comprehensively assessing the need for an extension, preparing a thorough request supported by relevant documentation, and maintaining open communication with the lender, borrowers can increase the likelihood of securing an extension that aligns with their financial goals. Negotiating and finalizing the extension involves careful consideration of the revised loan terms, ensuring legal compliance, and maintaining accurate records. By following the outlined process, borrowers can navigate the extension process with professionalism and diligence, ultimately resolving their temporary financial challenges while preserving a positive borrower-lender relationship.