When considering a hard money loan, understanding the typical origination fee is crucial for borrowers. Known for their flexibility, hard money loans have gained popularity in recent years. However, borrowers often struggle to determine what fees they can expect. The origination fee, which covers the lender’s administrative costs, is one of the most significant fees associated with hard money loans. By having an understanding of the typical origination fee, borrowers can make informed decisions and plan their financing accordingly.

Defining a Hard Money Loan

Understanding the Basics

A hard money loan is a type of loan that is typically provided by private investors or companies rather than traditional banks or financial institutions. These loans are often used by real estate investors or individuals who are unable to qualify for a conventional mortgage. Unlike traditional loans, hard money loans are typically short-term and have higher interest rates. They are primarily secured by real estate, meaning that the property being purchased or used as collateral serves as the primary source of repayment for the loan.

Secured by Real Estate

One of the defining characteristics of a hard money loan is that it is secured by real estate. This means that the property being purchased or used as collateral serves as a guarantee for repayment of the loan. In the event that the borrower defaults on the loan, the lender has the right to seize the property and sell it in order to recoup their investment. This is why hard money loans are often favored by real estate investors, as the value and equity of the property are key factors in determining whether or not they will be approved for the loan.

Short-Term and High Interest

Hard money loans are typically short-term loans, with repayment periods ranging from a few months to a few years. Unlike traditional loans that may have a term of 15 or 30 years, hard money loans are designed to be paid off relatively quickly. This short-term nature of the loans is reflected in the higher interest rates that are typically associated with them. Because hard money loans are riskier for lenders due to the lack of traditional underwriting criteria, they often charge higher interest rates to compensate for the added risk.

Origination Fees Explained

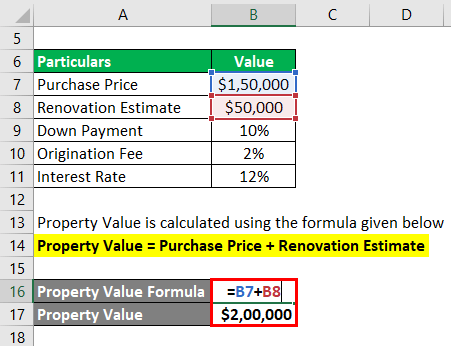

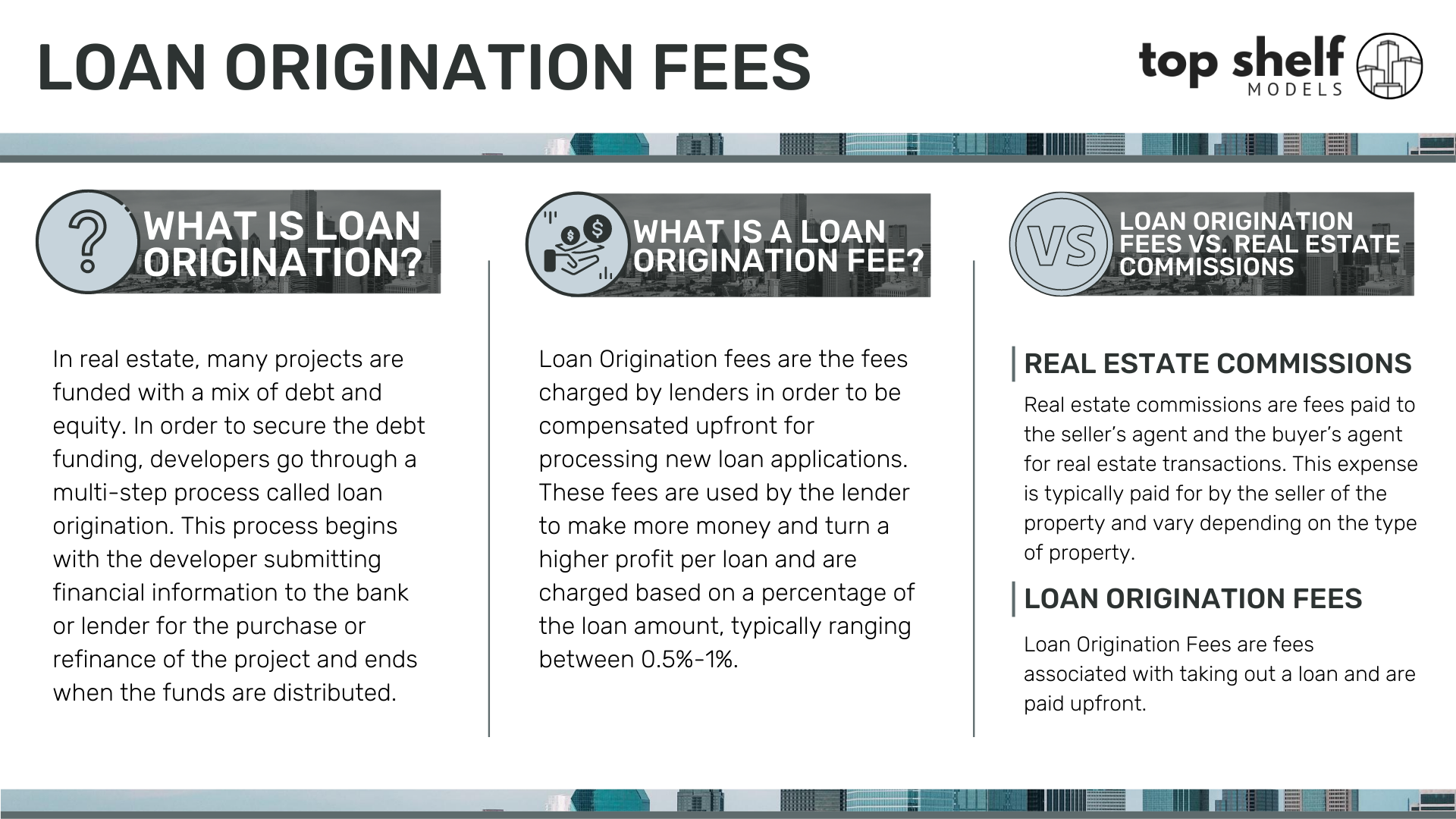

What is an Origination Fee?

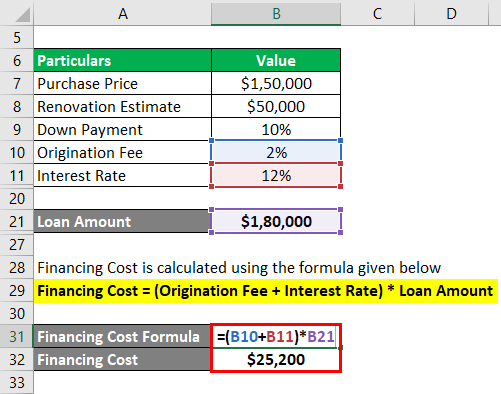

An origination fee is a fee that is charged by the lender to cover the costs associated with processing and funding a loan. It is typically a percentage of the loan amount and is often paid upfront at the time of closing. Origination fees are common in many types of loans, including mortgages, personal loans, and hard money loans. They are used to compensate the lender for the time and effort involved in underwriting the loan and to cover administrative costs.

Purpose of the Origination Fee

The purpose of the origination fee is to cover the costs incurred by the lender in originating and processing the loan. This includes tasks such as evaluating the borrower’s creditworthiness, verifying income and assets, conducting property appraisals, and preparing loan documents. The origination fee helps to ensure that the lender is adequately compensated for these services and provides them with a source of income for their work.

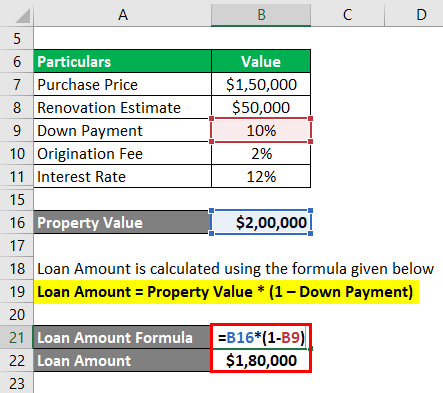

How Origination Fees are Calculated

Origination fees for hard money loans are typically calculated as a percentage of the loan amount. The specific percentage can vary depending on factors such as the lender’s policies, the borrower’s creditworthiness, and the overall risk of the loan. It is important for borrowers to carefully review and understand the terms of the loan agreement to determine the exact amount of the origination fee and how it is calculated.

Factors Influencing Origination Fees

Loan Amount and Term

The loan amount and term are two factors that can influence the origination fees charged by lenders. In general, larger loan amounts may result in higher origination fees, as there is typically more work involved in processing and originating a larger loan. Similarly, longer loan terms may also lead to higher origination fees, as the lender will be providing funds for a longer period of time. It is important for borrowers to carefully consider the impact of the loan amount and term on the total cost of the loan, including the origination fee.

Borrower’s Creditworthiness

The creditworthiness of the borrower is another important factor that can influence the origination fees charged by lenders. Borrowers with higher credit scores and strong credit histories may be able to negotiate lower origination fees, as they are generally considered to be lower risk. On the other hand, borrowers with lower credit scores or a history of financial difficulties may be charged higher origination fees, as the lender may perceive them to be a higher risk. It is important for borrowers to work on improving their creditworthiness before applying for a hard money loan in order to potentially secure more favorable terms.

Property Location and Type

The location and type of the property being financed can also impact the origination fees charged by lenders. Properties located in certain areas or neighborhoods may be considered to be higher risk, which can result in higher origination fees. Similarly, certain property types, such as commercial properties or properties requiring extensive renovations, may also be associated with higher origination fees. Borrowers should carefully consider the location and type of the property before applying for a hard money loan and factor in the potential impact on the overall cost of the loan.

Average Origination Fees for Hard Money Loans

National Averages

The average origination fees for hard money loans can vary depending on several factors, including the lender, the borrower’s creditworthiness, and the specific details of the loan. However, national averages can provide a general sense of what borrowers can expect. On average, origination fees for hard money loans range from 1% to 5% of the loan amount. It is important to note that these averages can vary significantly, and borrowers should always obtain multiple quotes from different lenders in order to compare fees and find the best deal.

Regional Differences

Origination fees for hard money loans can also vary regionally. In some areas, where there is high demand for hard money loans and limited competition among lenders, fees may be higher. On the other hand, in areas with more lenders and greater competition, borrowers may be able to find lenders offering lower origination fees. Borrowers should research the local market and reach out to multiple lenders in their area to obtain accurate information on regional average origination fees.

Variances by Lender

The specific lender can also greatly impact the origination fees charged for hard money loans. Different lenders may have different fee structures and policies, resulting in significant variances in the fees they charge. It is common for lenders to charge higher origination fees if they perceive a loan to be higher risk or more complex. Additionally, some lenders may offer discounted fees for repeat borrowers or for borrowers with strong creditworthiness. It is crucial for borrowers to compare fees and terms from multiple lenders to ensure they are getting the best deal possible.

Comparing Fees across Lenders

Shopping for the Best Deal

When seeking a hard money loan, it is important to shop around and compare fees across lenders. This involves obtaining quotes and fee breakdowns from multiple lenders to determine who offers the most competitive terms. While it may be tempting to choose a lender based solely on the interest rate or origination fee, borrowers should also consider other factors, such as the lender’s reputation, customer service, and overall loan terms. By carefully comparing fees and terms across lenders, borrowers can make an informed decision and potentially save money on their hard money loan.

Requesting Fee Breakdowns

When reaching out to lenders for quotes, borrowers should specifically request fee breakdowns. This will allow them to see exactly how much of the total cost is attributed to the origination fee and other associated fees. By obtaining detailed fee breakdowns, borrowers can better understand the cost structure of the loan and ensure that they are not being charged excessive fees. It is important to review these breakdowns carefully and ask questions if anything is unclear before signing any loan agreements.

Negotiating Origination Fees

In some cases, borrowers may be able to negotiate the origination fees charged by lenders. This is especially true for borrowers with strong creditworthiness or those who have multiple loan options. By demonstrating their creditworthiness and exploring other loan offers, borrowers may be able to negotiate lower origination fees or have certain fees waived altogether. However, it is important to approach negotiations with a realistic understanding of the lender’s policies and the market conditions. Not all lenders may be willing to negotiate, and borrowers should be prepared to explore other options if necessary.

Factors to Consider Besides Origination Fee

Interest Rates

While the origination fee is an important factor to consider when evaluating the cost of a hard money loan, borrowers should also pay attention to the interest rate. The interest rate, which is the cost of borrowing the money, will have a significant impact on the total cost of the loan. A lower interest rate can result in substantial savings over the life of the loan, even if the origination fee is slightly higher. It is crucial for borrowers to carefully evaluate the interest rate offered by each lender and compare it to other loan offers to ensure they are getting the best overall deal.

Prepayment Penalties

Another factor to consider besides the origination fee is the presence of prepayment penalties. Prepayment penalties are fees charged by lenders if the borrower pays off the loan before the agreed-upon term. These penalties can be substantial and can significantly impact the overall cost of the loan. Borrowers should carefully review the loan agreement to determine if prepayment penalties are included and how they are calculated. If possible, borrowers should seek out loans that do not have prepayment penalties, or if they do exist, they should negotiate for them to be minimized or waived.

Other Associated Costs

In addition to the origination fee and the interest rate, borrowers should be aware of other associated costs that may be included in the loan. These costs can include things like processing fees, underwriting fees, appraisal fees, and inspection fees. These fees can vary from lender to lender and can add up to a significant sum. Borrowers should carefully review the loan agreement and request a detailed breakdown of all associated costs before finalizing the loan. Understanding these costs and factoring them into the decision-making process will ensure that borrowers are making fully informed decisions.

Additional Fees in Hard Money Loans

Processing Fees

Processing fees are fees charged to cover the administrative costs associated with processing the loan application. These costs can include tasks such as credit checks, document preparation, and verification of income and assets. Processing fees can vary from lender to lender and can range from a few hundred dollars to several thousand dollars. Borrowers should carefully review these fees and compare them across lenders to ensure they are fair and reasonable.

Underwriting Fees

Underwriting fees are fees charged to cover the cost of evaluating the borrower’s creditworthiness and determining the terms of the loan. Underwriting fees can include tasks such as reviewing credit reports, calculating debt-to-income ratios, and assessing the value of the property being used as collateral. Like processing fees, underwriting fees can vary from lender to lender and should be carefully reviewed and compared by borrowers.

Appraisal and Inspection Fees

Appraisal and inspection fees are fees charged to cover the cost of evaluating the value and condition of the property being financed. These fees are often required as part of the underwriting process and are used to ensure that the property is worth the amount being lent. Appraisal fees are typically charged by a licensed appraiser, while inspection fees may be charged by a property inspector. Borrowers should be aware of these fees and factor them into their budget when considering a hard money loan.

Avoiding Excessive Origination Fees

Understanding the Market

One of the best ways to avoid excessive origination fees is to have a good understanding of the market. By researching the current market conditions and the prevailing rates and fees, borrowers can better negotiate with lenders and identify any unreasonable or excessive fees. Additionally, staying informed about the market can help borrowers identify lenders who may be offering more competitive terms or lower fees. Taking the time to educate oneself about the hard money loan market is an important step in avoiding excessive origination fees.

Working with Reputable Lenders

Working with reputable lenders is another way to avoid excessive origination fees. Reputable lenders are more likely to be transparent about their fees and offer fair and competitive terms. They are also more likely to provide clear and detailed fee breakdowns and are willing to answer any questions or concerns that borrowers may have. Borrowers should research lenders carefully, read reviews and testimonials, and seek recommendations from trusted sources before choosing a lender for their hard money loan.

Seeking Professional Advice

Seeking professional advice from real estate attorneys or financial advisors can also help borrowers avoid excessive origination fees. These professionals can review loan documents, provide guidance on negotiating fees, and offer insights into the overall fairness of the loan terms. While there may be additional costs associated with seeking professional advice, the potential savings and peace of mind gained from their expertise can be well worth the investment. Borrowers should consider seeking professional advice, especially if they are new to hard money loans or have concerns about the terms and fees being offered.

Transparency and Disclosure

Looking for Fee Transparency

Transparency and fee disclosure are crucial when it comes to choosing a lender and evaluating the cost of a hard money loan. Borrowers should look for lenders who are upfront about their fees and provide clear and detailed fee breakdowns. Any reputable lender should be willing to provide this information and answer any questions or concerns that borrowers may have. It is important for borrowers to feel comfortable with the fee structure and be able to make fully informed decisions before proceeding with a loan.

Reviewing Loan Documents

Reviewing loan documents carefully is another important step in ensuring transparency and understanding the cost of the loan. Borrowers should take the time to thoroughly review all loan documents, including the loan agreement, disclosure statements, and fee schedules. If anything is unclear or confusing, borrowers should seek clarification from the lender or even consult with a real estate attorney before signing the documents. Reviewing loan documents is essential to identifying any hidden fees or excessive charges and protecting the borrower’s interests.

Consulting Legal Expertise

Consulting legal expertise is particularly important when dealing with complex loan terms or large loan amounts. Real estate attorneys can review loan documents, provide guidance on the fairness of fees, and offer insights into any potential legal issues or concerns. While hiring legal counsel may involve additional costs, it can provide borrowers with the reassurance and protection they need when entering into a hard money loan agreement. Borrowers should carefully consider their individual circumstances and assess the need for legal expertise before proceeding with a hard money loan.

Conclusion

Finding the Best Origination Fee

When it comes to hard money loans, finding the best origination fee involves careful research, comparison, and negotiation. Borrowers should obtain quotes from multiple lenders, request fee breakdowns, and compare overall loan terms. By shopping around and exploring different options, borrowers can increase their chances of finding a lender who offers a competitive origination fee.

Considering the Loan as a Whole

While the origination fee is an important factor to consider, borrowers should also pay attention to other aspects of the loan, such as the interest rate, prepayment penalties, and other associated costs. By evaluating the loan as a whole and considering all of these factors, borrowers can make a more informed decision and choose a loan that best fits their needs and financial situation.

Making Informed Decisions

Making informed decisions is crucial when it comes to hard money loans. Borrowers should take the time to educate themselves about the market, work with reputable lenders, and seek professional advice when needed. By staying informed, comparing options, and understanding the terms and fees associated with the loan, borrowers can make decisions that are in their best interest and avoid excessive origination fees.

In conclusion, understanding the basics of hard money loans and the role of origination fees is crucial for borrowers. By researching, comparing, and carefully evaluating all aspects of the loan, borrowers can make informed decisions and find the best origination fee for their hard money loan. Transparency, fee disclosure, and professional advice can also play a critical role in ensuring that borrowers are fully aware of the costs and terms associated with the loan. Taking the time to carefully consider all factors will ultimately lead to a more successful and financially beneficial hard money loan experience.