Hard money loans provide a unique funding opportunity for individuals and businesses seeking quick access to capital. But what exactly is the range of loan amounts that can be obtained through this alternative financing option? From small-scale projects to large commercial ventures, hard money lenders offer a wide spectrum of loan amounts to cater to different financial needs. Whether you require a modest loan to fund a residential property purchase or a substantial amount for a commercial real estate investment, hard money loans provide flexible options to accommodate your specific requirements. In this article, we will explore the range of loan amounts available through hard money loans and delve into how this type of financing can benefit borrowers in various industries.

Understanding Hard Money Loans

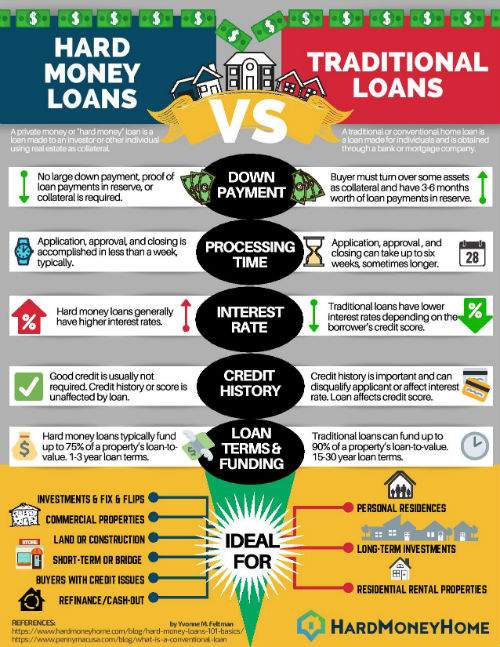

Hard money loans are a type of financing that is often used in real estate transactions. Unlike traditional bank loans, which are provided by financial institutions, hard money loans are funded by private individuals or companies. These loans are typically short-term and are secured by the value of the property being purchased.

Definition of hard money loans

A hard money loan is a type of loan that is secured by real estate and is funded by private individuals or companies. These loans are often used by real estate investors who need quick access to funding or who may not qualify for traditional bank loans due to credit or financial history. Hard money loans are typically short-term and have higher interest rates compared to traditional bank loans.

How hard money loans work

When applying for a hard money loan, the borrower will need to provide the lender with information about the property being purchased as well as their financial history. The lender will then assess the value of the property and determine the loan amount based on a percentage of its value, known as the loan-to-value ratio (LTV). Once the loan is approved, the borrower will receive the funds and can use them to purchase the property. Repayment terms and interest rates will be set by the lender, and the borrower will make regular payments until the loan is fully repaid.

Benefits of hard money loans

There are several benefits to using hard money loans for real estate transactions. One of the main advantages is the quick access to funding. Unlike traditional bank loans, which can take weeks or even months to process, hard money loans can often be approved and funded within days. This can be especially beneficial for real estate investors who need to act quickly in competitive markets. Additionally, hard money loans do not require the same level of strict credit and financial history checks as traditional bank loans, making them more accessible to a wider range of borrowers. Finally, hard money loans can be used for a variety of purposes, including property acquisition, renovation and improvements, and real estate investment opportunities.

Factors Influencing Loan Amounts

The loan amount for a hard money loan is influenced by several key factors. These factors play a significant role in determining how much money a borrower can receive from a lender.

Collateral value

One of the most important factors influencing the loan amount is the value of the property being used as collateral. The property is assessed by the lender to determine its current market value. The loan amount is typically a percentage of the property’s value, known as the loan-to-value (LTV) ratio. The higher the value of the property, the larger the loan amount that can be obtained.

Lender’s risk assessment

The lender will also consider their own risk when determining the loan amount. They will assess the borrower’s ability to repay the loan based on their financial history, credit score, and income. The lender will also consider the overall risk associated with the specific property being used as collateral. If the lender determines that there is a higher level of risk, they may offer a lower loan amount.

Borrower’s credit history

While hard money loans do not require the same level of strict credit checks as traditional bank loans, the borrower’s credit history can still influence the loan amount. A borrower with a higher credit score and a strong credit history may be able to secure a larger loan amount compared to someone with a lower credit score.

Location of the property

The location of the property can also impact the loan amount. Properties located in desirable areas with high potential for appreciation may be more attractive to lenders, who may be willing to offer a higher loan amount. On the other hand, properties in less desirable locations may result in a lower loan amount.

Typical Range of Loan Amounts

The range of loan amounts available through hard money loans can vary depending on various factors, including the type of property and the specific lender. However, there are typically minimum and maximum loan amounts that borrowers can expect.

Minimum loan amount

The minimum loan amount for a hard money loan can vary but is usually around $50,000. This minimum amount ensures that the lender’s costs and administrative fees are covered. It also helps to ensure that the loan is financially viable for the lender.

Maximum loan amount

The maximum loan amount for a hard money loan can also vary greatly depending on the lender and the specific circumstances. In general, hard money loans can range from a few hundred thousand dollars up to several million dollars. The maximum loan amount is typically determined by the lender’s risk assessment, the value of the property being used as collateral, and the borrower’s financial history.

Loan-to-value (LTV) ratio

The loan-to-value (LTV) ratio is an important factor in determining the loan amount. The LTV ratio represents the percentage of the property’s value that the lender is willing to loan. In most cases, the LTV ratio for hard money loans ranges from 50% to 70%. For example, if a property is worth $500,000 and the LTV ratio is 70%, the borrower could potentially receive a loan amount of up to $350,000.

Loan Amount Factors for Residential Properties

When it comes to residential properties, there are several factors that can influence the loan amount offered by a hard money lender.

Single-family homes

For single-family homes, the loan amount will typically be based on the value of the property and the borrower’s financial history. Lenders will assess the property’s value and may offer a loan amount ranging from 50% to 70% of its value.

Multi-unit properties

Multi-unit properties, such as duplexes or apartment buildings, can offer higher loan amounts compared to single-family homes. This is because the income generated from the rental units can provide additional security for the lender. The loan amount for multi-unit properties is typically based on the property’s value and potential rental income.

Condominiums and townhouses

Condominiums and townhouses are also eligible for hard money loans. The loan amount for these types of properties is typically based on the market value and financial viability of the specific unit. Lenders will assess the property’s value and the borrower’s financial history to determine the loan amount.

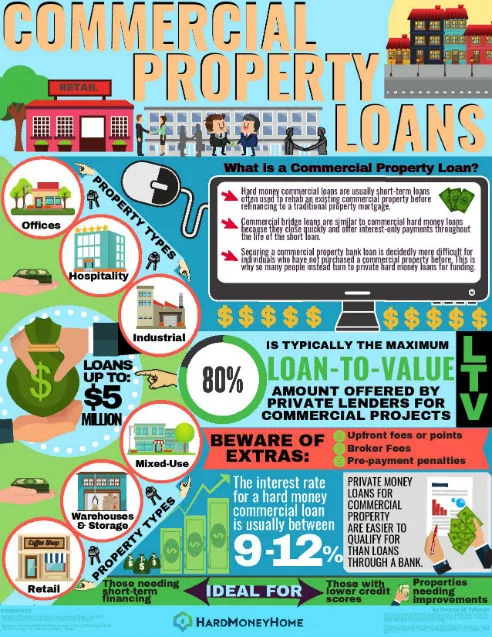

Loan Amount Factors for Commercial Properties

When it comes to commercial properties, the loan amount offered by a hard money lender can be influenced by several factors.

Office buildings

For office buildings, the loan amount will primarily depend on the property’s value and potential rental income. Lenders will assess the rental income generated by the property to determine the loan amount. The borrower’s financial history may also play a role in the loan amount offered.

Retail properties

Similar to office buildings, the loan amount for retail properties will be based on the property’s value and potential rental income. Lenders will assess the retail space’s rental income and the borrower’s financial history to determine the loan amount.

Industrial properties

Loan amounts for industrial properties will again be dependent on the property’s value and potential rental income. Lenders will assess the industrial space’s rental income and the borrower’s financial history to determine the loan amount.

Hospitality properties

Hospitality properties, such as hotels or resorts, can also be eligible for hard money loans. The loan amount for hospitality properties will typically be based on the property’s value, potential income from bookings, and the borrower’s financial history. Lenders will assess the property’s income potential and the borrower’s ability to manage and operate the property.

Importance of Loan Amounts for Borrowers

The loan amount is a crucial factor for borrowers as it determines their purchasing power and ability to meet their financial needs.

Meeting financial needs

The loan amount plays a crucial role in meeting the borrower’s financial needs. Whether it is acquiring a property, renovating an existing property, or investing in real estate opportunities, the loan amount must be sufficient to cover the expenses.

Ensuring property acquisition

For borrowers looking to purchase a property, having a suitable loan amount is essential to ensure the successful acquisition of the property. Without adequate funding, borrowers may miss out on valuable real estate opportunities.

Renovation and improvements

In many cases, borrowers may require additional funds to renovate or improve a property. The loan amount must be sufficient to cover the renovation costs and ensure that the property can be updated or enhanced as desired.

Real estate investment opportunities

For real estate investors, having access to a suitable loan amount is vital for seizing investment opportunities. The loan amount can determine the investor’s ability to acquire additional properties or take advantage of favorable market conditions.

Loan Amount Limitations

While hard money loans offer flexibility and quick access to funding, there are certain limitations to consider.

Availability of funds

The availability of funds can impact the loan amount. If the lender does not have sufficient capital to fund a large loan, borrowers may be limited in the amount they can borrow. It is important for borrowers to research and choose lenders who have the capacity to fund the desired loan amounts.

Lender’s criteria

Each hard money lender may have their own criteria and guidelines when it comes to loan amounts. Some lenders may have strict maximum loan amounts or lending limits based on factors such as the borrower’s financial history or the type of property being financed.

Borrower’s eligibility

The borrower’s eligibility can also impact the loan amount. Factors such as the borrower’s credit history, income, and financial stability may influence the lender’s decision on the loan amount. Borrowers with stronger credit and financial profiles may be eligible for larger loan amounts compared to those with weaker credit or financial histories.

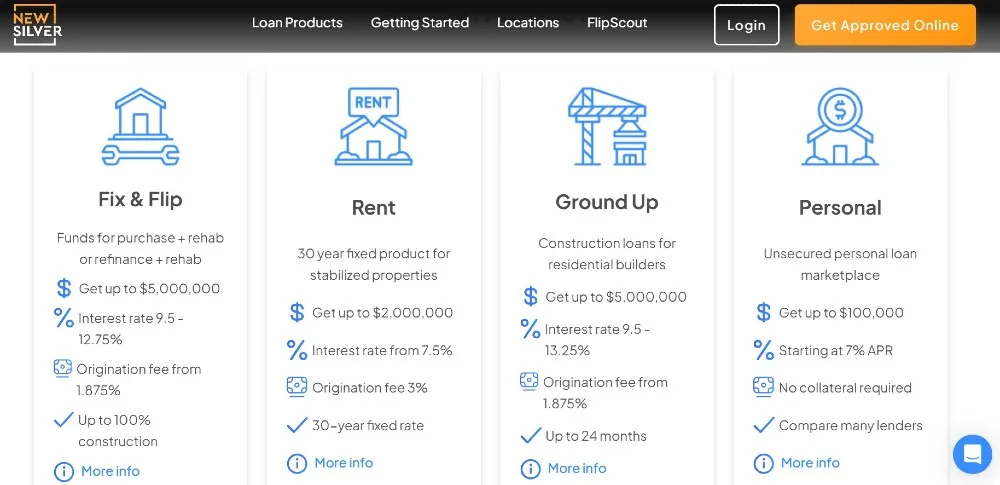

Factors Affecting Interest Rates

The interest rate for a hard money loan can be influenced by several factors, including the loan amount.

Loan amount impact on interest rates

In general, the loan amount can have an impact on the interest rate offered by a hard money lender. Higher loan amounts may result in lower interest rates, as the lender may view the loan as less risky due to the larger collateral value.

Other factors influencing rates

Aside from loan amounts, other factors can also influence the interest rates offered by hard money lenders. These factors may include the borrower’s credit history, the overall risk associated with the property, market conditions, and the lender’s own policies.

Finding a Suitable Hard Money Lender

When searching for a hard money lender, it is important to consider several factors to ensure that you find a suitable lender for your needs.

Researching lenders

Take the time to research different hard money lenders to understand their lending criteria, loan terms, and interest rates. Look for lenders who specialize in the type of property you are interested in and have a strong track record of funding similar projects.

Comparing loan offers

Obtain multiple loan offers from different lenders and compare the terms, loan amounts, and interest rates. This will help you determine which lender offers the most favorable terms and aligns with your borrowing needs.

Seeking recommendations

Reach out to other real estate professionals or investors for recommendations on reputable hard money lenders. Their firsthand experiences and recommendations can help guide you in finding a reliable and trustworthy lender.

Reading customer reviews

Read customer reviews and testimonials to gain insights into the experiences of previous borrowers. Pay attention to feedback regarding the loan process, communication, and overall satisfaction with the lender to make an informed decision.

Conclusion

Understanding the factors that influence loan amounts and interest rates is crucial when considering hard money loans for real estate financing. Factors such as the property’s value, the borrower’s credit history, and the lender’s risk assessment all play a role in determining the loan amount. By identifying the right hard money lender and comparing loan offers, borrowers can make informed decisions and secure the financing they need for their real estate ventures.