Hard money loans and traditional mortgages are two distinct types of lending options that serve different purposes. While traditional mortgages are regulated by specific laws and guidelines set by government agencies, such as the Consumer Financial Protection Bureau (CFPB), the regulatory landscape for hard money loans is quite different. Hard money loans, often sought by real estate investors or individuals with unique financial situations, are typically funded by private investors or companies and may not be subject to the same level of regulation as traditional mortgages. This article will explore the key differences in regulation between hard money loans and traditional mortgages, shedding light on the specific laws that govern each lending option and the implications for borrowers.

Overview of Hard Money Loans

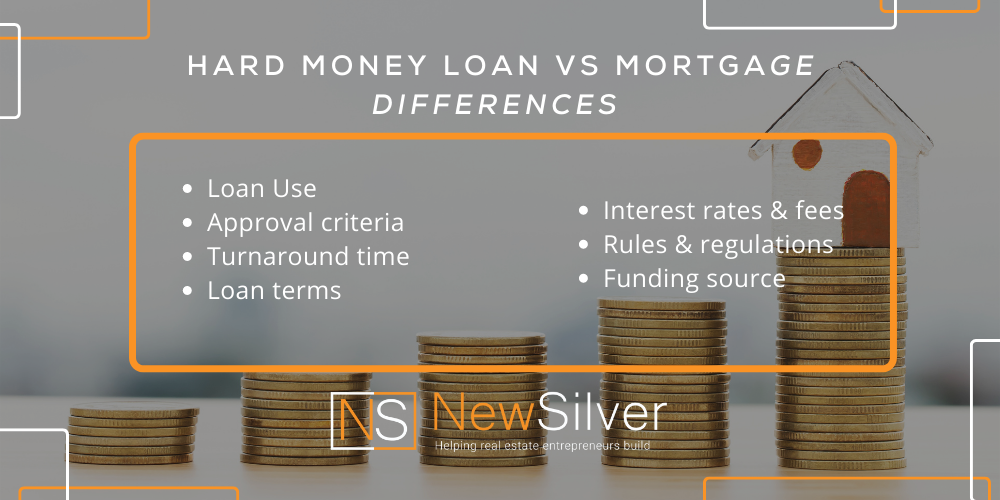

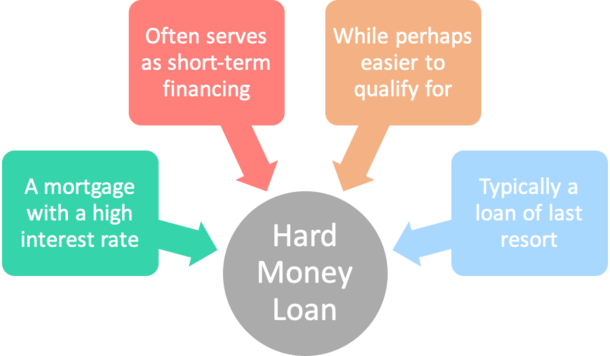

Hard money loans are a type of financing that is typically provided by private individuals or non-institutional lenders. These loans are secured by real estate assets, such as properties or land. Unlike traditional mortgages, hard money loans are known for their expedited approval process and flexible lending criteria. They are often used by borrowers who may not qualify for a traditional mortgage due to poor credit, insufficient income, or other challenging circumstances.

Definition of Hard Money Loans

Hard money loans, also known as private money loans or bridge loans, are short-term loans typically used for real estate investment purposes. These loans are typically secured by the property being purchased, which acts as collateral for the loan. The loan amount is usually based on the value of the property, rather than the borrower’s creditworthiness or income.

How Hard Money Loans Work

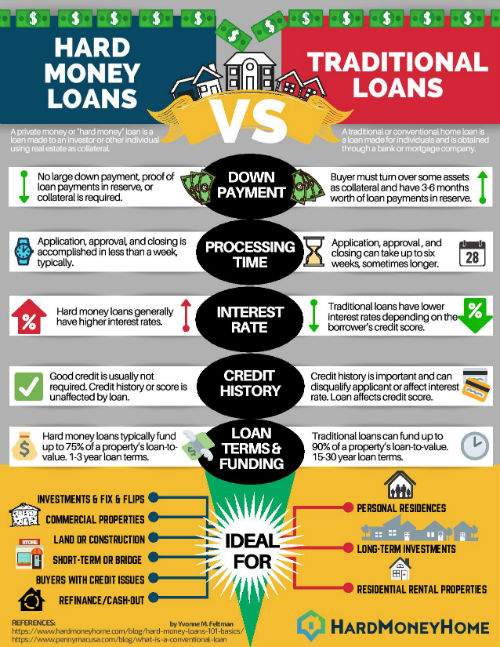

To obtain a hard money loan, a borrower must find a private lender or hard money lending company that specializes in this type of financing. The borrower submits an application, along with the necessary supporting documentation, such as a property appraisal and credit history. Unlike traditional mortgages, hard money loans typically have a faster approval process and can often be funded within days or weeks.

Once approved, the borrower will receive the funds and can use them to purchase the desired property or make necessary repairs and renovations. Hard money loans usually have a short loan term, typically ranging from a few months to a few years. The interest rates on hard money loans are generally higher than those of traditional mortgages, reflecting the increased risk to the lender.

Overview of Traditional Mortgages

Traditional mortgages are loans provided by banks, credit unions, or other financial institutions for the purpose of purchasing real estate. These mortgages are largely governed by federal regulations and are seen as long-term financing options for homeowners. Traditional mortgages tend to have lower interest rates and longer loan terms compared to hard money loans.

Definition of Traditional Mortgages

A traditional mortgage is a loan provided by a financial institution to facilitate the purchase of real estate. In a traditional mortgage, the borrower typically makes a down payment and borrows the remaining balance from the lender. The lender holds a lien on the property until the loan is fully repaid.

How Traditional Mortgages Work

To obtain a traditional mortgage, a borrower must go through a thorough application process that includes submitting financial documents, such as tax returns, pay stubs, and bank statements. The borrower’s creditworthiness, income, and other factors are evaluated by the lender to determine loan approval.

Once approved, the borrower and the lender agree on the loan amount, interest rate, and repayment terms. The borrower then makes regular monthly payments, typically over a period of 15 to 30 years, until the loan is fully repaid. Falling behind on payments can result in foreclosure, where the lender takes possession of the property.

Regulatory Environment for Hard Money Loans

Lack of Federal Regulation

Unlike traditional mortgages, hard money loans are not subject to extensive federal regulations. Since hard money loans are largely provided by private individuals or small lending companies, they are exempt from many of the federal laws that govern traditional mortgage lending. This lack of federal regulation allows for more flexibility in the lending process but also presents potential risks for both the borrower and the lender.

State Regulation of Hard Money Lending

Although hard money loans may not be subject to comprehensive federal regulations, they are still regulated at the state level. Each state has its own laws and regulations governing hard money lending, such as licensing requirements for lenders and restrictions on interest rates and fees. It is important for borrowers and lenders to familiarize themselves with the specific regulations in their state to ensure compliance and protect their interests.

Regulatory Environment for Traditional Mortgages

Federal Regulation of Traditional Mortgage Lending

Traditional mortgages are heavily regulated at the federal level. The Dodd-Frank Wall Street Reform and Consumer Protection Act, passed in 2010, introduced significant changes to the mortgage industry and aimed to protect consumers from predatory lending practices. This legislation established new rules and requirements for mortgage lenders, such as stricter underwriting standards and guidelines for loan origination and servicing.

Consumer Financial Protection Bureau (CFPB)

The Consumer Financial Protection Bureau (CFPB) is an agency created under the Dodd-Frank Act to enforce consumer protection laws and regulations, including those related to mortgage lending. The CFPB oversees and regulates mortgage servicers, ensuring borrowers are treated fairly and protected from abusive practices.

Other Regulatory Agencies

In addition to the CFPB, traditional mortgage lending is regulated by other federal agencies, such as the Federal Housing Administration (FHA) and the Federal National Mortgage Association (Fannie Mae). These agencies establish guidelines and standards for mortgage lending, particularly for loans backed by the government.

Differences in Regulation

Disclosure Requirements

Traditional mortgages are subject to extensive disclosure requirements, ensuring that borrowers receive clear and comprehensive information about the terms and costs of their loan. Lenders must provide borrowers with a Loan Estimate and a Closing Disclosure, which outline the loan terms, fees, and other relevant details. Hard money loans, on the other hand, may have less stringent disclosure requirements, as they are often considered commercial transactions and not subject to the same consumer protection regulations.

Interest Rate Regulation

Traditional mortgages have interest rate regulations imposed by federal and state laws, which aim to prevent predatory lending practices and ensure borrowers are not charged excessive rates. Hard money loans, as private transactions, are generally not subject to specific interest rate regulations. This means that lenders can set higher interest rates based on the perceived risk of the loan.

Loan-to-Value Ratio Limits

Traditional mortgages often have loan-to-value ratio limits, which restrict the amount a borrower can borrow based on the appraised value of the property. This helps protect lenders from the risk of loan defaults. Hard money loans, on the other hand, may allow for higher loan-to-value ratios since they are primarily based on the value of the property being used as collateral.

Loan Term Restrictions

Traditional mortgages typically have longer loan terms, such as 15 or 30 years, allowing borrowers to spread out their payments over an extended period. Hard money loans, being short-term loans, usually have much shorter loan terms ranging from a few months to a few years. This reflects the nature of these loans as bridge financing or temporary solutions rather than long-term financing options.

Advantages and Disadvantages of Hard Money Loans

Advantages of Hard Money Loans

One of the main advantages of hard money loans is their fast approval process and quick funding. Traditional mortgages often take weeks or months to close, whereas hard money loans can be funded within days. This can be crucial for real estate investors who need to act quickly to secure a property.

Another advantage of hard money loans is their flexibility in terms of lending criteria. Since these loans are primarily asset-based, lenders focus more on the value of the property being used as collateral rather than the borrower’s creditworthiness. This allows borrowers with poor credit or non-traditional income sources to access financing that may not be available through traditional mortgages.

Disadvantages of Hard Money Loans

The main disadvantage of hard money loans is the higher interest rates compared to traditional mortgages. Since lenders take on more risk with hard money loans, they charge higher rates to compensate for that risk. These higher interest rates can significantly increase the overall cost of borrowing.

Another disadvantage of hard money loans is their short loan terms. Borrowers may need to have a clear exit strategy in place to repay the loan within the specified time frame. Failing to do so could result in additional fees or even the loss of the property used as collateral.

Advantages and Disadvantages of Traditional Mortgages

Advantages of Traditional Mortgages

One of the key advantages of traditional mortgages is their lower interest rates compared to hard money loans. Traditional mortgages are typically offered by established financial institutions and benefit from lower funding costs, which allows for more competitive interest rates. This can result in significant savings over the life of the loan.

Another advantage of traditional mortgages is their longer loan terms. This allows borrowers to spread out their payments over a more extended period, making them more manageable and affordable. Longer loan terms can also provide stability for homeowners who plan to stay in their property for an extended period.

Disadvantages of Traditional Mortgages

One disadvantage of traditional mortgages is the strict underwriting criteria used to determine loan eligibility. Borrowers must meet specific credit and income requirements to qualify for a traditional mortgage, which can be challenging for individuals with poor credit or non-traditional income sources.

Another potential disadvantage of traditional mortgages is the longer approval process and funding timeline. Borrowers may have to wait weeks or even months for their loan to close, which can be a significant drawback for those who need financing urgently.

Factors to Consider When Choosing Between Hard Money Loans and Traditional Mortgages

Borrower’s Creditworthiness

If you have excellent credit and a stable income, you may be more likely to qualify for a traditional mortgage with favorable terms and lower interest rates. On the other hand, if you have poor credit or non-traditional income sources, a hard money loan may be your best option.

Loan Purpose and Timeframe

Consider your specific loan purpose and timeframe. If you are a real estate investor seeking quick funding for a property purchase or renovation, a hard money loan may be more suitable due to its faster approval process and short-term nature. However, if you are purchasing a primary residence and plan to hold onto it for an extended period, a traditional mortgage with its lower long-term interest rates may be more cost-effective.

Available Collateral

The type and value of the collateral you have available can also influence your decision. Hard money loans are typically based on the value of the property being used as collateral, so if you have a valuable property, it may be easier to qualify for a hard money loan. Traditional mortgages, on the other hand, require a detailed appraisal and may have restrictions on certain types of properties.

Interest Rates and Fees

Compare the interest rates and fees associated with both hard money loans and traditional mortgages. While hard money loans often have higher interest rates, traditional mortgages may have additional fees, such as origination fees or mortgage insurance premiums. Consider the overall cost of borrowing and weigh it against the benefits of each financing option.

Loan Processing Time

If you need financing urgently or have a time-sensitive transaction, a hard money loan may be the best choice due to its faster approval and funding timeline. However, if you have the luxury of time and can wait for the longer approval process of a traditional mortgage, it may be worthwhile to explore this option for potentially lower interest rates and longer loan terms.

Desired Loan Terms

Consider the desired loan terms for your financing. If you prefer a longer loan term and more manageable monthly payments, a traditional mortgage may be a better fit. However, if you are looking for a short-term loan with the intention of quickly paying it off or flipping a property, a hard money loan with its shorter terms may align better with your objectives.

Conclusion

In conclusion, hard money loans and traditional mortgages are two distinct financing options with their own advantages and disadvantages. Hard money loans offer flexibility, faster approval, and access to financing for borrowers who may not qualify for a traditional mortgage. Traditional mortgages, on the other hand, provide lower interest rates, longer loan terms, and more extensive federal regulation. When deciding between the two, it is crucial to consider factors such as creditworthiness, loan purpose, available collateral, interest rates, fees, loan processing time, and desired loan terms. By carefully evaluating your specific needs and circumstances, you can make an informed decision as to which type of financing is most suitable for your situation.