One crucial aspect to consider when seeking financing from hard money lenders for real estate investments is whether or not a business plan is required. While some traditional lenders place great emphasis on a comprehensive business plan, it is important to understand that hard money lenders typically have different requirements. This article explores whether or not hard money lenders require a business plan for real estate investments, shedding light on the key factors these lenders consider when evaluating loan applications.

Introduction

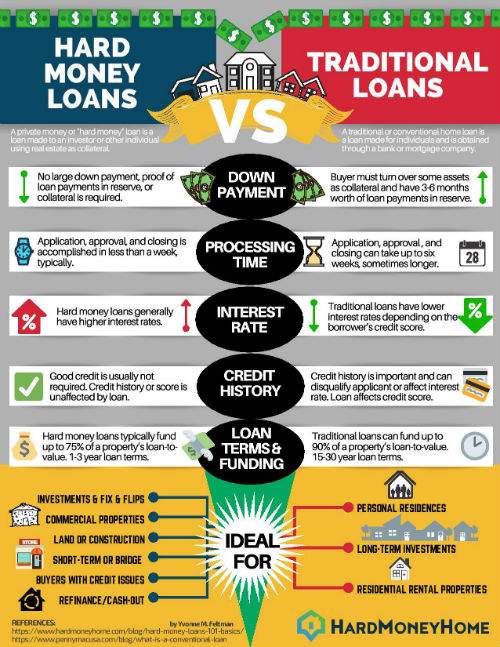

When it comes to real estate investments, securing financing can be a challenging endeavor. Traditional lenders may have strict requirements and lengthy approval processes, making it difficult for investors to obtain the necessary funds in a timely manner. This is where hard money lenders come in. Hard money lenders are private individuals or organizations that offer short-term loans based on the value of the real estate property being used as collateral. Unlike traditional lenders, hard money lenders typically focus on the value of the asset rather than the borrower’s creditworthiness. In this article, we will explore the role of hard money lenders in real estate investing and the importance of having a business plan when seeking their financing.

Understanding Hard Money Lenders

Definition

Hard money lenders are individuals or companies that provide short-term loans secured by real estate. Unlike traditional lenders such as banks, hard money lenders do not rely heavily on the borrower’s credit history or income to determine eligibility. Instead, they primarily consider the value of the property being used as collateral.

Key Characteristics

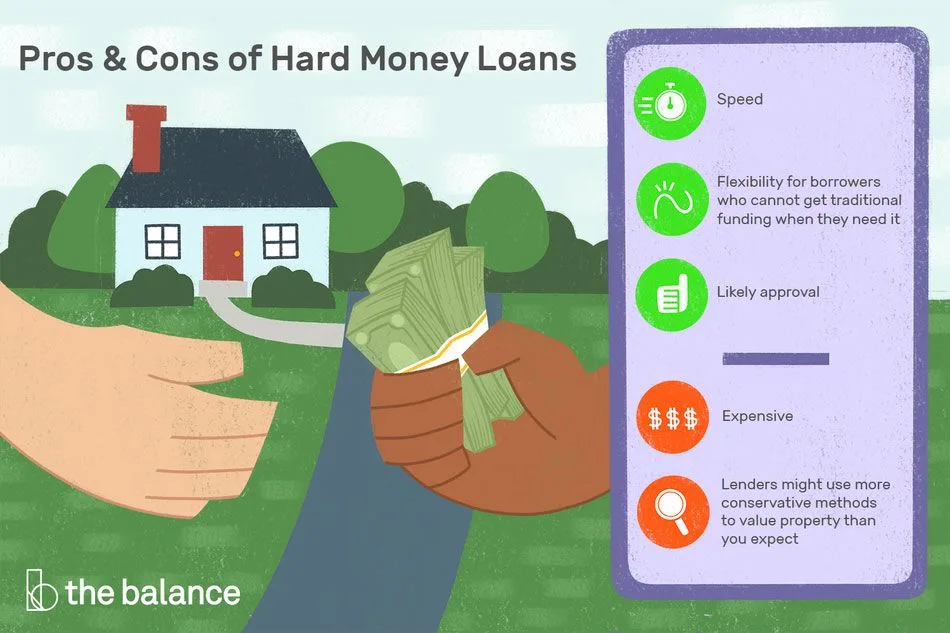

Hard money loans often have higher interest rates and fees compared to traditional loans. This is due to the increased risk that hard money lenders take on by providing funding to borrowers who may not qualify for traditional financing. Hard money loans are typically used for real estate investment projects that have a high potential for profit, such as fix-and-flip projects.

Role in Real Estate Investing

Hard money lenders play a crucial role in the real estate investment industry. Their willingness to provide funding based on the value of the property allows investors to quickly secure the funds they need to acquire properties, make necessary repairs, and sell them for a profit. This flexibility and speed make hard money lenders an attractive option for real estate investors who need to act quickly in a competitive market.

The Importance of a Business Plan

Definition and Purpose

A business plan is a detailed document that outlines the goals, strategies, and financial projections of a business. In the context of real estate investing, a business plan serves as a roadmap for the investor’s project.

The purpose of a business plan is to provide a clear and comprehensive overview of the investment opportunity. It demonstrates to potential lenders, including hard money lenders, that the investor has carefully considered all aspects of the project and has a well-thought-out plan for achieving success.

Benefits of Having a Business Plan

Having a business plan can provide several benefits for real estate investors, particularly when seeking funding from hard money lenders:

-

Increased Credibility: A business plan enhances the investor’s credibility by showing that they have thoroughly examined the market conditions, analyzed the property’s potential, and developed a strategic plan to achieve their investment goals.

-

Risk Mitigation: By conducting a thorough market analysis and financial projections, investors can identify potential risks and plan contingencies to mitigate them. This demonstrates foresight and risk management capabilities to lenders.

-

Targeted Strategies: A business plan allows investors to outline their specific strategies for acquiring, renovating, and selling the property. This helps lenders understand the investor’s approach and assess its viability.

-

Financial Viability: Financial projections included in the business plan provide lenders with a clear picture of the investor’s expected return on investment and the potential profitability of the project.

Hard Money Lenders’ Requirements

Varied Standards

Different hard money lenders may have varying requirements when it comes to business plans. While some may place a strong emphasis on a comprehensive and detailed plan, others may focus more on the value and potential of the property being used as collateral. It is essential for investors to research and understand the specific standards of the hard money lenders they are considering.

Importance of a Business Plan

Despite the variations in requirements, having a business plan is generally advantageous when dealing with hard money lenders. A well-crafted plan demonstrates the investor’s professionalism, preparedness, and commitment to success. It also helps lenders evaluate the investor’s ability to execute the project effectively and generate the expected returns.

Flexibility in Certain Cases

In some cases, hard money lenders may be open to funding projects without a formal business plan. This is more likely to occur when the property’s potential value or the investor’s experience and track record are exceptionally compelling. However, even in these cases, it is still beneficial for the investor to have a well-documented plan to present to the lender, as it provides a clear and organized framework for the project.

Key Elements of a Real Estate Business Plan

A comprehensive real estate business plan typically includes the following key elements:

Executive Summary

The executive summary provides an overview of the investment opportunity. It should succinctly explain the investor’s goals, the property’s location and characteristics, and the investment strategy. This section should be concise but compelling enough to capture the attention of the hard money lender.

Property Analysis

The property analysis section delves into the details of the property being considered for investment. It includes information such as the property’s location, size, condition, and potential value. It is important to provide a thorough analysis of the property and its potential profitability, as this is a significant factor that hard money lenders consider when evaluating loan applications.

Market Analysis

A comprehensive market analysis helps investors assess the potential demand and profitability of the investment. It includes an examination of local market trends, comparable sales, rental rates, and other relevant market factors. A well-researched market analysis demonstrates to hard money lenders that the investor has a deep understanding of the market and has made informed investment decisions based on this knowledge.

Financial Projections

The financial projections section outlines the expected revenues, expenses, and profitability of the investment. It should include details such as acquisition costs, renovation expenses, carrying costs, and anticipated sale prices. In addition to demonstrating the investor’s financial acumen, this section also helps hard money lenders assess the viability and potential profitability of the project.

Exit Strategy

The exit strategy outlines how the investor plans to exit the investment and generate returns. Common exit strategies in real estate investing include selling the property, refinancing with traditional lenders, or holding the property as a rental. A well-defined exit strategy demonstrates the investor’s foresight and helps hard money lenders evaluate the overall feasibility of the project.

Demonstrating Investment Viability

Showcasing Profit Potential

One of the primary objectives of a business plan is to demonstrate the investment’s profit potential to hard money lenders. This can be achieved by providing realistic and well-supported financial projections that outline the expected revenue and profitability of the project. By showcasing a compelling profit potential, investors increase their chances of securing funding from hard money lenders.

Analyzing Risks

Hard money lenders understand that investing in real estate entails some level of risk. A well-prepared business plan should include a comprehensive risk analysis, identifying potential challenges and proposing strategies to mitigate them. By demonstrating an understanding of the risks involved and presenting sensible solutions, investors can build trust and credibility with hard money lenders.

Highlighting Experience and Expertise

Hard money lenders evaluate not only the investment opportunity but also the investor’s ability to execute the project successfully. Therefore, it is crucial to highlight the investor’s experience and expertise in the real estate industry. This can be achieved by providing a summary of previous successful projects, relevant certifications or licenses, and any special skills or knowledge that set the investor apart.

Tailoring a Business Plan for Hard Money Lenders

Keeping It Concise

While a comprehensive business plan is important, it is crucial to keep it concise when presenting it to hard money lenders. Lenders are often busy and prefer to review concise and focused plans that highlight the key aspects of the investment opportunity. It is recommended to limit the plan to a maximum of 20-30 pages and use bullet points and tables to present information clearly and succinctly.

Emphasizing Property Details

Given that hard money lenders primarily focus on the property’s value, it is essential to provide detailed information about the property in the business plan. This includes property location, size, condition, potential value, and any unique selling points. The aim is to demonstrate to the lender that the property is a sound investment with potential for profit.

Addressing Potential Challenges

Hard money lenders are aware that real estate investment projects are not without risks. Investors should acknowledge and address potential challenges in their business plan. By outlining potential risks and providing well-thought-out strategies to mitigate them, investors can instill confidence in hard money lenders and increase their chances of obtaining funding.

Including an Exit Strategy

An exit strategy is a vital component of any real estate business plan, particularly when dealing with hard money lenders. Including a well-defined exit strategy demonstrates to lenders that the investor has a clear plan for exiting the investment and generating returns. This provides reassurance to the lender that their investment will be repaid within the agreed-upon timeframe.

Alternatives to Traditional Hard Money Lenders

Private Money Lenders

Private money lenders are individuals or small groups of investors who provide funding for real estate investments. Similar to hard money lenders, they typically focus on the value of the property rather than the borrower’s creditworthiness. Private money lenders may have more flexibility in their lending criteria and may be more willing to fund unconventional investment opportunities.

Crowdfunding Platforms

Crowdfunding platforms have gained popularity in recent years as a source of financing for real estate investments. These online platforms allow investors to raise funds from a large pool of individual investors who contribute smaller amounts. Crowdfunding can be an attractive alternative to traditional hard money lenders, as it provides access to a diverse group of potential investors.

Real Estate Investment Groups

Real estate investment groups are associations of individuals who pool their funds to invest in real estate projects. These groups typically have established relationships with lenders and may have access to more favorable financing terms. Joining a real estate investment group can provide investors with access to capital and the expertise of experienced investors.

Benefits of Having a Business Plan

Clear Vision and Focus

Developing a business plan forces real estate investors to clarify their goals and develop a clear vision for their investment project. It helps them identify the necessary steps, strategies, and resources needed to achieve their objectives. This clarity of vision enables investors to stay focused and make informed decisions throughout the investment process.

Better Decision-Making

A well-crafted business plan provides investors with a framework for making important investment decisions. It helps them evaluate the potential risks and rewards of different strategies, guiding them in choosing the most viable and profitable course of action. By ensuring that decisions are based on sound analysis and planning, investors can enhance their chances of success.

Increased Investor Confidence

When seeking funding from hard money lenders or other sources, having a business plan instills confidence in potential investors. A comprehensive and well-presented plan demonstrates the investor’s professionalism, preparedness, and commitment to success. It provides reassurance that the investor has a thorough understanding of the investment opportunity and has developed a well-thought-out plan for achieving success.

Effective Communication Tool

A business plan serves as a communication tool between the investor and the lender. It enables the investor to clearly articulate their investment goals, strategies, and expected returns. By presenting information in a structured and organized manner, investors can effectively convey their ideas to hard money lenders, helping them make an informed decision about providing funding.

Conclusion

While hard money lenders may not always require a formal business plan, having one can significantly increase the chances of securing their financing. A well-crafted business plan demonstrates professionalism, preparedness, and a clear vision for the investment project. It helps investors showcase the profitability of the investment, analyze potential risks, and highlight their expertise and experience in the real estate industry. By tailoring the business plan to the specific requirements of hard money lenders, investors can increase their credibility and enhance their chances of success. Ultimately, a comprehensive business plan serves as a valuable tool for real estate investors seeking funding for their projects.