Using a hard money loan for commercial properties is a common question amongst real estate investors seeking alternative financing options. While traditional loans may have stringent requirements and lengthy approval processes, hard money loans offer a more flexible and streamlined approach. These loans are typically provided by private investors or lending institutions and are secured by the property itself. In this article, we will explore the potential benefits and considerations of utilizing a hard money loan for commercial properties, providing valuable insights for those looking to diversify their investment portfolio.

What is a hard money loan?

Definition

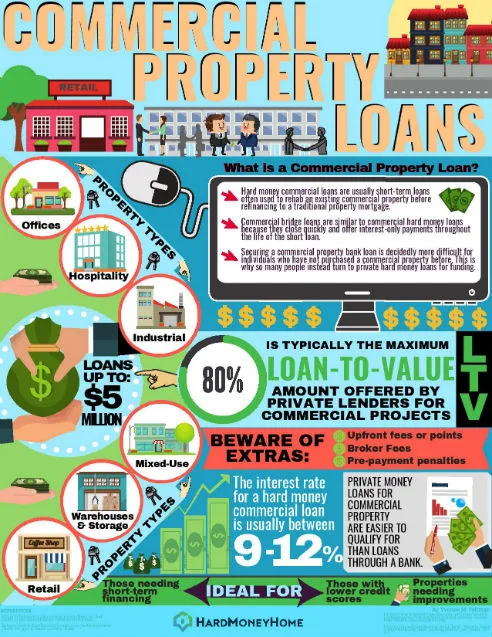

A hard money loan is a type of short-term financing that is typically used by real estate investors to purchase or renovate commercial properties. Unlike traditional loans from banks or other financial institutions, hard money loans are funded by private individuals or companies. These loans are secured by the value of the property being purchased, rather than the borrower’s creditworthiness or income.

How it differs from traditional loans

Hard money loans differ from traditional loans in several key ways. Firstly, traditional loans are typically issued by banks and other established financial institutions, while hard money loans come from private lenders. Secondly, traditional loans often require extensive documentation and a lengthy approval process, whereas hard money loans can be approved quickly with less stringent requirements. Additionally, traditional loans are based primarily on the borrower’s creditworthiness and income, while hard money loans focus more heavily on the value of the property being financed.

Types of commercial properties eligible for hard money loans

Office buildings

Office buildings are a common type of commercial property that can be financed through hard money loans. These properties are typically leased to businesses and can range in size from small office spaces to large corporate complexes. Hard money lenders may consider financing office buildings based on factors such as location, condition, and potential rental income.

Retail spaces

Retail spaces, including shopping centers and standalone stores, can also be eligible for hard money loans. These properties are typically used by retailers to sell goods or provide services to customers. Hard money lenders may evaluate the potential profitability of the retail space and the overall demand in the market before extending a loan.

Industrial properties

Industrial properties, such as manufacturing plants and warehouses, are another type of commercial property that can be financed through hard money loans. These properties are often used for manufacturing, storage, or other industrial activities. Hard money lenders may assess factors such as the condition of the property, its location, and the potential rental or sale value.

Multi-family properties

Multi-family properties, including apartment buildings and condominium complexes, can also qualify for hard money loans. These properties are designed to house multiple families or individuals and can provide a steady stream of rental income. Hard money lenders may consider factors such as the occupancy rate, rental history, and potential for future appreciation.

Hotels and motels

Hotels and motels are commercial properties that cater to travelers and provide lodging and related services. Financing for these properties can be obtained through hard money loans. Hard money lenders may consider factors such as the property’s location, occupancy rates, and the potential for revenue growth.

Raw land

While less common, hard money loans can also be used to finance the purchase of raw land. Raw land refers to undeveloped or vacant land that may have potential for future development. Hard money lenders may assess factors such as the location of the land, its zoning restrictions, and the potential for future development or sale.

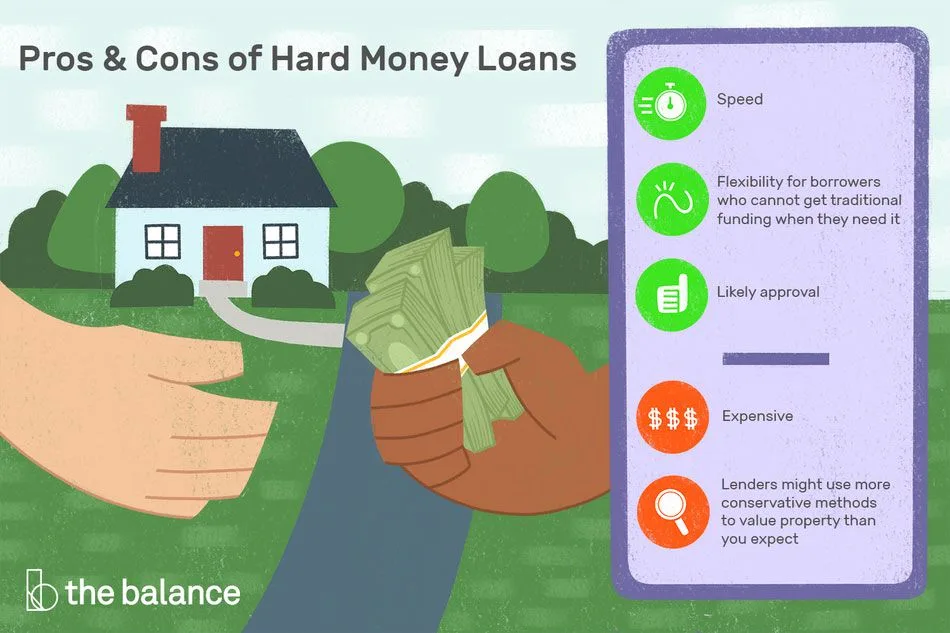

Benefits of using a hard money loan for commercial properties

Quick approval process

One of the major benefits of using a hard money loan for commercial properties is the quick approval process. Traditional loans often involve extensive paperwork and due diligence, which can take weeks or even months to complete. In contrast, hard money lenders typically provide a faster turnaround time and can approve a loan in a matter of days. This can be particularly beneficial in situations where a quick purchase or investment opportunity arises.

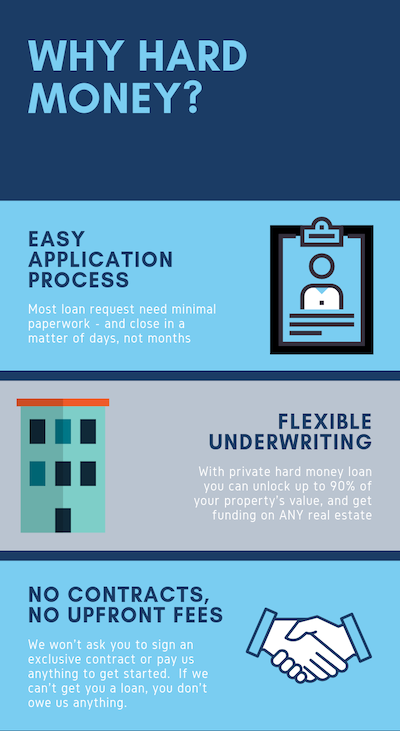

Flexible terms

Another advantage of hard money loans is the flexibility they offer in terms of repayment and other loan terms. While traditional loans often have rigid repayment schedules and terms, hard money lenders may be more willing to negotiate terms that meet the borrower’s specific needs. This can include options for interest-only payments, balloon payments, or extended loan terms.

Less reliance on credit score

Unlike traditional loans, which heavily rely on the borrower’s creditworthiness, hard money loans place less emphasis on credit scores. Instead, hard money lenders focus primarily on the value of the property being financed. This means that borrowers with lower credit scores or less established credit histories may still be able to qualify for a hard money loan, making it a more accessible financing option for some individuals.

Ability to finance distressed properties

Hard money loans are often used to finance distressed properties, which are properties that are in poor condition or facing financial challenges. Traditional lenders may be hesitant to finance distressed properties due to the higher level of risk involved. However, hard money lenders may be more willing to provide financing for these properties, allowing investors to acquire and rehabilitate them.

Opportunity for equity participation

In some cases, hard money lenders may offer the opportunity for equity participation in a commercial property. This means that the lender will receive a share of the property’s profits or appreciation in addition to interest payments. This can be a mutually beneficial arrangement, as it aligns the interests of the lender and borrower and provides the borrower with potential future financial gains.

Factors to consider before using a hard money loan for commercial properties

Interest rates and fees

When considering a hard money loan for a commercial property, it is important to carefully evaluate the interest rates and fees associated with the loan. Hard money loans often have higher interest rates compared to traditional loans, as they carry a higher level of risk. Additionally, borrowers may be required to pay origination fees, closing costs, and other charges. It is crucial to assess the overall cost of the loan and determine whether the potential benefits outweigh the higher expenses.

Loan-to-value ratio

The loan-to-value (LTV) ratio is an important factor to consider when using a hard money loan for a commercial property. The LTV ratio represents the percentage of the property’s value that the lender is willing to finance. Hard money lenders typically have lower LTV ratios compared to traditional lenders, as they seek to mitigate their risk. It is essential to understand the lender’s LTV requirements and ensure that the loan amount meets your needs and financial objectives.

Repayment terms

Before choosing a hard money loan for a commercial property, it is essential to carefully review the repayment terms. Hard money loans often have shorter repayment periods compared to traditional loans, with terms typically ranging from six months to a few years. It is crucial to assess your ability to meet the repayment schedule and evaluate the potential impact on your cash flow and financial stability.

Exit strategy

Having a well-defined exit strategy is crucial when using a hard money loan for a commercial property. Hard money lenders are primarily interested in the property’s value and its potential to generate returns. It is important to have a clear plan for either selling the property, refinancing with a traditional loan, or paying off the hard money loan with alternative financing. Failing to have a viable exit strategy may lead to difficulties in repaying the loan, which can result in financial and legal consequences.

Borrower experience and track record

Hard money lenders often consider the experience and track record of the borrower when evaluating loan applications for commercial properties. They may look for evidence of successful real estate investments, property management experience, and a demonstrated ability to generate income from similar properties. It is important to present a strong case for your ability to successfully manage and profit from the commercial property to increase the chances of loan approval.

Loan timeline

The timeline for receiving funding through a hard money loan should also be considered. While hard money loans can offer quick approvals, it is important to understand the entire process, from the initial application to the funding and disbursement of funds. Ensuring that the loan timeline aligns with your investment objectives and project deadlines is crucial to avoid delays and potential complications.

How to find a reputable hard money lender for commercial properties

Research and due diligence

Conducting thorough research and due diligence is essential when looking for a reputable hard money lender for commercial properties. Start by gathering information on different lenders and their lending practices. Look for lenders who specialize in commercial property financing and have a solid reputation in the industry. Online research, industry publications, and professional networks can provide valuable insights into the credibility and track record of potential lenders.

Seek recommendations and referrals

Seeking recommendations and referrals from real estate professionals, investors, and industry peers can be a valuable way to find reputable hard money lenders. These individuals may have firsthand experience with specific lenders and can provide insights into their reliability, professionalism, and overall lending process. Personal recommendations can help you identify lenders who have a strong track record and a positive reputation within the industry.

Check lender’s credentials

Before choosing a hard money lender, it is important to check their credentials and ensure they are licensed and regulated. Research the lender’s registration with relevant regulatory bodies and verify that they comply with all legal and ethical guidelines. Checking their credentials can provide reassurance that the lender operates within a regulated framework and adheres to industry standards.

Review customer testimonials and reviews

Reading customer testimonials and reviews can provide valuable insights into the experiences of borrowers who have worked with a specific hard money lender. Look for reviews or testimonials that highlight positive experiences, professionalism, and transparency in the lending process. Conversely, be cautious of lenders who have a significant number of negative reviews or complaints, as this may be indicative of potential issues or red flags.

Compare interest rates and terms

When evaluating hard money lenders, it is important to compare interest rates and loan terms. Request quotes from multiple lenders and carefully review the terms and conditions provided. Consider factors such as interest rates, points or fees, repayment schedules, and any potential penalties or charges. By comparing multiple lenders, you can identify the most favorable terms and secure a loan that aligns with your financial goals.

Application process for a hard money loan for commercial properties

Initial application

The application process for a hard money loan for commercial properties typically starts with an initial application. This application may require information about the property you intend to finance, your personal financial information, and your investment goals. Some lenders may also request a business plan or property appraisal at this stage. Submitting a complete and accurate application is crucial to ensure a smooth process and increase the chances of loan approval.

Property valuation

Once the initial application is received, the hard money lender will likely conduct a property valuation to assess its value and potential as collateral. This valuation may involve an on-site inspection, market analysis, and evaluation of the property’s condition and potential for income generation. The property valuation helps the lender determine the loan amount they are willing to extend based on the property’s value.

Documentation and financial requirements

Hard money lenders typically require borrowers to provide various documents and financial information to support the loan application. This may include bank statements, tax returns, proof of income, financial statements, and property-related documents such as title deeds and insurance policies. Meeting these documentation and financial requirements is crucial to demonstrate your ability to repay the loan and provide sufficient collateral.

Loan approval and terms negotiation

Upon completion of the property valuation and documentation review, the hard money lender will evaluate the loan application and make a decision regarding approval. If approved, the lender will then present the borrower with the proposed loan terms, including interest rates, repayment schedules, and any specific conditions or requirements. At this stage, there may be room for negotiation to ensure that the loan terms align with your financial objectives and investment plans.

Funding and disbursement

Once the loan approval and terms have been agreed upon, the lender will proceed with funding and disbursement. Depending on the lender’s processes and timelines, the funds may be provided through a wire transfer or a cashier’s check. It is important to carefully review the disbursement process and clarify any questions or concerns beforehand to ensure a smooth and efficient transfer of funds.

Risks and drawbacks of using a hard money loan for commercial properties

Higher interest rates

One of the primary risks of using a hard money loan for commercial properties is the higher interest rates compared to traditional loans. Hard money lenders assume a higher level of risk, and as a result, charge higher interest rates to compensate for this risk. The higher interest rates can have a significant impact on the overall cost of the loan, and borrowers should carefully assess the potential financial implications before committing to a hard money loan.

Shorter loan terms

Hard money loans often have shorter loan terms compared to traditional loans. While traditional loans may have terms ranging from several years to several decades, hard money loans typically have terms ranging from several months to a few years. The shorter loan terms can put pressure on borrowers to repay the loan quickly, potentially impacting cash flow and profitability. It is important to evaluate the feasibility of meeting the shorter repayment schedule before opting for a hard money loan.

Potential for increased costs

In addition to higher interest rates, hard money loans may come with additional costs and fees. These can include origination fees, closing costs, and other charges that can add to the overall cost of the loan. Borrowers should carefully review the loan terms and associated costs to assess the financial impact of these additional expenses.

Limited recourse for borrower

Hard money loans typically have limited recourse options for the borrower. This means that if the borrower fails to repay the loan or defaults, the lender may have the right to seize the property used as collateral. Unlike traditional loans, where borrowers may have more options for negotiating and resolving missed payments or financial difficulties, hard money loans often provide limited flexibility for borrowers in challenging situations.

Higher risk of default

Due to the higher interest rates, shorter loan terms, and limited recourse options, there is an inherently higher risk of default associated with hard money loans for commercial properties. If borrowers are unable to repay the loan as agreed, they may face financial and legal consequences, including the potential loss of the property used as collateral. It is crucial to carefully assess the risks involved and ensure that the investment opportunity justifies the potential risks before pursuing a hard money loan.

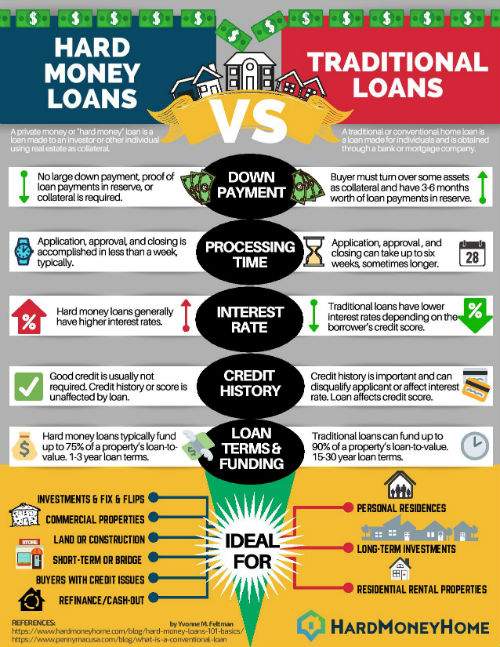

Hard money loan vs. traditional commercial loan

Loan requirements

Traditional commercial loans often have stringent requirements in terms of credit scores, income documentation, and debt-to-income ratios. Hard money loans, on the other hand, are primarily focused on the value of the property being financed. While traditional loans place more emphasis on the borrower’s financial profile, hard money loans may be more accessible to borrowers with lower credit scores or less established credit histories.

Approval process

Traditional commercial loans typically involve a longer and more comprehensive approval process compared to hard money loans. Traditional lenders may require extensive documentation, financial statements, business plans, and appraisals before approving a loan. In contrast, hard money lenders often provide faster approval times, with a focus on the property’s value and potential profitability.

Interest rates

Interest rates for traditional commercial loans are often lower compared to hard money loans. Traditional lenders typically offer more competitive rates due to the lower level of risk associated with these loans. Hard money lenders, on the other hand, charge higher interest rates to compensate for the increased risk they assume by financing commercial properties.

Repayment terms

Traditional commercial loans generally offer longer repayment terms compared to hard money loans. Traditional lenders may provide repayment schedules ranging from several years to several decades, while hard money loans typically have terms ranging from several months to a few years. The shorter repayment terms of hard money loans can impact cash flow and profitability, requiring borrowers to repay the loan more quickly.

Credit score considerations

Traditional commercial loans heavily weigh the borrower’s creditworthiness, requiring a solid credit score and a history of responsible financial management. Hard money loans, while considering the borrower’s credit score, place less emphasis on it. Hard money lenders focus more on the value and potential profitability of the property being financed.

Collateral evaluation

Collateral evaluation is a key factor in both traditional commercial loans and hard money loans. Traditional lenders may require a detailed appraisal and assessment of the property’s value to determine the loan amount they are willing to extend. Hard money lenders also evaluate the collateral but typically focus more heavily on the property’s potential profitability and future value.

Success stories and case studies of using hard money loans for commercial properties

Examples of successful investments

There have been numerous success stories of investors using hard money loans to finance commercial properties and achieving significant returns. For example, an investor may have obtained a hard money loan to purchase an office building in an up-and-coming neighborhood. After renovating and leasing the space, the investor was able to sell the building at a substantial profit, thanks to the increased demand and appreciation in the area. These success stories highlight the potential of using hard money loans to seize profitable investment opportunities and generate substantial profits.

Case studies of commercial property acquisitions

In case studies of commercial property acquisitions, investors have used hard money loans to acquire distressed properties at a discounted price. With the financing provided by the hard money loan, the investor was able to rehabilitate the property, increase its market value, and secure long-term tenants. The successful leasing and management of the property led to steady rental income and eventual resale at a significant profit. These case studies demonstrate how hard money loans can help investors acquire and revitalize commercial properties with strong potential for growth and profitability.

Benefits and outcomes

The use of hard money loans for commercial properties has resulted in numerous benefits and positive outcomes for investors. These include quick funding, the ability to finance distressed properties that may not qualify for traditional loans, and flexibility in loan terms. Hard money loans have also allowed investors with lower credit scores to participate in commercial property investments. By carefully evaluating opportunities and risks, and leveraging the benefits of hard money loans, investors have been able to achieve substantial profits and returns on their investments in commercial properties.

Conclusion

In conclusion, a hard money loan can be an attractive financing option for investors looking to purchase or renovate commercial properties. The quick approval process, flexible terms, and less reliance on credit scores make hard money loans a viable option for those who may not qualify for traditional financing. However, it is important to carefully consider the risks and drawbacks associated with hard money loans, such as higher interest rates and shorter loan terms. Conducting thorough research, evaluating potential lenders, and having a solid understanding of the loan terms and requirements are key to successfully navigating the process of using a hard money loan for commercial properties. By doing so, investors can capitalize on profitable investment opportunities and achieve success in the commercial real estate market.