In the world of real estate investment, leveraging multiple properties to secure a single hard money loan can be a game-changer. However, it is important to understand the intricacies and potential risks involved in this approach. This article explores the feasibility of using multiple properties as collateral for a single hard money loan and provides valuable insights for investors seeking to maximize their borrowing power while minimizing their exposure. Let’s dive into the world of real estate financing and examine the possibilities awaiting savvy investors.

What is a hard money loan?

Definition of a hard money loan

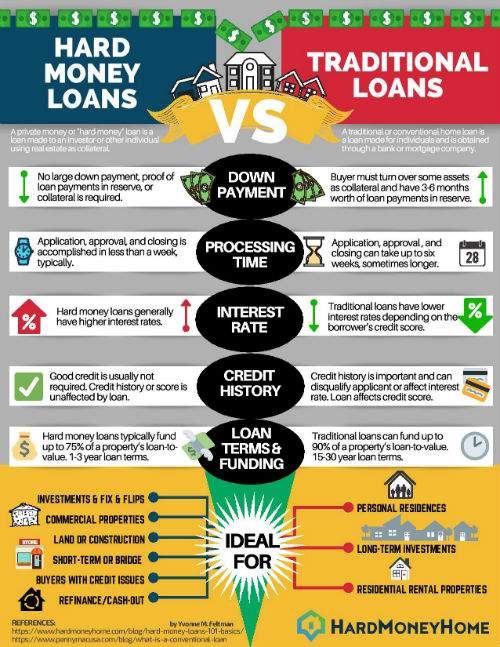

A hard money loan is a type of short-term loan that is typically used by real estate investors or borrowers who need quick access to funds. Unlike traditional loans from banks or mortgage lenders, hard money loans are often provided by private individuals or investors who are willing to lend money based on the borrower’s real estate collateral rather than their creditworthiness. These loans are usually secured by the value of the property being purchased or invested in, making them attractive to borrowers who may not qualify for traditional financing options.

Features of a hard money loan

Hard money loans have several distinctive features that set them apart from conventional loans. Firstly, they are short-term loans with a repayment period typically ranging from months to a few years. This makes them ideal for investors who aim to purchase, renovate, and sell properties quickly. Additionally, hard money loans are known for their fast approval process and quick access to funds. Unlike conventional loans that require extensive paperwork and lengthy approval procedures, hard money loans can often be approved and funded within a matter of days. Moreover, hard money lenders focus primarily on the value of the underlying property rather than the borrower’s credit score, enabling borrowers with less-than-perfect credit to still secure financing for their real estate projects.

Using multiple properties as collateral

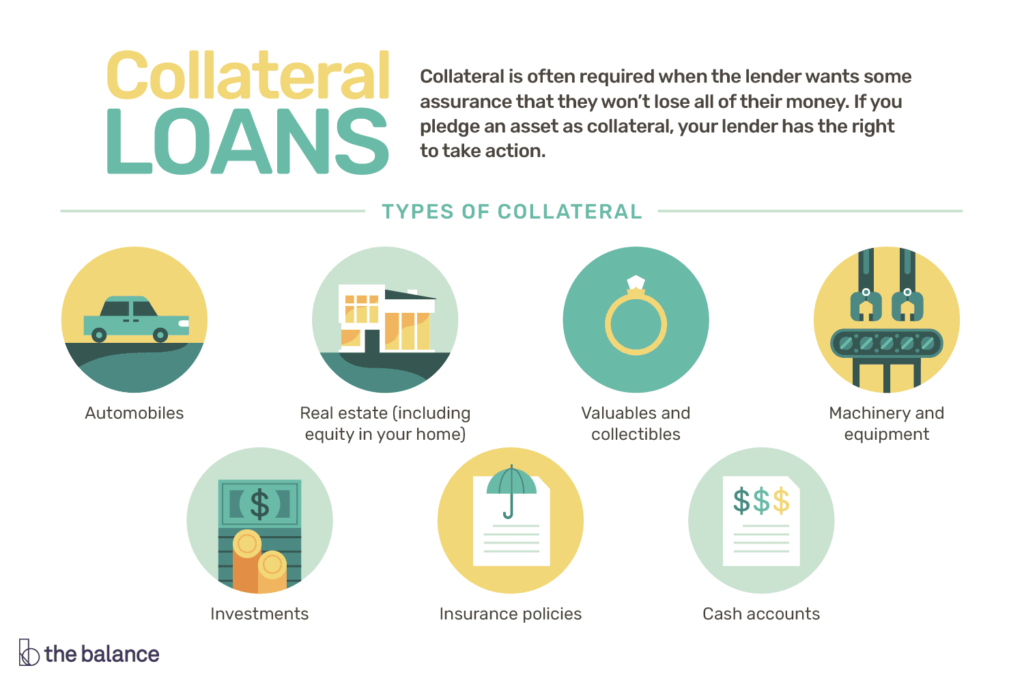

Understanding collateral in a hard money loan

Collateral is an essential aspect of securing a hard money loan. It acts as a form of security for the lender, providing reassurance that in the event of default, they have assets that can be liquidated to recover their investment. Traditionally, a single property is used as collateral for a hard money loan. However, in some cases, borrowers may be eligible to use multiple properties as collateral. This means that the borrower is pledging multiple real estate properties to secure the loan, increasing the lender’s confidence in their ability to recover their investment.

Advantages of using multiple properties as collateral

Using multiple properties as collateral for a hard money loan can provide several advantages for borrowers. Firstly, it can help borrowers increase their borrowing capacity. By using additional properties as collateral, borrowers can potentially access larger loan amounts than they could with just one property as collateral. This can be particularly beneficial for borrowers looking to undertake larger real estate projects or acquire multiple properties simultaneously. Additionally, using multiple properties as collateral may lead to more favorable loan terms, such as lower interest rates or longer repayment periods. Lenders may view this as a lower-risk scenario, as they have a higher chance of recovering their investment through multiple properties in the event of borrower default.

Limitations of using multiple properties as collateral

While using multiple properties as collateral for a hard money loan has its advantages, there are also limitations to consider. One limitation is the potential risk of losing multiple properties in the event of loan default. The lender has the right to seize and liquidate all the properties pledged as collateral to recover their investment. This puts the borrower at a higher risk of losing multiple assets compared to using a single property as collateral. Additionally, the process of using multiple properties as collateral may be more complex and time-consuming. The borrower must provide necessary documentation for each property, and the lender may require additional due diligence to assess the value and condition of each property. This can result in a more intricate application process and potentially longer approval timelines.

Factors to consider

Equity and value of the properties

When considering using multiple properties as collateral for a hard money loan, it is crucial to assess the equity and value of each property. The lender will typically consider the combined value of all the properties to determine the maximum loan amount they are willing to provide. Additionally, the borrower should evaluate the equity in each property and ensure that the combined equity is sufficient to meet the lender’s requirements. If the properties have minimal equity, the lender may be less willing to accept them as collateral or offer a lower loan amount.

Loan-to-value ratio

The loan-to-value (LTV) ratio is an important factor for hard money lenders when determining the risk associated with a loan. The LTV ratio represents the loan amount compared to the value of the property. Lenders often set a maximum LTV ratio that they are willing to accept, which can vary depending on the property type and location. When using multiple properties as collateral, the combined LTV ratio is calculated to assess the overall risk exposure. Borrowers should carefully analyze and ensure that the combined LTV ratio meets the lender’s criteria to increase the chances of approval.

The lender’s criteria

Different lenders may have varying criteria when it comes to accepting multiple properties as collateral. Some lenders may have restrictions on the number or type of properties that can be used, while others may require specific criteria regarding the properties’ condition and location. It is crucial for borrowers to understand and evaluate the lender’s criteria before applying for a hard money loan with multiple properties as collateral. This will help borrowers find lenders that are more likely to approve their loan application and provide suitable terms.

Title and ownership

Before using multiple properties as collateral, it is essential to ensure that the borrower has clear title and ownership rights to each property. Lenders will likely conduct thorough due diligence to verify ownership and any existing liens or encumbrances on the properties. Borrowers should gather all necessary documentation, such as property deeds, title insurance policies, and any legal agreements related to the properties. This ensures that there are no complications that could affect the lender’s ability to secure their investment.

Legal and tax implications

Using multiple properties as collateral can have legal and tax implications that borrowers need to consider. The legal requirements for pledging multiple properties as collateral can vary depending on the jurisdiction and any local regulations. It is advisable for borrowers to consult with legal professionals who specialize in real estate and lending to ensure compliance with all legal obligations. Additionally, borrowers should consult with tax professionals to understand any potential tax implications, such as property taxes, capital gains taxes, or deductible expenses related to the loan. Being aware of the legal and tax implications can help borrowers make informed decisions and avoid any unexpected issues down the line.

How to apply for a hard money loan with multiple properties as collateral

Compile property information

To apply for a hard money loan with multiple properties as collateral, borrowers must compile detailed information about each property. This includes property addresses, legal descriptions, ownership documents, existing mortgages or liens, property appraisals, and any other relevant property-specific information. It is crucial to ensure that all property information is accurate, up-to-date, and properly documented to streamline the loan application process.

Prepare financial documentation

In addition to property information, borrowers will also need to prepare financial documentation to support their loan application. This includes personal and business financial statements, tax returns, bank statements, and proof of income or assets. The lender will assess the financial stability and ability of the borrower to repay the loan, even with multiple properties as collateral. Providing comprehensive and accurate financial documentation will help strengthen the borrower’s case and increase the likelihood of loan approval.

Find a suitable hard money lender

Finding a suitable hard money lender is a crucial step in the process of applying for a loan with multiple properties as collateral. It is important to research and identify lenders who have experience and specialize in providing loans for real estate investments. Additionally, borrowers should consider factors such as the lender’s reputation, interest rates, loan terms, and their flexibility in accepting multiple properties as collateral. Reviewing and comparing multiple lenders can help borrowers secure the most favorable loan terms and increase their chances of approval.

Submit the loan application

Once all the necessary information and documentation have been compiled, borrowers can submit their loan application to the chosen hard money lender. The application process may involve completing an application form, providing supporting documents, and paying any applicable fees. It is essential to carefully review the application and ensure that all information is accurate and complete before submission. Timely submission of the loan application will help to expedite the approval process and enable borrowers to access the funds they need for their real estate projects in a timely manner.

Risks and considerations

Defaulting on the loan

One of the primary risks associated with using multiple properties as collateral is the potential for loan default. If the borrower fails to repay the loan according to the agreed-upon terms, the lender has the right to foreclose on the properties and recover their investment. In the case of utilizing multiple properties as collateral, defaulting on the loan may result in the loss of multiple properties simultaneously, which can significantly impact the borrower’s financial stability.

Implications for each property

When using multiple properties as collateral, it is important to understand that the default on the loan could have implications for each individual property. If the lender exercises their right to foreclose, all properties pledged as collateral will be at risk. This means that even properties with strong financial performance or potential may be subjected to foreclosure, potentially causing substantial loss to the borrower.

Impact on credit score

Defaulting on a hard money loan and the subsequent loss of multiple properties can have a severe negative impact on the borrower’s credit score. A poor credit score will make it more challenging to obtain future financing for real estate projects or other ventures. It is essential for borrowers to consider the potential consequences and evaluate their ability to repay the loan before using multiple properties as collateral.

Potential loss of properties

The possibility of losing multiple properties due to loan default is a significant consideration when using them as collateral. Borrowers should carefully assess the financial stability of their real estate investments and evaluate the potential risks associated with using multiple properties as collateral. A thorough analysis of market conditions, rental income, vacancy rates, and other factors should be conducted to ensure that the investment is viable and has the potential to generate sufficient cash flow to cover the loan obligations.

In conclusion, using multiple properties as collateral for a hard money loan can provide advantages such as increased borrowing capacity and potentially more favorable loan terms. However, borrowers must carefully consider the associated risks, including the potential loss of multiple properties and negative impact on credit scores. It is essential to thoroughly assess the equity, value, and financial stability of each property, as well as understand the lender’s criteria and legal and tax implications. By following the necessary steps and making informed decisions, borrowers can navigate the process of applying for a hard money loan with multiple properties as collateral and achieve their real estate investment goals effectively.