If you are considering obtaining a hard money loan, you may be wondering if there are any options available for interest-only payments. In this article, we will explore the feasibility of interest-only payments with hard money loans and discuss potential benefits and drawbacks associated with this payment structure. By the end, you will have a clear understanding of whether interest-only payments are a viable choice for your financial needs.

Understanding Hard Money Loans

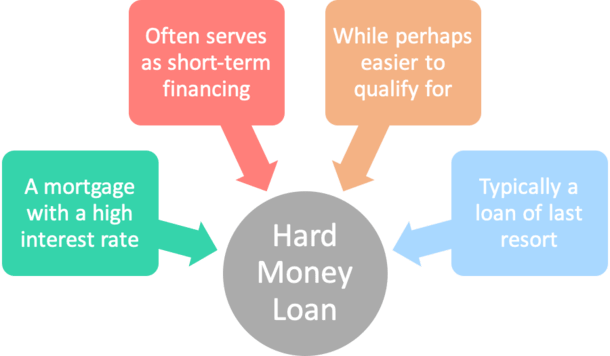

Definition of Hard Money Loans

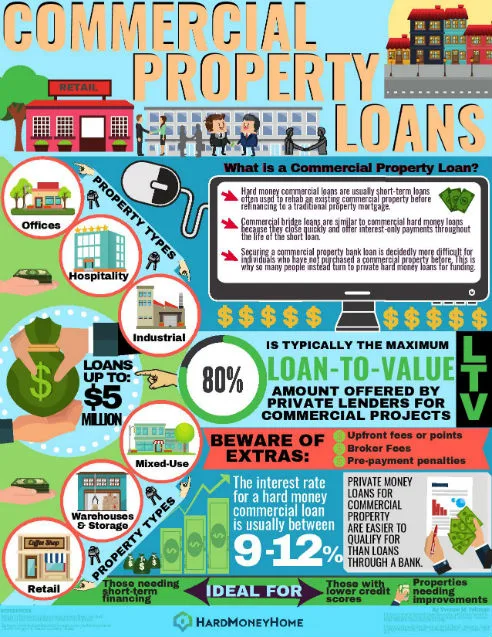

Hard money loans, also known as private money loans, are a type of financing that are secured by real estate. Unlike traditional bank loans, hard money loans are typically funded by private individuals or small lending companies. These loans are often used by real estate investors and borrowers who may not qualify for conventional financing due to factors such as credit history or property condition. Hard money loans are generally short-term in nature, with a typical term ranging from six months to two years.

Features of Hard Money Loans

There are several key features that distinguish hard money loans from traditional bank loans. First, the approval process for hard money loans is typically faster and less stringent. Lenders focus primarily on the value of the property being used as collateral, rather than the borrower’s creditworthiness. Second, hard money loans often require higher interest rates compared to traditional loans, due to the increased risk associated with this type of financing. Finally, hard money loans generally have a lower loan-to-value (LTV) ratio, meaning that the lender will only provide a portion of the property’s appraised value.

Benefits of Hard Money Loans

Hard money loans offer several advantages that make them an attractive option for borrowers in certain situations. Firstly, the speed of approval and funding is a major benefit of hard money loans. This can be crucial for real estate investors who need to act quickly to secure a property or take advantage of a time-sensitive opportunity. Additionally, hard money lenders are often more flexible in their lending criteria, allowing borrowers with less-than-perfect credit or unique circumstances to still obtain financing. Finally, since hard money loans are typically short-term, borrowers can quickly complete their projects and repay the loan, minimizing long-term interest costs.

Drawbacks of Hard Money Loans

While hard money loans have their benefits, they also have some drawbacks that borrowers should be aware of. One significant disadvantage is the higher interest rates associated with these loans. Since hard money loans are considered riskier by lenders, they compensate for that risk by charging higher interest rates. Additionally, hard money loans often have shorter terms, which means borrowers must have a clear plan for refinancing or selling the property before the loan term expires. Lastly, the lower loan-to-value ratio can result in borrowers needing to provide a larger down payment, which may be challenging for some borrowers.

Interest-only Payments in Hard Money Loans

What are Interest-only Payments?

Interest-only payments, as the name suggests, are payments that only cover the interest portion of a loan, without any repayment of the principal amount borrowed. In the context of hard money loans, interest-only payments allow borrowers to temporarily lower their monthly payments by deferring the repayment of the principal balance. This payment structure is often used by real estate investors who rely on the rental income or future sale proceeds of the property to repay the loan.

Why Opt for Interest-only Payments?

There are several reasons why borrowers may opt for interest-only payments when obtaining a hard money loan. One main reason is cash flow management. By making interest-only payments, borrowers can reduce their monthly expenses and allocate the saved funds towards other investment opportunities or property improvements. This can be appealing for real estate investors who aim to maximize their cash on hand or undertake additional projects simultaneously. Additionally, interest-only payments can provide borrowers with greater financial flexibility during the term of the loan.

Advantages of Interest-only Payments

Interest-only payments offer several advantages for borrowers in certain situations. Firstly, the lower monthly payments free up cash flow, allowing borrowers to maintain greater financial flexibility. This can be especially beneficial for real estate investors who rely on rental income to cover their expenses. Secondly, interest-only payments can provide temporary relief for borrowers who may be facing short-term financial challenges. Finally, interest-only payments may also have potential tax benefits for borrowers, as the interest portion of the payments is often tax-deductible.

Disadvantages of Interest-only Payments

While interest-only payments can provide temporary benefits to borrowers, there are also some disadvantages to consider. Foremost, interest-only payments postpone the repayment of the principal amount borrowed. This means that borrowers do not build equity in the property during the interest-only period, potentially limiting their financial options in the future. Additionally, interest-only payments can result in higher total interest costs over the life of the loan since the principal is not being repaid. Borrowers should carefully assess their long-term financial goals and plans before opting for interest-only payments.

Options for Interest-only Payments

1. Traditional Hard Money Lenders

Some traditional hard money lenders may offer interest-only payment options to borrowers. These lenders specialize in providing short-term financing for real estate projects and often have experience in structuring loans with flexible repayment options. It is important for borrowers to research and carefully select reputable hard money lenders that offer interest-only payment terms that align with their needs and goals.

2. Some Private Lenders

Private individuals or small lending companies may also be willing to offer interest-only payment terms for hard money loans. These lenders may be more open to negotiating customized repayment structures based on the borrower’s specific requirements. Borrowers should approach private lenders with a solid business plan and clear exit strategy to increase the likelihood of obtaining interest-only payment options.

3. Negotiating with the Lender

In some cases, borrowers may be able to negotiate with the lender to include interest-only payment terms in the loan agreement. This may require demonstrating a strong financial position, a compelling business plan, and providing additional collateral as assurance. Negotiating interest-only payments can be more successful when dealing with lenders who prioritize the long-term relationship with the borrower and are willing to accommodate their needs.

4. Adjustable-rate Mortgages (ARMs)

Another option for interest-only payments in hard money loans is to utilize adjustable-rate mortgages (ARMs). ARMs offer an initial period, typically ranging from three to ten years, during which borrowers only pay interest on the loan. After the initial period, the interest rate adjusts periodically based on market conditions, and principal payments may be required. Borrowers should carefully analyze the terms and potential risks of ARMs before considering this option.

5. Balloon Payments

Borrowers may also choose to structure their hard money loans with a balloon payment at the end of the loan term. This allows borrowers to make interest-only payments during the loan term and then repay the entire principal balance in a lump sum at the end. Balloon payments can provide short-term relief for cash flow management and may be suitable for borrowers who anticipate a significant influx of funds in the future.

6. Interest Reserve Accounts

Some hard money lenders may require borrowers to establish interest reserve accounts as a condition for offering interest-only payments. Interest reserve accounts are separate accounts where borrowers deposit funds to cover the interest payments during the loan term. This ensures that the lender receives their interest payments even if the borrower faces temporary financial difficulties. Interest reserve accounts can be beneficial for borrowers who prefer to have a structured method for managing interest payments.

Considerations When Opting for Interest-only Payments

1. Loan-to-Value (LTV) Ratio

The loan-to-value (LTV) ratio is an important factor to consider when opting for interest-only payments. Hard money lenders often have specific LTV requirements, and interest-only payment options may be more limited for borrowers with higher LTV ratios. Borrowers with lower LTV ratios may have more flexibility in negotiating interest-only payment terms with their lender.

2. Creditworthiness of the Borrower

While hard money lenders focus less on creditworthiness compared to traditional lenders, the borrower’s credit history and financial stability can still impact the availability and terms of interest-only payments. Lenders may require borrowers to have a strong credit profile and a proven track record of successful real estate projects to qualify for interest-only payments.

3. Duration of the Loan

The duration of the loan is another important consideration when opting for interest-only payments. Borrowers should ensure that the interest-only period aligns with their financial goals and plans for repaying the principal balance. It is crucial to assess the feasibility of refinancing or selling the property to repay the loan before the interest-only period ends.

4. Exit Strategy

Having a clearly defined exit strategy is essential when considering interest-only payments. Borrowers must have a solid plan for repaying the principal balance, whether through refinancing, selling the property, or using other available funds. Failing to have a viable exit strategy can lead to financial challenges and may impact the borrower’s ability to secure future financing.

5. Financial Stability

Borrowers should carefully evaluate their financial stability before opting for interest-only payments. Interest-only payments may be advantageous in certain situations, but borrowers must have confidence in their ability to make the necessary payments when required. It is crucial to have sufficient cash flow, reserves, and contingency plans to ensure financial stability throughout the loan term.

Risks and Challenges

1. Increased Long-term Costs

One of the primary risks of interest-only payments is the potential for increased long-term costs. By deferring the repayment of the principal balance, borrowers may end up paying more in interest over the life of the loan. It is essential for borrowers to carefully calculate the total cost of the loan and compare it to alternative repayment options to fully understand the implications of choosing interest-only payments.

2. Higher Risk for Borrower

Opting for interest-only payments can increase the risk for the borrower. Without making regular principal payments, the borrower’s equity in the property remains unchanged during the interest-only period. If property values decline or the borrower is unable to refinance or sell the property as planned, they may face challenges in repaying the principal balance when it becomes due.

3. Potential Negative Equity

Negative equity, also known as an underwater mortgage, is another potential challenge associated with interest-only payments. Negative equity occurs when the outstanding loan balance exceeds the current market value of the property. By deferring principal payments, borrowers may be at a higher risk of experiencing negative equity, especially if property values decline.

4. Limited Flexibility

While interest-only payments provide short-term financial flexibility, they can limit the borrower’s long-term options. If the borrower does not have a clear plan for repaying the principal balance or encounters unforeseen financial challenges, they may face limited refinancing or selling options. This lack of flexibility can be a significant drawback of interest-only payments.

Factors Influencing Interest-only Options

1. Lender Requirements and Policies

Different lenders have varying requirements and policies regarding interest-only payments. Some lenders may be more open to offering this payment structure, while others may not provide it at all. It is crucial for borrowers to research and select lenders who are willing to accommodate their interest-only payment preferences.

2. Property Type and Location

The type and location of the property can also influence the availability of interest-only payment options. Lenders may have specific criteria for certain property types or regions, which may affect their willingness to offer interest-only terms. Borrowers should be aware of these factors and choose properties that align with their desired payment structure.

3. Borrower’s Financial Profile

The borrower’s financial profile, including creditworthiness, income stability, and experience in real estate investing, can play a significant role in the availability of interest-only payments. Lenders may be more inclined to offer this payment structure to borrowers with strong financial profiles and a proven track record of successful projects.

4. Loan Amount and Duration

Loan amount and duration are also important factors that can influence interest-only options. Some lenders may have minimum loan amount requirements, limiting the availability of interest-only terms for smaller loans. Additionally, certain lenders may only offer interest-only payments for specific loan durations. Borrowers should carefully consider the loan amount and duration when exploring interest-only payment options.

5. Current Market Conditions

Current market conditions, including interest rates and property trends, can impact the availability and terms of interest-only payments. Lenders may adjust their lending requirements and payment options based on market conditions. Borrowers should stay informed about market trends and work with lenders who offer favorable terms during the desired interest-only period.

6. Loan Purpose

The purpose of the loan can also influence the availability of interest-only payment options. Lenders may have specific policies for different loan purposes, such as fix-and-flip projects or rental property investments. Borrowers should communicate their loan purpose clearly to potential lenders and seek out those who specialize in their desired investment strategy.

Alternatives to Interest-only Payments

1. Amortizing Payments

Amortizing payments involve regular payments that include both interest and principal. This repayment structure allows borrowers to gradually reduce the principal balance over time, building equity in the property. Amortizing payments can be a suitable option for borrowers who prefer a more traditional repayment structure and want to minimize long-term interest costs.

2. Full Repayment of Principal and Interest

Full repayment of principal and interest is another alternative to interest-only payments. This repayment option involves making payments that cover both the interest and principal components of the loan. By repaying the principal balance in addition to the interest, borrowers can build equity in the property and fully repay the loan over time.

3. Other Loan Options

Depending on their specific financial goals and circumstances, borrowers may also consider other loan options. These could include traditional bank loans, government-backed loan programs, or alternative financing options. It is important for borrowers to thoroughly research and compare different loan options to determine the best fit for their needs.

Tips for Navigating Hard Money Loans

1. Thoroughly Research Lenders

When considering a hard money loan, it is crucial to thoroughly research potential lenders. Look for reputable lenders with a track record of successful transactions and positive customer reviews. Compare interest rates, fees, loan terms, and borrower requirements to ensure you are getting the best possible deal.

2. Seek Professional Guidance

Navigating the world of hard money loans can be complex, especially for those who are new to real estate investing. Consider seeking professional guidance from a real estate attorney, accountant, or experienced real estate investor. Their expertise can help you make informed decisions and avoid any potential pitfalls.

3. Understand the Terms and Conditions

Before signing any loan agreement, make sure you fully understand the terms and conditions of the loan. Carefully review the interest rate, repayment schedule, prepayment penalties, and any other fees or requirements. If anything is unclear, ask the lender for clarification or seek professional advice.

4. Plan for the Future

When obtaining a hard money loan, it is essential to have a clear plan for the future. Consider your exit strategy, whether it involves refinancing, selling the property, or paying off the loan through other means. Having a well-thought-out plan will help you stay on track and maximize the benefits of the loan.

Conclusion

Hard money loans can be a valuable financing option for real estate investors and borrowers who have unique circumstances or limitations that prevent them from obtaining traditional bank loans. The option of interest-only payments provides borrowers with increased flexibility and potential cash flow advantages during the loan term. However, it is crucial for borrowers to carefully assess the risks, drawbacks, and considerations associated with interest-only payments before making a decision. By thoroughly understanding the options, exploring alternatives, and seeking professional guidance, borrowers can navigate the world of hard money loans effectively and make informed decisions that align with their financial goals.