Hard money loans have long been associated with real estate investments, but are they exclusively limited to this sector? While real estate remains the primary focus, there are situations where hard money loans can be used for other purposes as well. This article explores the various applications of hard money loans beyond real estate investments, shedding light on the versatility and potential opportunities that these loans present. Whether you’re a real estate investor looking to diversify your portfolio or a business owner in need of quick funding, understanding the broader scope of hard money loans is essential.

What are Hard Money Loans?

Definition

Hard money loans are a type of financing that is often used by real estate investors, business owners, and individuals who require quick access to funds. Unlike traditional loans that are offered by banks and other financial institutions, hard money loans are typically funded by private investors or small lending companies. These loans are secured by collateral, such as real estate or other valuable assets, and are known for their faster approval process and higher interest rates.

Characteristics

There are several key characteristics that distinguish hard money loans from traditional loans. These include:

-

Collateral-based: Hard money loans are secured by collateral, which provides the lender with a level of protection if the borrower defaults on the loan. This collateral can be in the form of real estate, business assets, or other valuable property.

-

Short-term: Hard money loans are generally short-term loans, with repayment terms typically ranging from a few months to a few years. This short-term nature allows borrowers to secure financing quickly and use the funds for time-sensitive investments or business opportunities.

-

Quick approval process: Compared to traditional loans, hard money loans have a much faster approval process. This is because the loan decision is primarily based on the value of the collateral and the borrower’s ability to repay the loan, rather than their credit history or financial statements.

-

Higher interest rates: Due to the higher risk involved in hard money lending, these loans often come with higher interest rates compared to traditional loans. Borrowers should carefully consider the cost of borrowing when evaluating the feasibility of a hard money loan.

-

Flexible terms: Hard money loans typically have more flexibility in terms of repayment schedules and loan structures. This can be advantageous for borrowers who need customized financing options to meet their specific needs and investment objectives.

Types of Hard Money Loans

Real Estate Financing

One of the most common uses of hard money loans is for real estate financing. Real estate investors often rely on hard money loans to finance the purchase of investment properties or to fund renovations and repairs. These loans provide investors with the flexibility and speed they need to secure properties quickly and take advantage of time-sensitive investment opportunities.

Business Funding

Hard money loans can also be used for business funding purposes. Small business owners who are unable to secure traditional bank loans may turn to hard money lenders for financing. These loans can be used to fund start-ups, expansion projects, equipment purchases, or other business-related expenses. Hard money loans for business funding can provide entrepreneurs with access to capital when traditional lenders are hesitant to extend credit.

Personal Loans

While less common, hard money loans can also be obtained for personal use. Individuals who need quick access to funds for emergency expenses, debt consolidation, or other personal financial needs may consider a hard money loan as an alternative to traditional loans. Similar to other types of hard money loans, personal hard money loans are secured by collateral, which reduces the risk for the lender.

Hard Money Loans for Real Estate Investments

Advantages

When it comes to real estate investing, hard money loans offer several advantages:

-

Faster funding: One of the biggest advantages of hard money loans for real estate investments is the speed at which funds can be obtained. This is crucial in a competitive real estate market where time is of the essence. Hard money lenders can often provide financing within days, allowing investors to secure properties quickly.

-

Flexible borrower requirements: Traditional lenders typically have stringent borrower requirements, such as high credit scores and steady income. Hard money lenders, on the other hand, focus more on the value of the collateral. This means that borrowers with less-than-perfect credit or unconventional income sources can still qualify for a hard money loan.

-

Potential for higher loan amounts: Hard money lenders are often more willing to lend larger sums of money compared to traditional lenders. This can be particularly beneficial for real estate investors who are looking to finance larger projects or acquire multiple properties simultaneously.

Disadvantages

Despite their advantages, hard money loans for real estate investments also come with certain disadvantages:

-

Higher interest rates: Hard money loans typically come with higher interest rates compared to traditional loans. This is because the lender is taking on a higher level of risk by providing financing without thoroughly evaluating the borrower’s creditworthiness. Investors should carefully evaluate the cost of borrowing and the potential impact on their investment returns.

-

Shorter loan terms: Hard money loans are generally shorter in duration compared to traditional loans. While this can be advantageous for borrowers who aim to quickly flip properties for profit, it can also put pressure on investors to sell or refinance within a short timeframe.

-

Higher costs: In addition to higher interest rates, hard money loans often come with additional fees and costs, such as origination fees, appraisal fees, and loan servicing fees. Borrowers should consider these costs when evaluating the overall feasibility of a hard money loan for their real estate investment.

Hard Money Loans for Business Funding

Advantages

Hard money loans can offer several advantages for small business funding:

-

Access to capital: When traditional lenders are hesitant to provide financing to small businesses, hard money loans can be a viable alternative. Business owners who have been turned down by banks can often secure funding through hard money lenders, allowing them to pursue their business growth strategies.

-

Fast funding: Similar to real estate investments, speed is often essential in the business world. Hard money loans provide the advantage of quick funding, allowing business owners to seize opportunities, purchase inventory, or invest in equipment without delay.

-

Flexible use of funds: Unlike traditional business loans that may have restrictions on the use of funds, hard money loans offer more flexibility. Business owners can use the funds from a hard money loan for various purposes, such as working capital, capital expenditures, debt consolidation, or expansion plans.

Disadvantages

Hard money loans for business funding also come with their own set of disadvantages:

-

Higher costs: Hard money loans typically come with higher interest rates and fees compared to traditional business loans. This can add to the overall cost of borrowing and impact the profitability of the business.

-

Shorter loan terms: Hard money loans for business funding are often short-term in nature. While this can be advantageous for fast-growing businesses that expect quick returns on investment, it may not be ideal for businesses that require longer-term financing to support their growth strategies.

-

Potential impact on credit: If a business fails to meet the repayment terms of a hard money loan, it can negatively impact the business owner’s personal credit. This can make it more difficult to secure future financing from traditional lenders.

Hard Money Loans for Personal Loans

Advantages

In certain situations, hard money loans can offer advantages for personal financing:

-

Quick access to funds: Hard money loans can provide individuals with quick access to funds, making them suitable for emergency expenses or times when immediate cash is needed. This can be particularly beneficial when traditional lenders are unable to provide financing within the required timeframe.

-

Less stringent borrower requirements: Hard money lenders generally focus more on the value of the collateral rather than an individual’s creditworthiness. This means that individuals with less-than-perfect credit scores or unconventional income sources may still qualify for a hard money loan.

-

Flexibility in loan terms: Hard money loans for personal use may offer more flexibility in terms of repayment schedules and structures compared to traditional loans. This can allow borrowers to tailor their loan terms to their specific financial needs and repayment capabilities.

Disadvantages

There are also potential disadvantages to consider when obtaining a hard money loan for personal use:

-

Higher interest rates: Hard money loans typically come with higher interest rates compared to traditional loans. Borrowers should carefully evaluate the cost of borrowing and consider whether the benefits of quick access to funds outweigh the higher interest charges.

-

Shorter loan terms: Hard money loans are typically shorter in duration compared to traditional loans. Borrowers should consider whether they are able to meet the repayment terms within the specified timeframe.

-

Limited consumer protection: Unlike traditional loans that are subject to regulations and consumer protection laws, hard money loans may have fewer safeguards for borrowers. Individuals should carefully review the terms and conditions of the loan and understand the potential risks involved.

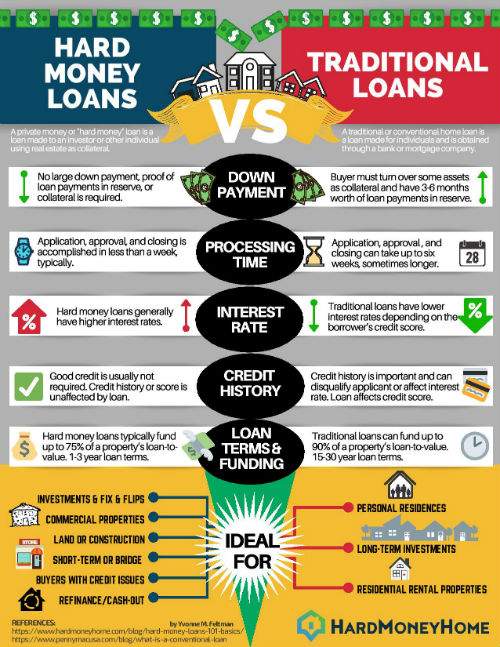

Key Differences between Hard Money Loans and Traditional Loans

Collateral Requirements

One of the main differences between hard money loans and traditional loans lies in the collateral requirements. Traditional lenders typically require collateral, such as personal assets or business assets, to secure the loan. However, the evaluation of the borrower’s creditworthiness and financial statements also plays a significant role in the approval process.

Hard money loans, on the other hand, primarily rely on the value of the collateral. The lender assesses the collateral to determine the loan amount that can be extended. This means that even borrowers with poor credit or unconventional income sources may still be eligible for a hard money loan if the collateral is deemed valuable enough.

Approval Process

The approval process for hard money loans and traditional loans also differs significantly. Traditional loans often involve a lengthy and complex approval process that includes extensive documentation, credit checks, income verification, and underwriting procedures. This process can often take weeks or even months before a final loan decision is made.

In contrast, hard money loans have a much simpler and faster approval process. This is because the loan decision is primarily based on the value of the collateral and the borrower’s ability to repay the loan. As a result, hard money loans can often be approved and funded within days, providing borrowers with quick access to the funds they need.

Interest Rates

Interest rates are another key difference between hard money loans and traditional loans. Traditional loans offered by banks and other financial institutions generally have lower interest rates since they are backed by the creditworthiness of the borrower and are subject to regulations.

Hard money loans, on the other hand, come with higher interest rates. This is due to the higher risk involved in hard money lending, as these loans are often extended to borrowers with less-than-perfect credit or unconventional income sources. The higher interest rates compensate the lender for the increased risk they undertake by providing financing without thoroughly vetting the borrower’s financial background.

Loan Terms

Loan terms also vary between hard money loans and traditional loans. Traditional loans typically have longer loan terms, ranging from several years to several decades, depending on the type of loan. This allows borrowers more time to repay the loan and may offer more affordable monthly payments.

Hard money loans, on the other hand, are generally short-term loans. These loans often have terms ranging from a few months to a few years. The shorter loan terms are designed to align with the short-term nature of the investments or projects that hard money loans are often used to finance, such as real estate flips or business expansion plans. Borrowers should consider whether they are comfortable with the shorter repayment timeframe when evaluating the feasibility of a hard money loan.

Factors to Consider When Applying for a Hard Money Loan

When applying for a hard money loan, there are several factors that borrowers should consider to ensure a successful borrowing experience:

Loan-to-Value Ratio

The loan-to-value (LTV) ratio is an important factor in hard money lending. It represents the ratio of the loan amount to the value of the collateral. Different hard money lenders may have different LTV requirements, which can vary depending on the type of collateral and the specific loan program.

Borrowers should carefully evaluate the LTV ratio offered by the lender and consider whether it aligns with their financing needs. An excessively high LTV ratio may expose the borrower to higher risk, while an excessively low LTV ratio may limit the amount of funding available.

Repayment Strategy

Having a clear repayment strategy is crucial when applying for a hard money loan. Borrowers should have a well-developed plan for repaying the loan and ensuring that they can meet the repayment obligations within the specified timeframe.

This may involve analyzing the cash flow generated by the investment or business that the loan is funding, as well as considering alternative exit strategies in case the initial plan does not go as expected. It is important for borrowers to thoroughly assess the feasibility of the proposed repayment strategy before proceeding with a hard money loan.

Exit Plan

An exit plan is a crucial element in real estate investing and business funding when using hard money loans. Since hard money loans are often short-term in nature, borrowers should have a clear plan for how they will exit the loan, either through selling the property, refinancing with a traditional loan, or other means.

Having an exit plan helps to minimize the risk associated with the short-term nature of hard money loans and demonstrates to the lender that the borrower has considered their ability to meet the repayment obligations. Borrowers should work closely with their financial advisors or industry professionals to develop a solid exit plan before securing a hard money loan.

How to Find Hard Money Lenders

Finding reputable hard money lenders requires a combination of research and networking. Here are some ways to locate potential hard money lenders:

Online Platforms

There are several online platforms and directories that connect borrowers with hard money lenders. These platforms allow borrowers to compare lenders, review their loan programs and criteria, and even submit loan applications online. Some popular online platforms for finding hard money lenders include LoanPost, PrivateLenderLink, and Connected Investors.

Local Networking

Networking within the local real estate or business community can also be a valuable resource for finding hard money lenders. Attending industry events, seminars, and networking groups allows borrowers to meet and connect with potential lenders who specialize in hard money lending.

Building relationships with local professionals, such as real estate agents, mortgage brokers, or business advisors, can also provide valuable referrals to reputable hard money lenders. These professionals often have firsthand experience working with lenders and can provide insights and recommendations.

Referrals

Word-of-mouth referrals can be a reliable way to find reputable hard money lenders. Asking for recommendations from trusted friends, colleagues, or industry professionals who have successfully obtained hard money loans in the past can help borrowers identify lenders with a proven track record.

Borrowers should also consider reaching out to local real estate investment clubs or business associations for referrals. These groups often have members who have experience with hard money lending and can provide valuable recommendations.

Tips for Success with Hard Money Loans

When utilizing hard money loans, it’s important to keep the following tips in mind to maximize the chances of success:

Understand the Terms and Costs

Before committing to a hard money loan, borrowers should thoroughly understand the terms and costs associated with the loan. This includes the interest rate, fees, repayment schedule, and any additional costs. Evaluating the affordability and feasibility of the loan based on these factors is crucial to avoid entering into a loan agreement that may not align with the borrower’s financial goals and capabilities.

Have a Clear Investment Strategy

For real estate investors and business owners, having a clear investment strategy is essential when considering a hard money loan. This includes identifying potential investment opportunities, understanding market conditions, and conducting thorough due diligence on the investment. Having a well-defined investment strategy minimizes risks and increases the likelihood of a successful return on investment.

Work with Experienced Professionals

Seeking guidance from experienced professionals in the industry can greatly enhance the success of utilizing a hard money loan. Real estate investors may benefit from working with knowledgeable real estate agents, appraisers, and contractors who can provide insights and advice throughout the investment process. Business owners can consult with experienced business advisors, accountants, and attorneys to ensure that the strategic use of hard money loans aligns with their business goals.

By leveraging the expertise and experience of professionals in the field, borrowers can make informed decisions and maximize the potential benefits of a hard money loan.

Conclusion

Hard money loans can be a valuable financing option for real estate investments, business funding, and personal needs. With their flexible terms, faster approval process, and access to quick capital, hard money loans provide borrowers with an alternative source of financing when traditional lenders may not be an option.

However, it is important for borrowers to carefully evaluate the advantages and disadvantages of hard money loans before proceeding. Higher interest rates, shorter loan terms, and potential impact on credit should be considered alongside the benefits of quick funding and more flexible borrower requirements.

By understanding the key differences between hard money loans and traditional loans, considering important factors like loan-to-value ratio, repayment strategy, and exit plan, and leveraging resources to find reputable hard money lenders, borrowers can position themselves for success in utilizing hard money loans. With the right strategy and careful evaluation of the loan terms, hard money loans can be a valuable tool for achieving real estate investment goals, supporting business growth, or meeting personal financial needs.