Are hard money loans a viable option for non-residential properties such as churches or warehouses? This question often arises among real estate investors and potential buyers seeking financing outside of traditional lending channels. Although hard money loans are typically associated with residential properties, it is important to understand whether this alternative financing option extends to the commercial sector. In this article, we will explore the availability of hard money loans for non-residential properties, specifically focusing on churches and warehouses. By examining the key considerations and potential challenges, we aim to provide valuable insights for those navigating the world of commercial real estate financing.

What are Hard Money Loans?

Definition

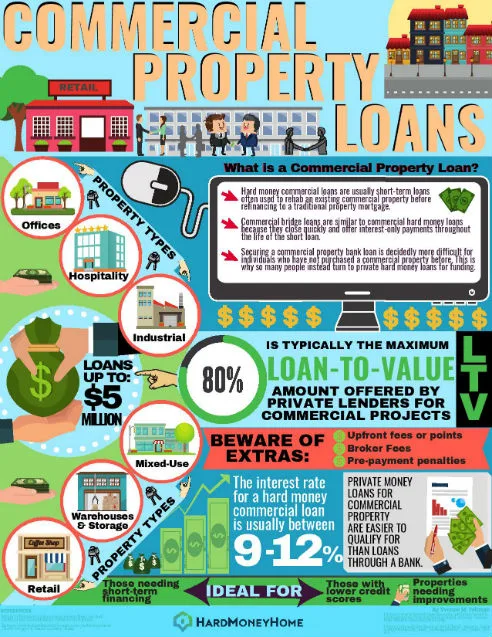

Hard money loans, also known as private money loans, are a type of financing that is secured by real estate collateral rather than the borrower’s creditworthiness. These loans are typically offered by private investors or companies, rather than traditional banks or financial institutions. Hard money loans are commonly used by real estate investors or businesses that need quick access to capital, and they are often used for non-residential properties such as churches or warehouses.

Qualifications and Requirements

To qualify for a hard money loan, borrowers typically need to meet certain criteria set by the lender. While the exact requirements can vary, key qualifications often include:

-

Collateral: The non-residential property being financed will serve as collateral for the loan. The property must have sufficient value to secure the loan amount.

-

Equity: Borrowers are typically required to have a certain amount of equity in the property being financed. Lenders want to ensure that borrowers have a vested interest in the success of the project.

-

Creditworthiness: While hard money lenders may be more flexible with their lending criteria compared to traditional lenders, some level of creditworthiness is still typically required. This can include factors such as credit score, income, and experience in real estate investment.

-

Repayment Plan: Borrowers need to present a feasible plan for repaying the loan, which may include selling the property, refinancing with a traditional lender, or generating income from the property.

It’s important to note that each lender may have their own specific set of qualifications and requirements, so borrowers should thoroughly research and understand the terms before applying for a hard money loan.

Advantages and Disadvantages

Hard money loans offer several advantages and disadvantages compared to traditional loans. Understanding these pros and cons can help borrowers make an informed decision when considering this type of financing for non-residential properties.

Advantages:

-

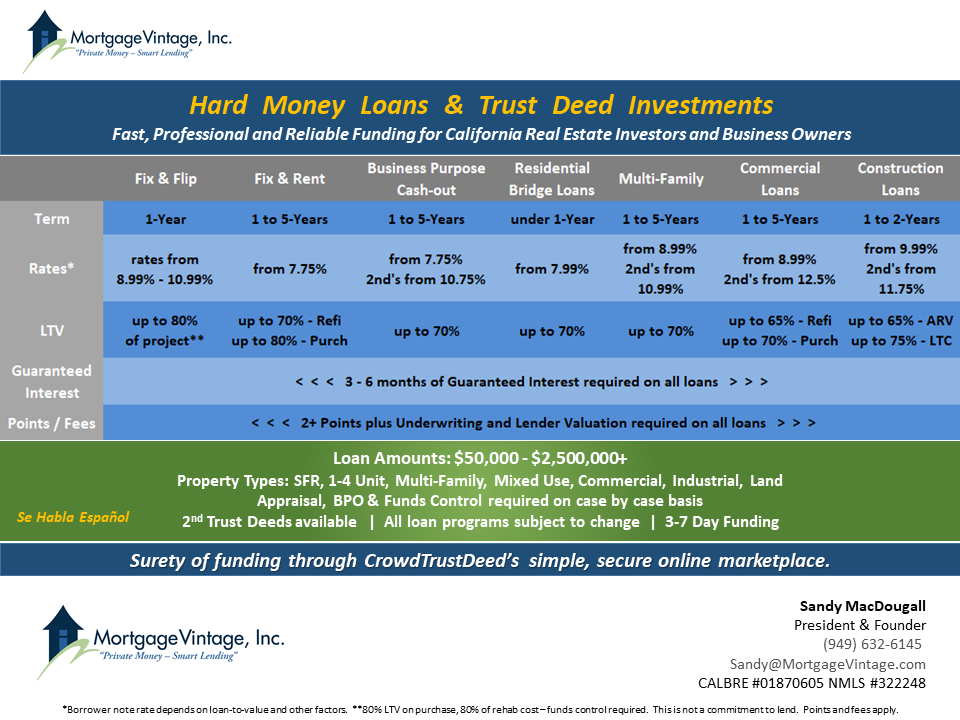

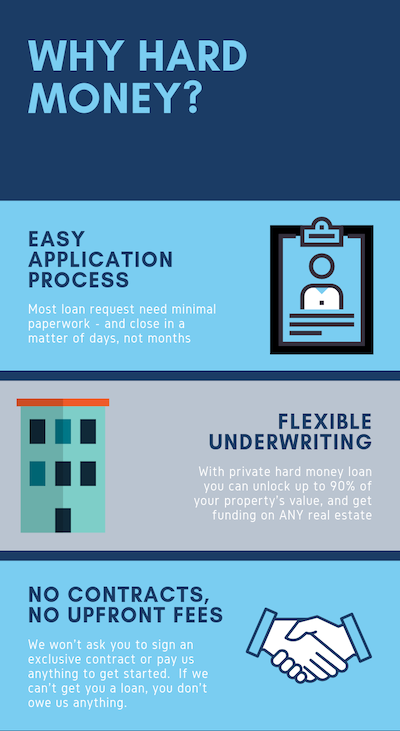

Quick Approval and Funding: Hard money loans typically have a shorter loan approval process compared to traditional loans. This can be beneficial for borrowers who need immediate access to capital for time-sensitive projects.

-

Flexible Terms and Conditions: Since hard money loans are funded by private investors or companies, borrowers may have more flexibility in negotiating loan terms and conditions. This can include interest rates, repayment schedules, and collateral requirements.

-

Overcoming Credit Challenges: Hard money loans can be an alternative financing option for borrowers who may have difficulty obtaining a traditional loan due to credit issues or lack of financial history.

-

Investment Opportunities: Hard money loans can enable investors to take advantage of real estate investment opportunities that may not be feasible with other types of financing. This can include purchasing undervalued properties or investing in properties requiring renovations.

Disadvantages:

-

Higher Interest Rates: Hard money loans often come with higher interest rates compared to traditional loans. The higher rates reflect the increased risk assumed by the lender, as hard money loans are typically considered more risky due to their collateral-based nature.

-

Short-Term Repayment Period: Hard money loans usually have shorter repayment periods, often ranging from a few months to a few years. This can put pressure on borrowers to sell or refinance the property within a short timeframe to repay the loan.

-

Potential Risks and Penalties: If borrowers are unable to repay the loan within the agreed-upon timeframe, they may face additional fees, penalties, or even foreclosure on the property. It is crucial for borrowers to carefully assess their ability to meet repayment obligations.

-

Limited Lenders in the Market: While the popularity of hard money loans has been growing, the number of lenders specializing in non-residential properties may still be limited. This can affect the availability of tailored loan options and create a more competitive lending environment.

Common Uses

Hard money loans can be used for a variety of purposes related to non-residential properties. Some common uses include:

-

Purchasing Non-Residential Properties: Real estate investors can utilize hard money loans to acquire non-residential properties, such as churches, warehouses, office buildings, or retail spaces. These loans provide a flexible financing option when traditional lenders are not feasible or do not meet the timeline requirements.

-

Renovations and Upgrades: Hard money loans can be used to fund renovations, repairs, or upgrades to non-residential properties. For example, a church may need funding for renovations and improvements to enhance the worship experience or update outdated facilities.

-

Bridge Financing: Hard money loans can act as short-term bridge financing when traditional financing is not immediately available or is being arranged. This can be helpful for investors who need quick access to capital to secure and stabilize a non-residential property.

-

Real Estate Development: Hard money loans can support real estate development projects for non-residential properties. This may include ground-up construction, property subdivision, or conversion projects.

-

Emergency or Time-Sensitive Funding: In some cases, non-residential property owners may require fast access to capital for emergency situations or time-sensitive projects. Hard money loans can provide the necessary funding in these scenarios.

Overall, hard money loans offer a flexible financing solution for non-residential properties, enabling borrowers to pursue opportunities that may not be possible with traditional financing options.